NeoBank clone

White-Label Neobank Clone – Custom Digital Banking Solution

Create a branded neobank with full customization, advanced security & AI-driven insights. Build a next-gen banking experience with Neobank Clone.

Go Live in 3 Days with 60 Days Tech SupportComplete Source CodesComplete RebrandingComplete WhitelabelingApp Publishing SupportFree 1 Year Updates

Customizable Neobank Clone for Businesses & Individuals

Develop a fully customizable neobanking solution tailored for individuals, startups, enterprises, and gig workers.

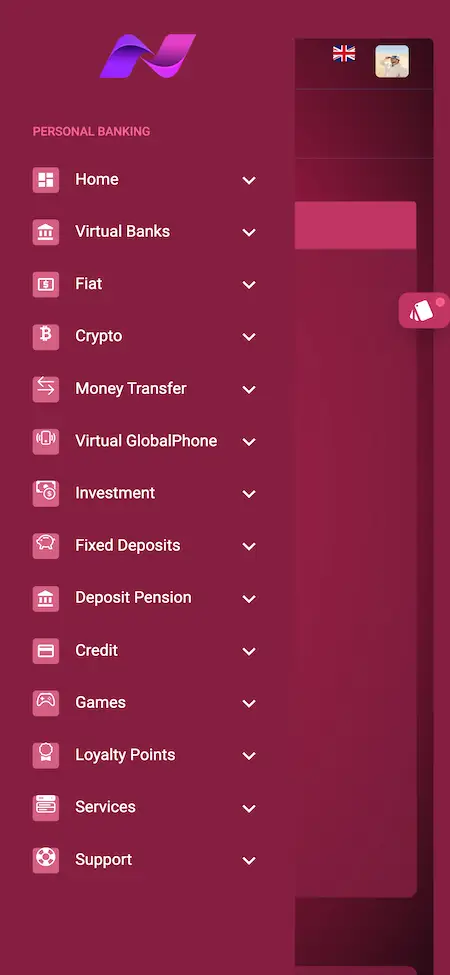

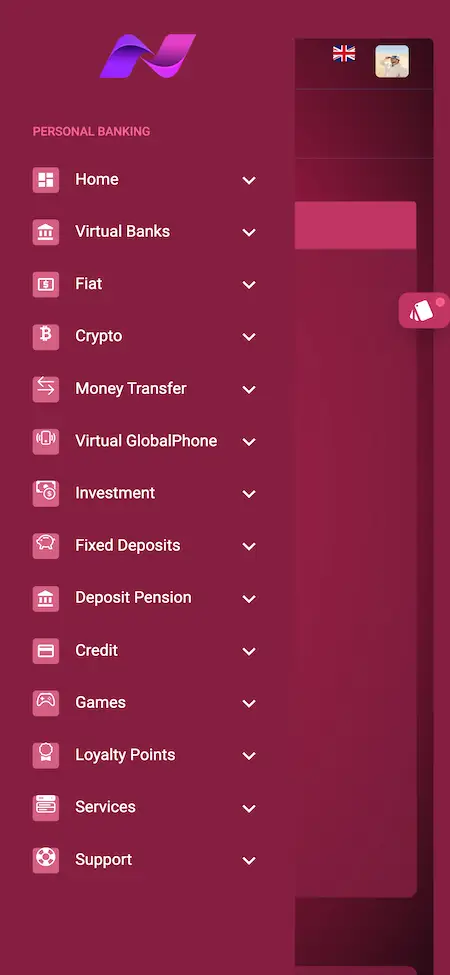

A Neobank Clone solution is a comprehensive financial platform that seamlessly integrates traditional banking services with cutting-edge features, catering to both fiat and cryptocurrency transactions. It offers a global Neowallet Bank and a Crypto P2P Exchange, allowing users to manage fiat and crypto wallets, issue network cards, and conduct transactions through MasterCard services.

The solution encompasses a diverse array of features, including free merchant and agent POS apps, support for WooCommerce, virtual global phone numbers, customizable issuance and network fees, various withdrawal options, and a sophisticated point-of-sale card acceptance system.

With capabilities such as crypto peer-to-peer trading, investment opportunities with automated interest calculations, agent-assisted cash deposits and withdrawals, and support for over 21 global payment gateways, this Neo banking solution provides a holistic financial ecosystem. It also incorporates features like loans, fixed deposits, deposit pension schemes, internal KYC, accounting, invoicing, and NFC card support on the merchant app, making it a versatile and powerful financial platform for users and businesses alike.

Enhanced Financial Flexibility: A professionally developed Neobanking solution provides users with unparalleled flexibility by seamlessly integrating traditional banking services with advanced cryptocurrency features.

Efficient Transaction Management: With features such as free merchant and agent POS apps, diverse withdrawal options, and support for over 21 global payment gateways, the solution streamlines transaction processes for both users and businesses.

Innovative Investment Opportunities: Offering investment options with automated interest calculations, the Neobanking solution empowers users with innovative and user-friendly financial instruments, fostering a dynamic approach to wealth management.

Comprehensive Financial Ecosystem: From loans, fixed deposits, and deposit pension schemes to internal KYC, accounting, and NFC card support, the solution creates a comprehensive financial ecosystem, giving users and businesses a decisive edge in managing their financial affairs.

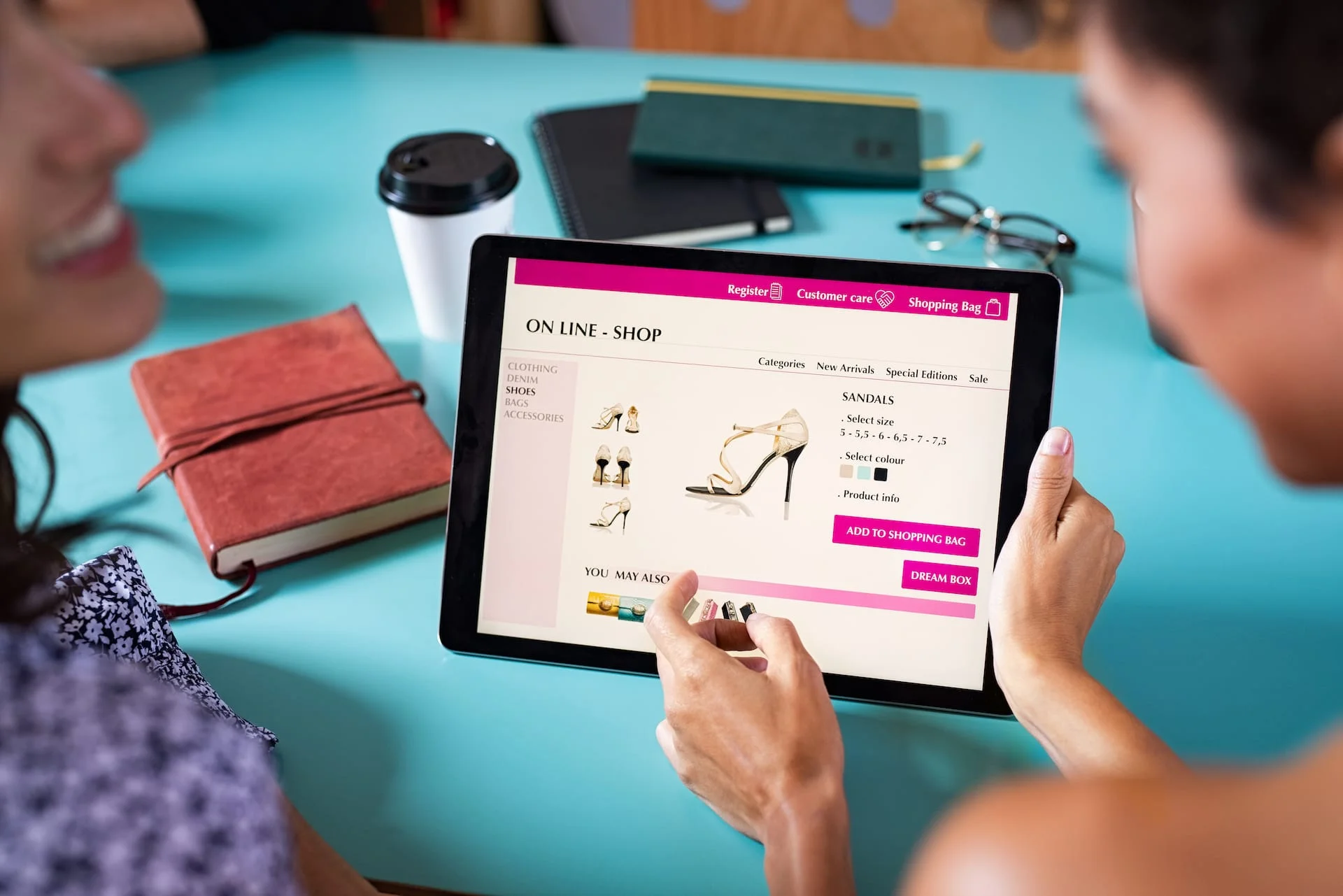

Seamless Digital Banking Experience

Our Neobank clone offers a user-friendly interface, enabling customers to manage their finances effortlessly through intuitive navigation and comprehensive account management tools.

Advanced Security Measures

Our Neobank clone prioritizes the security of customer data and transactions, incorporating robust encryption protocols, biometric authentication, and real-time fraud monitoring to ensure the highest level of protection against cyber threats and unauthorized access.

Customizable Financial Solutions

Users can personalize their banking experience by selecting from a range of financial products and services tailored to their needs, including savings accounts, loans, investments, and budgeting tools.

24/7 Customer Support

Our Neobank clone provides round-the-clock customer support through multiple channels, including live chat, email, and phone assistance, offering prompt resolution of inquiries, concerns, and technical issues to enhance customer satisfaction and loyalty.

Key Features of Neobank Digital Bank App Clone

Cutting-edge Features

that drive

Neobank Clone

NeoBank Clone solutions showcase a paradigm shift in banking by embracing cutting-edge features that redefine the user experience. These digital-centric platforms prioritize global accessibility, allowing users to manage their finances from anywhere in the world through intuitive digital interfaces.

Global Accessibility

NeoBank solutions offer users worldwide access to their accounts and transactions through digital platforms.

Real-Time Notifications

Users receive instant updates on transactions, ensuring transparency and real-time awareness of their financial activities.

Personalized Financial Insights

Utilizing advanced algorithms, NeoBanks provide personalized insights and recommendations to help users make informed financial decisions.

In-App Budgeting Tools

NeoBank apps often include innovative budgeting features, empowering users to manage and track their spending with ease.

Biometric Security

Enhancing security measures, NeoBanks often incorporate biometric authentication methods like fingerprint or facial recognition.

Quick and Seamless Onboarding

NeoBanks streamline the account creation process, allowing users to open and manage accounts rapidly through intuitive digital interfaces.

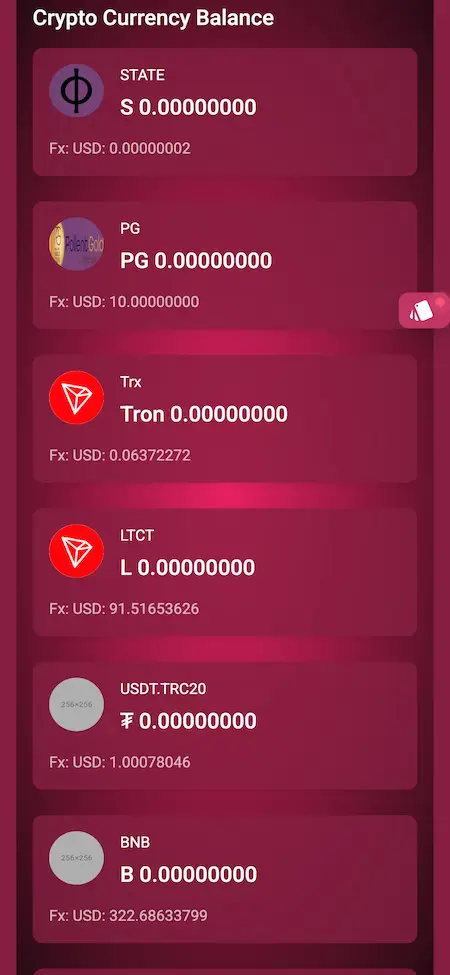

Cryptocurrency Integration

Many NeoBanks integrate cryptocurrency services, allowing users to manage both traditional and digital assets within a single platform.

Comprehensive Features Across Web, App, and Admin

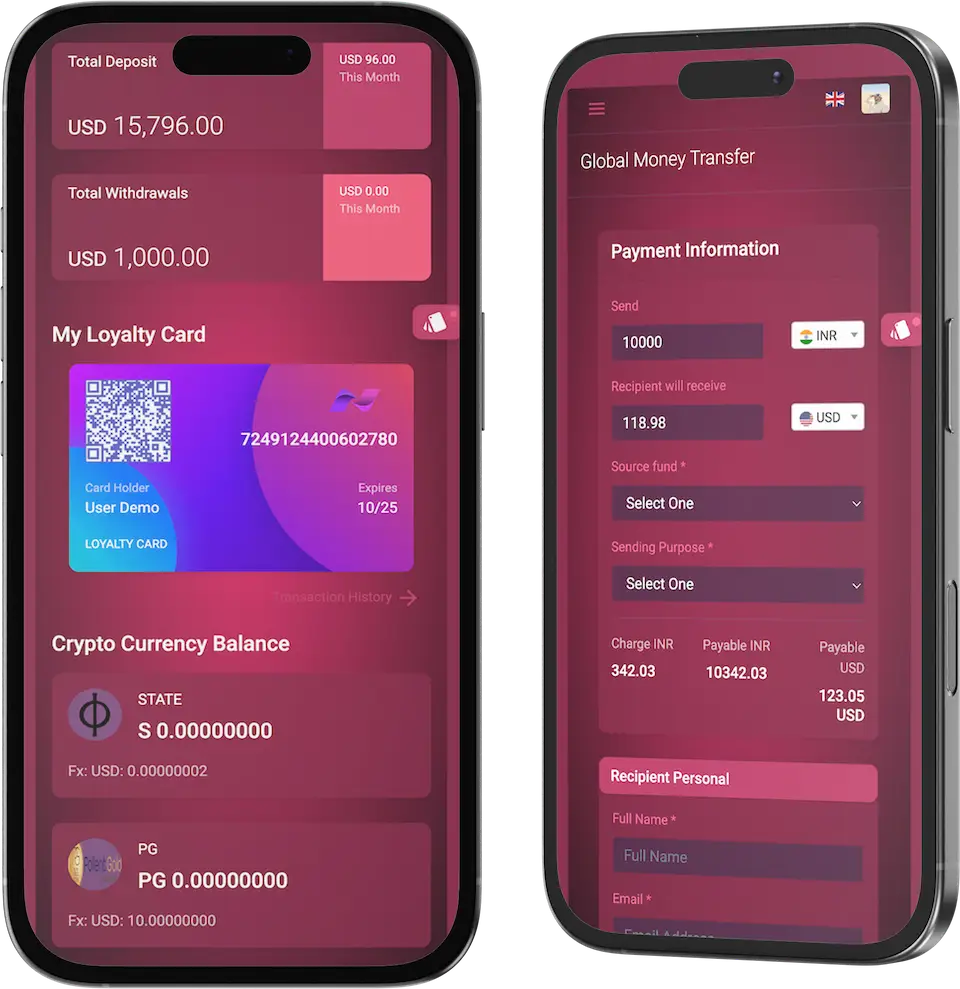

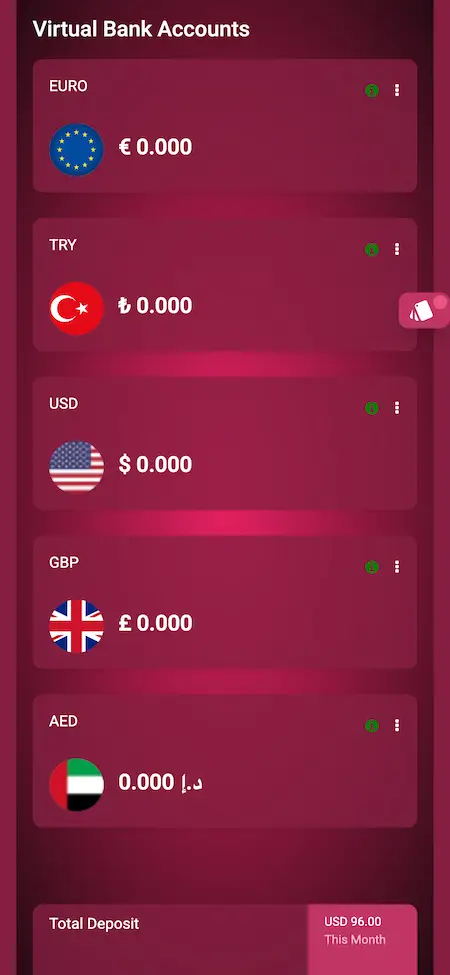

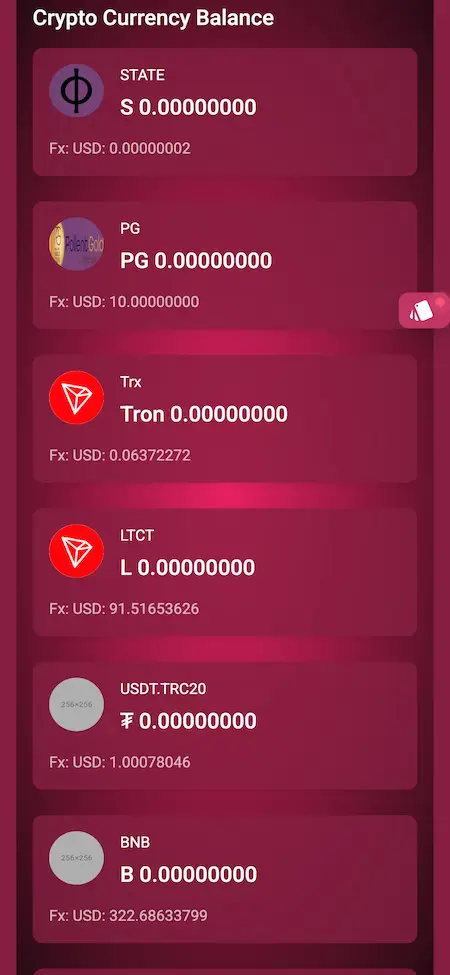

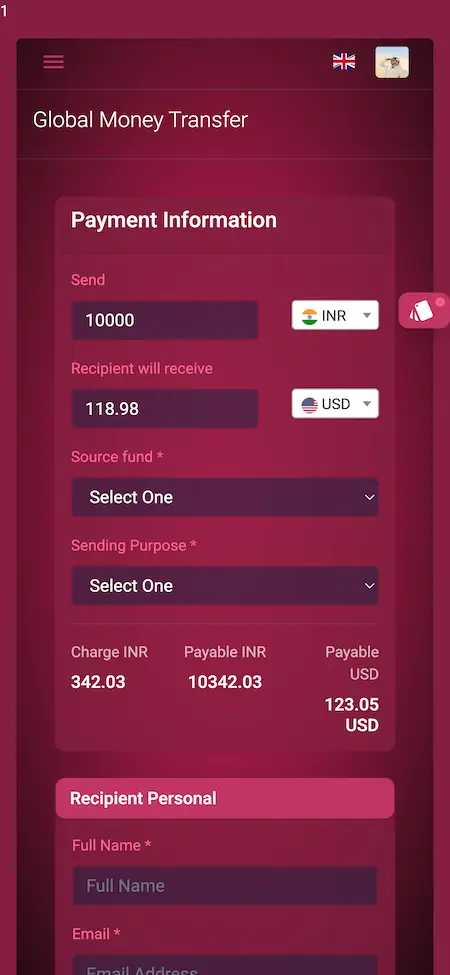

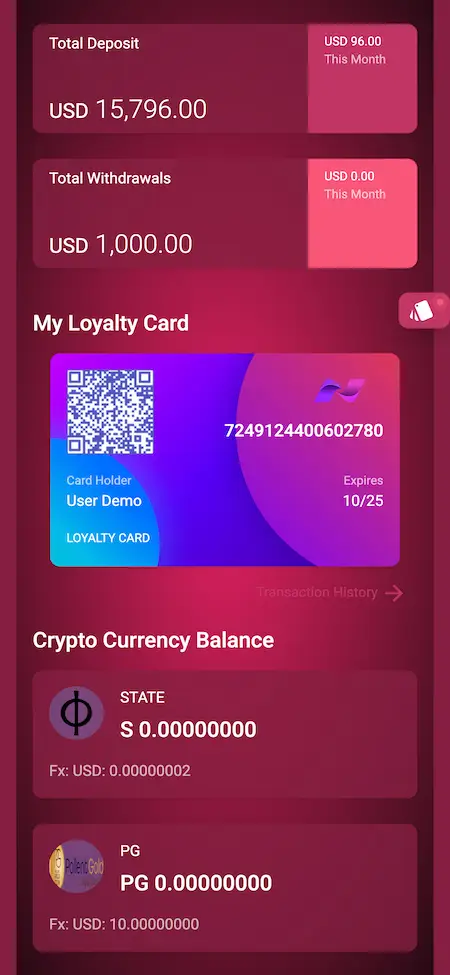

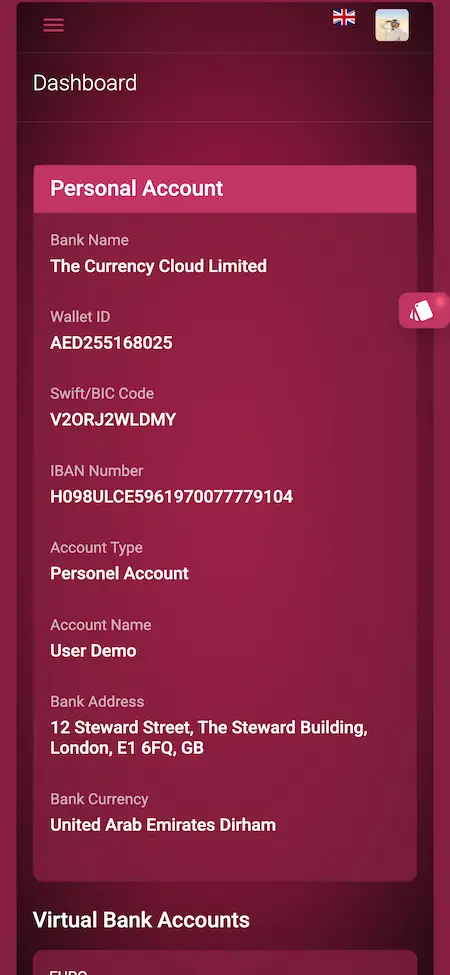

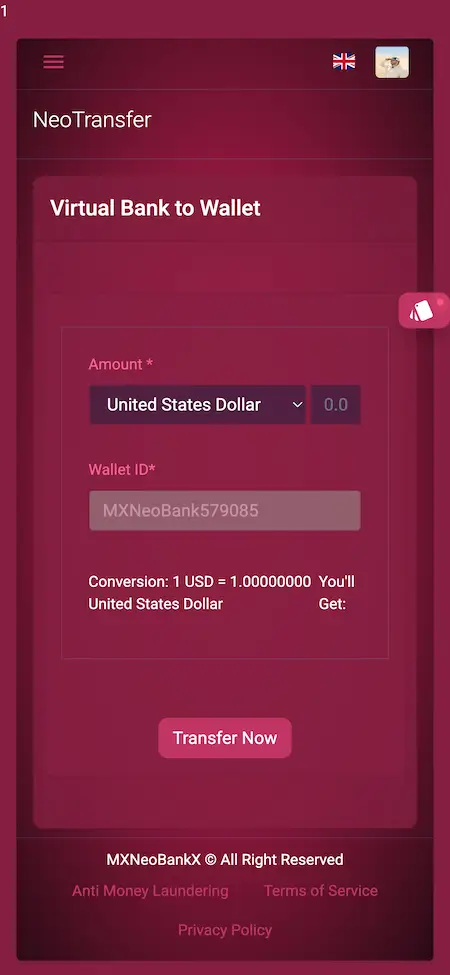

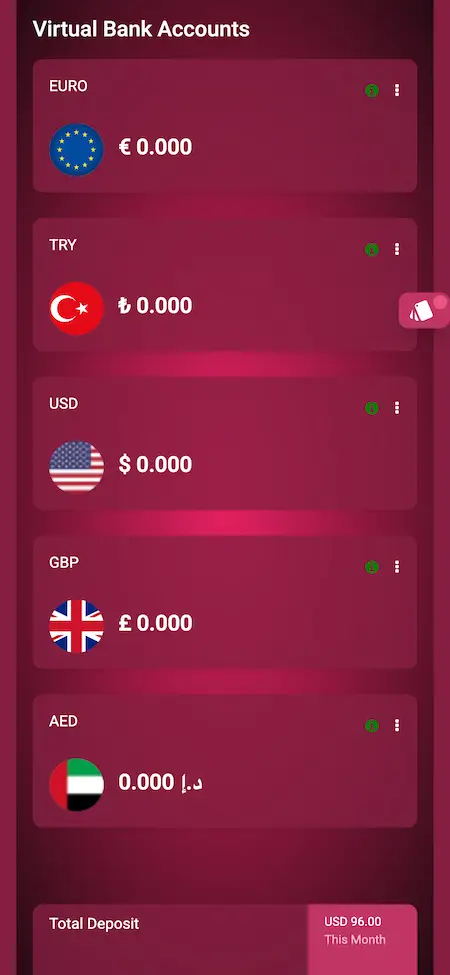

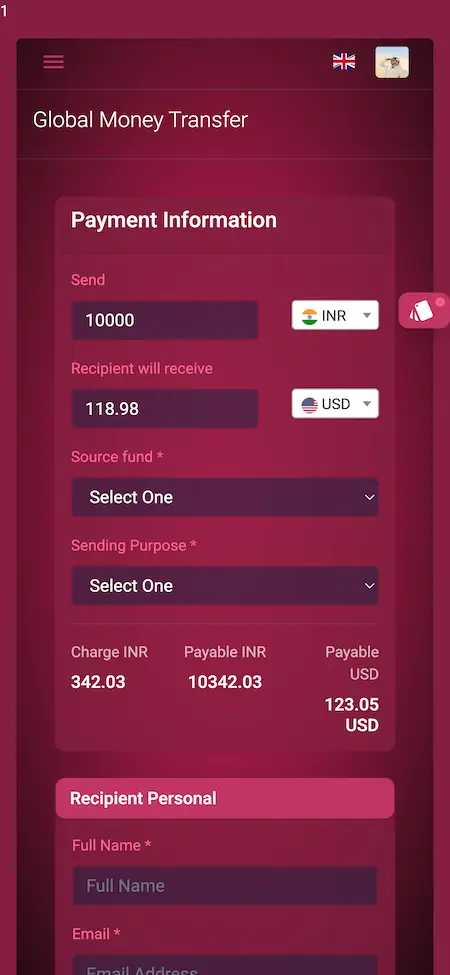

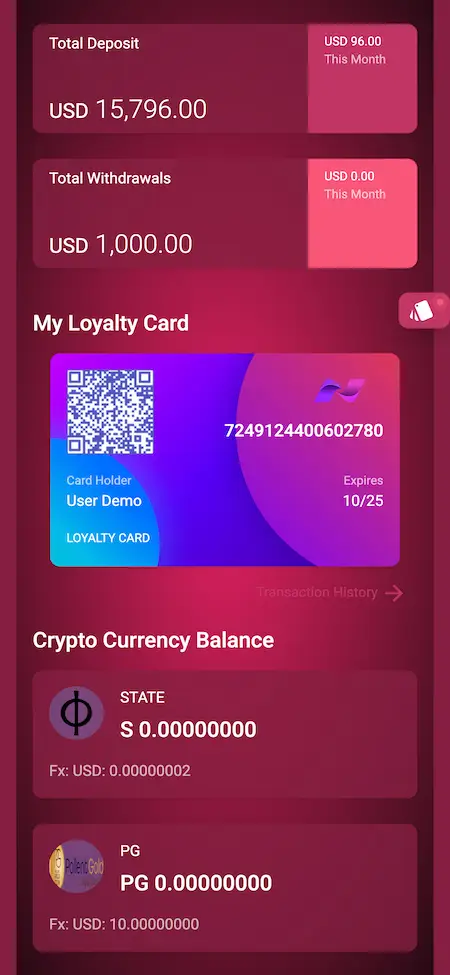

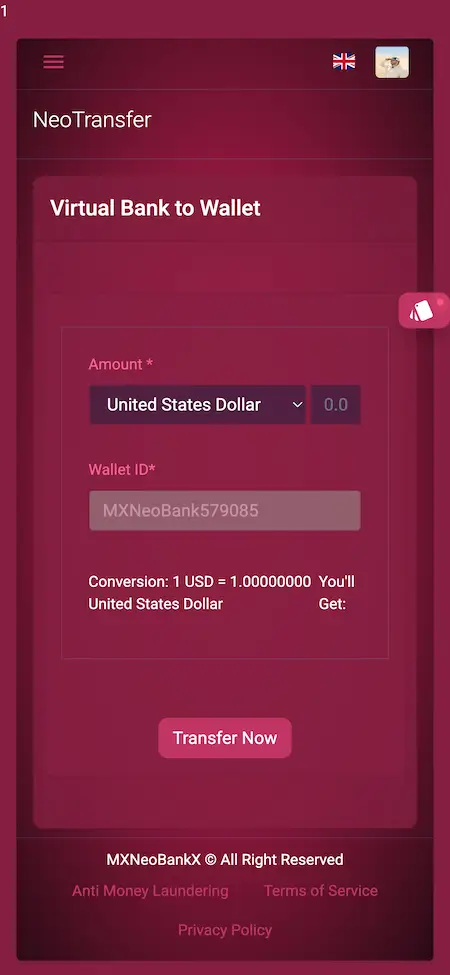

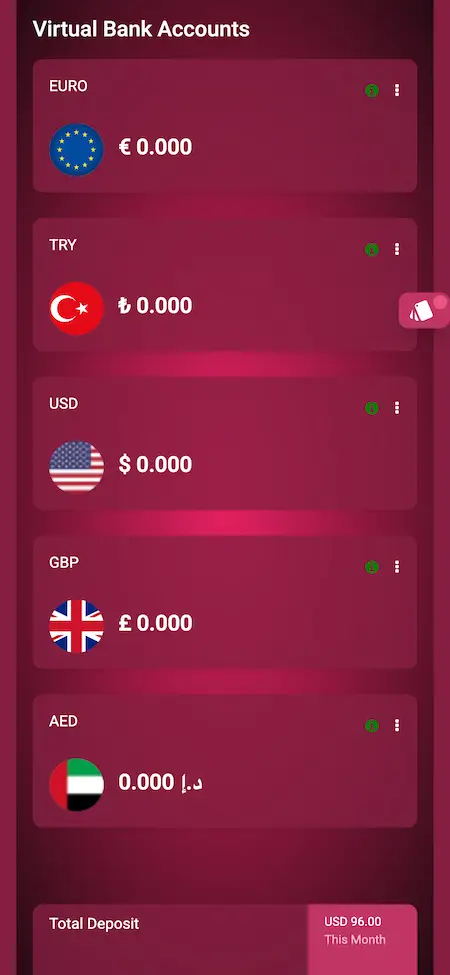

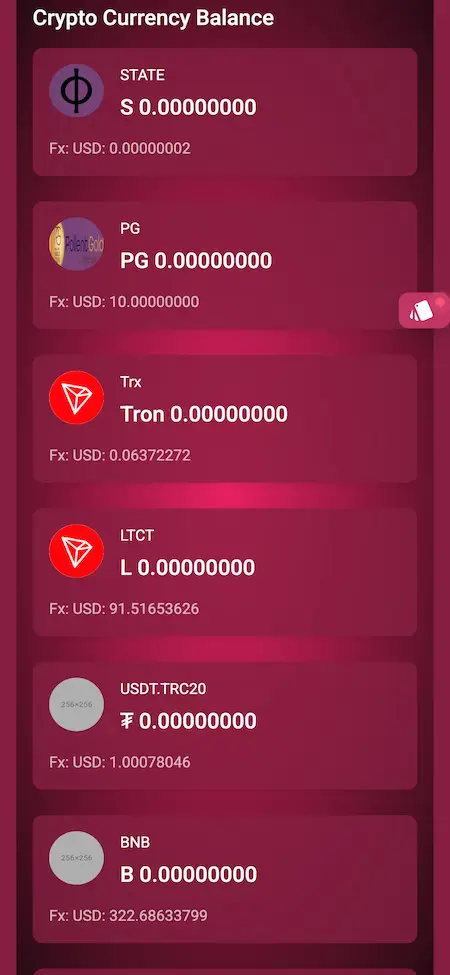

Multi-Currency Wallet Management: Users can manage both fiat and cryptocurrencies in a single wallet, enabling seamless transactions in multiple currencies.

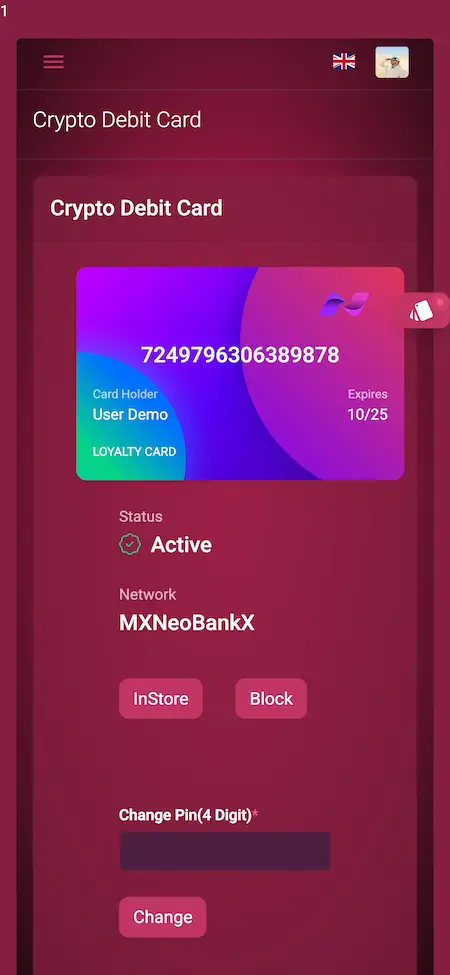

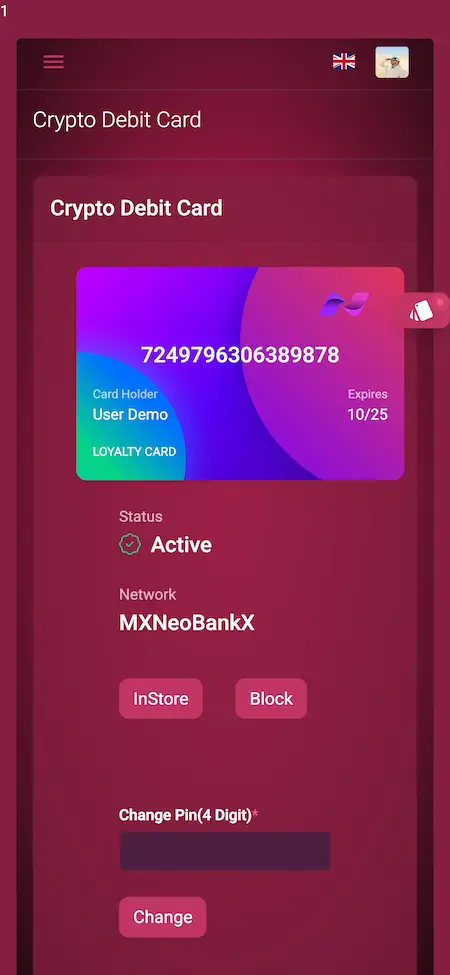

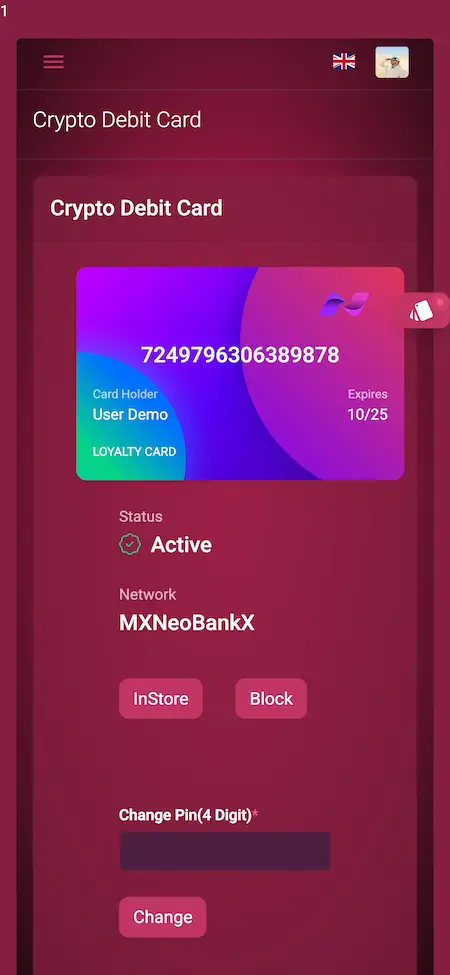

Personalized Card Issuance: Empowers users to issue personalized network cards, ensuring secure and customized transactions.

Integrated Investment Platform: Offers an investment platform with automated interest calculations, facilitating effective fund management.

Seamless Crypto P2P Trading: Facilitates easy and secure peer-to-peer cryptocurrency trading with the ability to create and manage trade advertisements.

Flexible Withdrawal Options: Provides users with various withdrawal options, ensuring flexibility in accessing funds.

User-Friendly Payment Link and Button Generation: Allows users to generate payment links and buttons easily, streamlining the process of receiving payments or donations.

Customizable Fee Management: Administrators can configure issuance and network fees, adapting to market conditions.

Comprehensive Reporting and Analytics: Empowers administrators with a powerful interface for detailed reporting and analytics.

KYC Compliance and Verifai Integration: Incorporates internal KYC processes and integrates with Verifai for secure identity verification.

Automated Currency Rate Management: Manages currency exchange rates automatically for real-time and accurate transactions.

Security with 2FA: Implements robust security measures, including two-factor authentication (2FA).

Theme and Content Management: Enables administrators to customize front-end content and themes from the backend.

NFC Support for Contactless Transactions: Supports NFC card technology, enabling contactless transactions for user convenience.

Real-Time Notifications: Sends real-time email and SMS notifications to keep users informed about account activities.

Intuitive Investment Dashboard: Offers a user-friendly dashboard for managing investments with automated interest calculations.

Crypto P2P Trading Interface: Provides a user-friendly interface for secure cryptocurrency peer-to-peer trading.

Mobile Wallet and Card Management: Allows users to manage wallets and cards on-the-go for convenient financial control.

Virtual Global Phone Numbers Integration: Integrates with virtual global phone numbers, enhancing communication options directly through the mobile app.

User Flow of our Neobank Clone

User Registration and Account Setup

Users create accounts, providing necessary information for account setup and KYC compliance.

Multi-Currency Wallet Configuration

Users configure their multi-currency wallets, selecting preferred fiat and cryptocurrencies.

Card Issuance and Personalization

Users issue personalized network cards, customizing for secure and convenient transactions.

Exploration of Investment Opportunities

Users explore the integrated investment platform, considering automated interest calculations.

Crypto P2P Trading and Advertisements

Users engage in secure cryptocurrency peer-to-peer trading, with options to create trade ads.

Flexible Fund Withdrawal System

Users utilize various withdrawal options for flexibility in accessing their funds at ease and when needed.

Payment Link and Button Generation

Users generate payment links and buttons for seamless receipt of payments or donations.

Real-Time Mobile Transactions and Notifications

Users perform transactions on the mobile app with NFC support, receiving real-time notifications for account activities.

Benefits and Seamless Implementation

Ready

Pre-built and readily available, reducing development time and enabling quick implementation.

Now

Immediate access to modern technologies, enabling businesses to stay current and competitive.

Set

Configured to suit specific needs, minimizing the need for extensive customization before deployment.

In

Customization to suit own needs is essential for everyone and we do it all for you.

Go

Once deployed, can be quickly integrated into existing systems, enabling seamless adoption.

Time

Readymade Approach saves you a deal of time and gives you edge with early launch.

Demo Video in Action

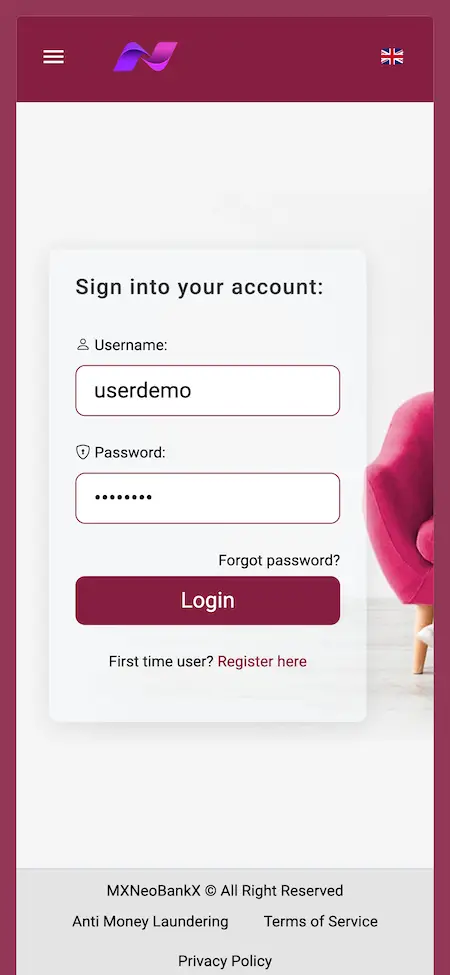

Access Demo

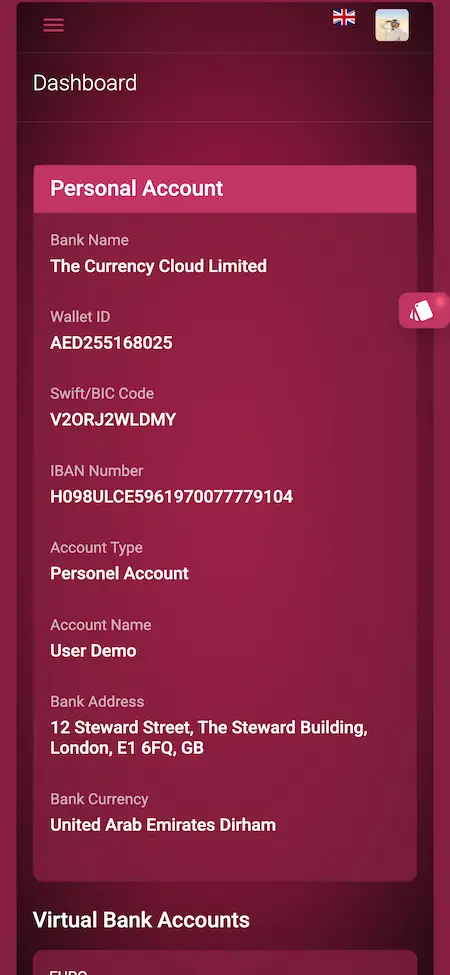

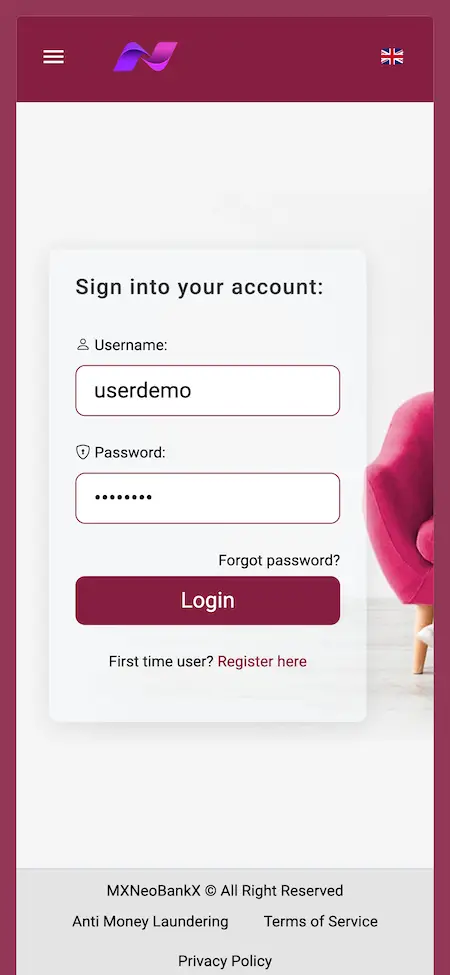

MXNeoBank

Merchant App

Access the merchant app on both platforms.

➤ merchant | Merchant_321

Web Panels

Explore the multiple web panels of the solution

MXNeoBankX with BAAS

Merchant App

Access the merchant app on both platforms.

➤ merchant | Merchant_321

Web Panels

Explore the multiple web panels of the solution

Technology Stack

Web & Admin

PHP with Bootstrap Framework | NodeJS | MySQL & MongoDB

Android Apps

Flutter Full Components Apps with Latest Dependencies

iOS App

Flutter Full Components Apps with Latest Dependencies

3rd Party API

Google Maps, Twilio, Firebase, Pay Api, Translate & MTR.

Deliverables - What You'll Get

User App

Access the user app on both platforms.

Merchant App

Access the merchant app on both platforms.

Web Panels

Explore the multiple web panels of the solution

Free Deployment

We do complete rebranding of your web and apps with your logo, icons & color scheme and deploy them.

Source & Project Codes

We provide you with complete source codes with no encryption so you can work on them as per your custom needs.

Apps Publishing

We take care of publishing your apps in both the stores on your developer accounts and get them approved.

Support Timeline

We include 60 Days of tech bug support and 1 year of products if any in terms of SDK or API at no extra cost.

Addons Available

Provide users with a comprehensive cryptocurrency portfolio tracking feature, allowing them to monitor the performance of their crypto assets, view historical trends, and receive insights for better investment decisions. Empowers users with a holistic view of their cryptocurrency holdings, encourages active management, and fosters a deeper understanding of market dynamics.

Integrate an intelligent budgeting tool that categorizes and analyzes user spending patterns, offering personalized budget recommendations and expenditure insights. Enhances financial literacy, promotes responsible spending habits, and provides users with actionable insights to manage their finances effectively.

Testimonials

See how individuals & companies like yours used Miracuves app platform to help them achieve their business goals using IT Solutions & Services

Why Choose Miracuves

Fully Customizable

Miracuves provides customization services to ensure that our clients get the exact features & flows they need for their specific needs.

Complimentary Tech Support

At Miracuves we ensure that all your support needs are met in time and with discretion to ensure no downtime.

Free Bug Support

Miracuves provides complimentary bug support timeline to clients to ensure that the platform runs smoothly and without any issues.

Complete Source Code

Miracuves ensures you get complete usage ownership of the Neobank clone by offering you the complete source code.

Custom development requires a high budget but our ready-made clone script comes with ample features and free rebranding service at a budget price.

Waiting is boring, that is why we bring you this ready-to-launch clone script which is completely customizable as per your needs.

We have vast experience in developing cryptocurrency-based applications to make your deployment capable enough to boost your crypto trading business.

We know the seriousness of security in the current times of data breach. That is why we have already verified our clone script with rigorous security testing.

Our dedication to providing a comprehensive solution, we’ve also optimized the script for enhanced speed, ensuring that users experience swift and efficient performance.

Combining al the key points we come to the stage of efficient functioning solution which delivers the right purpose and functions for everyone.

Why Our Premium Neobank Clone Script Over Custom Development?

Cost Effective

Custom development requires time and budget with our ready-made Neobank clone script get all features and rebranding service at a pocket friendly price.

Time to Market

Our ready-to-launch Neobank clone script is completely customizable as per your needs and is constantly updated to meet market standards.

Expertise

Having vast experience in developing Digital Banking System to provide, Neobank clone capable enough to boost your Digital Banking , Virtual Account & Transfer.

Security

We know the seriousness of security in all in one apps like Neobank. That is why we do QAT & various Code Assesments on the Neobank clone script to keep data safe.

Insights For International Deposit & Transfer Platform Entrepreneurs

- Concept

- Feature

- Capabilites

- Inclusions

- Marketability

- Revenue

- Prospects

A Neobank-like digital banking platform offers a fully online, branchless banking experience designed to provide seamless financial services to users. Unlike traditional banks, a fintech-driven banking solution eliminates physical infrastructure and enhances user convenience through AI-driven automation, real-time transactions, and personalized financial management.

Completely Digital Banking Model: No physical branches.

Seamless Account Opening & KYC Verification: Instant user onboarding.

AI-Powered Financial Insights & Smart Budgeting: Personalized money management.

Instant Payments & Real-Time Fund Transfers: Faster transactions.

Multi-Currency Accounts & Cross-Border Transactions: Global banking solutions.

Cryptocurrency & Digital Wallet Integration: Future-proof financial services.

Card Issuance (Virtual & Physical) & Contactless Payments: Enhanced accessibility.

Regulatory Compliance & Secure Transactions: Ensures data protection.

Customizable White-Label Solution: Business branding options.

Mobile & Web Compatibility for 24/7 Access: Improved user convenience.

A Neobank-like platform ensures a fast, secure, and user-friendly banking experience, catering to the digital-savvy generation.

Neobank Clone X (with BaaS)

A Neobank Clone X version integrates Banking-as-a-Service (BaaS) to provide extended financial capabilities, allowing businesses to embed banking services into their operations. This version is ideal for fintech startups, enterprises, and businesses looking to offer embedded financial services without building banking infrastructure from scratch.

Embedded Finance for Businesses & Startups: Enables seamless financial services integration.

Customizable APIs for Banking Services: Supports third-party financial ecosystems.

Instant Bank Account Creation for Users & Businesses: Simplifies digital banking.

White-Label Banking Solutions for Enterprises: Enables brand-specific financial products.

Automated Compliance & AML/KYC Solutions: Ensures regulatory adherence.

Real-Time Payment Processing with Direct Bank Integrations: Improves transaction speed.

Lending & Credit Infrastructure for BNPL & Microloans: Expands financial inclusivity.

Multi-Tenant SaaS Architecture for Scalable Solutions: Supports high-growth enterprises.

Revenue Sharing & Partner Banking Models: Increases business opportunities.

AI-Based Fraud Prevention & Risk Management: Enhances security.

A Neobank Clone with BaaS is an ideal solution for businesses looking to integrate digital banking, offer financial services, and scale in the fintech industry.

A feature-rich digital banking platform includes:

Instant Digital Account Opening with Paperless KYC: Simplifies onboarding.

AI-Powered Spending Insights & Automated Budgeting: Enhances financial planning.

Multi-Currency Wallet & International Transfers: Supports global users.

Integrated Cryptocurrency Trading & Wallet Services: Adds digital assets management.

Virtual & Physical Debit/Credit Card Issuance: Secure transactions.

Contactless NFC Payments & QR Code Transactions: Increases convenience.

Automated Bill Payments & Subscription Management: Simplifies expenses.

Secure End-to-End Encryption & Biometric Authentication: Enhances data security.

AI-Based Fraud Detection & Risk Management: Prevents cyber threats.

White-Label Customization for Business Branding: Expands B2B opportunities.

A banking platform like Neobank must offer security, user-friendliness, and a variety of financial tools to ensure seamless operations.

A scalable and high-performance fintech banking solution offers:

Real-Time Transactions & Instant Fund Settlements: Accelerates banking processes.

AI-Driven Risk Analysis & Fraud Prevention: Enhances security.

Regulatory Compliance & AML/KYC Verification Modules: Ensures legal adherence.

Automated Interest Calculation & Loan Processing: Simplifies lending.

Secure API Integrations for Third-Party Financial Services: Expands ecosystem.

Multi-Platform Compatibility (iOS, Android, Web): Ensures accessibility.

Cross-Border Payment Support with Forex Management: Enables global transactions.

AI-Powered Chatbots & 24/7 Customer Support: Enhances user experience.

Smart Saving & Investment Features: Optimizes wealth management.

Data Analytics & User Behavior Insights: Improves platform efficiency.

A banking app like Neobank must provide seamless digital transactions, financial intelligence, and security compliance.

A comprehensive fintech banking platform includes:

Fully Digital Account Management & KYC Verification: Hassle-free banking.

Multi-Currency Wallet & International Payment Gateway: Expands financial flexibility.

Virtual Debit/Credit Cards & Custom Payment Solutions: Enhances transactions.

Automated Bill Payments, Savings, & Investment Portfolios: Simplifies finances.

Robust Security Framework with Data Encryption: Protects sensitive information.

Instant Loan Approval & Credit Scoring System: Supports financial accessibility.

Cryptocurrency Trading & Blockchain Security: Integrates digital assets.

Comprehensive Admin Dashboard with Analytics Tools: Improves decision-making.

Smart AI-Based Customer Support & Fraud Detection: Ensures security.

API & SDK Integrations for Third-Party Services: Enables customization.

A Neobank-like fintech platform offers a complete suite of financial tools for seamless user experience.

A highly scalable and competitive fintech banking solution benefits from:

Rising Demand for Digital-Only Banking Services: Growing user adoption.

Increasing Adoption of Mobile & Cashless Transactions: Expanding fintech trends.

Seamless Integration with E-Commerce & Online Businesses: Business-friendly.

Regulatory Support for Fintech Innovations: Encourages industry growth.

AI & Blockchain Enhancements for Financial Security: Improves reliability.

Multi-Currency & Crypto Integration for Global Reach: Increases market potential.

Strong Revenue Models through Subscription & Transaction Fees: Ensures profitability.

White-Label Solutions for B2B Expansion: Enables enterprise partnerships.

Personalized Financial Services Using AI-Driven Insights: Enhances engagement.

Social Banking & Peer-to-Peer Lending Features: Adds financial inclusivity.

A digital banking solution like Neobank is an ideal fintech investment in the ever-evolving financial landscape.

A sustainable digital banking business model includes:

Subscription-Based Banking Services: Monthly/annual fees for premium features.

Transaction & Withdrawal Fees: Earnings from user transactions.

Interchange Revenue from Card Payments: Profits from card transactions.

Foreign Exchange & Cross-Border Transfer Fees: Monetizes international transactions.

Cryptocurrency Exchange & Wallet Service Fees: Expands digital finance earnings.

Interest on Loans & Overdraft Facilities: Strengthens financial services.

Revenue from Third-Party API & Fintech Partnerships: Monetizes integrations.

White-Label Licensing for Enterprises & Startups: Expands business scalability.

Affiliate & Referral Program for User Acquisition: Encourages organic growth.

Data Analytics & AI-Driven Financial Advisory Services: Adds business intelligence revenue.

A Neobank-like financial platform must implement multiple revenue streams to ensure long-term profitability.

A next-gen digital banking platform will evolve with:

AI-Driven Personalized Banking & Automated Financial Advisors: Enhances customer service.

Blockchain-Based Smart Contracts & DeFi Integrations: Future-proof banking.

Biometric & Voice-Activated Banking Services: Improves security.

5G-Powered Instant Transactions & Cloud-Based Banking: Enhances speed.

Machine Learning for Credit Scoring & Risk Analysis: Increases lending efficiency.

A fully optimized Neobank-like platform ensures future scalability, security, and financial inclusivity, making it a smart investment in the digital finance industry.

Our Development Process for Neobank Clone App

Requirements Gathering

We start by understanding your requirement in regards to purpose, goals and future targets. Following the same we start customizing our Neobank Clone script to match to your specific needs.

Design

Our next step is the designing part where our skilled designers will understand your creative needs and will work with you closely to get the idea in ui/ux design ready to implement.

Development

At this stage, Miracuves start the rebranding process as we offer a ready-to-launch Neobank Clone App. Here we do setup, configurations and required modifications as agreed.

Testing

We use a rigorous testing process to ensure that the Neobank clone is completely free of bugs and meets all of your requirements before it is deployed on your requested servers.

Deployment

Once the quality team passes us the green signal we will proceed to the deployment process, ensuring your Neobank clone is smoothly deployed and runs as you have wanted.

Support & Maintainence

We offer 60 days of free support and maintenance services including technical support, and bug support to ensure that your Neobank clone continues to meet your business goals.

Check Out Our Full Range of App Clone Solutions

Check Out Other Solutions Offered By Miracuves

Miracuves offers a comprehensive suite of ready-to-deploy solutions tailored for seamless functionality across various industries. Designed with user-friendliness at their core, our products enhance efficiency and simplify processes, ensuring a hassle-free experience for all your business needs

Frequently Asked Questions & Release Log

Reseller Panel APIs. BSICards Visacard added Woocommerce Plugin - Discontinued BSICards Mastercard added Search option in Prepaycards Deprecated Basic, Dark, Pro themes Fixed Value Prepaid cards from Livitpay. Addon Mastercard replacement for Visa Cards. Visa USD / Euro Cards Added. MasterCard Monthly Fee MasterCard Cancellation Virtual Global Phone Numbers (Vonage) - Finance / Prime Theme only. Mobile App API Updates New Prime Theme ( Purchase AdminUX Pro ) Delete All User Data

1. Crypto MasterCard. 2. Bug Fixes 3. Crypto Closed Loop Card 4. Merchant-Agent App to support Crypto Cards and Tap2Pay NFC cards.

1. App API Updates 2. Bug Fixes 3. Games ( Finance and Premium Theme only) 4. Onramper admin API update

1. App API Updates 2. Bug Fixes 3. Stripe Merchant Key Update. 4. Remittances 5. New Finance Theme 6. Admin Rights 7. Add on Admins 8. Bug Fixes

1. User KYC Admin Managed 2. Loans 3. Fixed Deposit 4. Deposit Pension Schemes 5. Admin Dashboard Decluttered 6. Separate Design for Mastercard and Closed Loop Card 7. Bug Fixes 8. Onramper 9. Merchant App Stripe Add on 10. Loyalty Points and Referrals

1) Bug & Security Fixes 2) User App API 3) Merchant App now multi-currency ( Merchant can choose local currency )