It’s wild to think that someone once paid 10,000 Bitcoins for two pizzas, right? Fast forward to today, and those same coins could probably buy you a private island. Bitcoin has matured — and so has how we trade it. In a world where decentralization is more than just a buzzword, peer-to-peer (P2P) Bitcoin trading isn’t just surviving—it’s thriving.

If you’re a startup founder, solopreneur, or digital product dreamer, you’ve probably had that “what if” moment—what if you could build the next LocalBitcoins or Paxful? With centralized exchanges tightening their rules, P2P platforms are back in the spotlight, offering flexibility, freedom, and a fresh way to earn.

But before you dive wallet-first into the crypto sea, let’s unpack how this model actually works. Stick with us as we break down the business mechanics, revenue streams, user journeys, and future-forward strategies. At Miracuves, we’ve helped innovators launch clone apps that disrupt. Let’s dig in.

What Is P2P Bitcoin Trading, Anyway?

P2P Bitcoin trading platforms allow buyers and sellers to connect directly and execute transactions without a third-party middleman holding funds. Think Craigslist meets Coinbase—but smarter.

Key Characteristics:

- Direct User Matching: Via ads or algorithmic pairings

- Multi-Payment Options: Cash, PayPal, gift cards, bank transfers

- Dispute Management: With user ratings and admin intervention

- Escrow System: To reduce fraud and build trust

Core Revenue Streams: How Do P2P Platforms Make Money?

Let’s face it, you’re not building a P2P platform just for the vibes. You want cash flow.

1. Trading Fees

Most platforms charge a flat percentage (usually 0.5–1%) per transaction, either from the buyer, seller, or both. Unlike centralized exchanges, these fees are often lower due to minimal overhead.

2. Ad Posting Fees

Premium ad placement fees let power sellers buy better visibility. Think of it as Google Ads for crypto.

3. Escrow Charges

Some platforms charge a nominal escrow fee to maintain wallets and ensure dispute management services.

4. Membership Tiers

Freemium models can upsell:

- Faster KYC processing

- Dedicated support

- Fee discounts

5. Affiliate Programs

Referrals = growth. Reward users who bring friends. Win-win.

User Journey: What a Typical P2P Flow Looks Like

- Sign Up & KYC

User signs up and completes identity verification (usually required for compliance). - Wallet Creation

A custodial or non-custodial wallet is created. - Search or Post Ad

User posts an offer or browses available trades based on amount, payment method, or price. - Escrow Activation

BTC is held in escrow after trade is initiated. - Payment Transfer

The buyer transfers funds directly (bank, UPI, etc.). - Release & Rate

Seller confirms receipt, BTC is released, and users leave reviews.

The Global Appeal: Why Users Love P2P Platforms

- No Borders: Trade with anyone across the globe.

- No Banks, No Problems: Ideal for unbanked or underbanked communities.

- Better Privacy: Less data shared than on centralized exchanges.

- More Payment Options: Even barter or gift cards in some regions!

Building Blocks of a P2P Bitcoin Platform (Clone or Custom)

If you’re thinking of launching your own app, here’s what you’ll need under the hood:

1. Escrow System

Built on smart contracts or admin-controlled wallets for fund safety.

2. Robust Matching Engine

Filters based on payment mode, price, country, etc.

3. Multi-Language Support

Localization = retention.

4. Two-Factor Authentication

Security is non-negotiable.

5. Dispute Resolution Panel

With automated rules + human backup.

Risks and How to Manage Them

Let’s not sugarcoat it—P2P platforms walk a tightrope.

1. Fraud & Scams

Escrow and a strong dispute mechanism are your shield.

2. Regulatory Uncertainty

Work with legal experts and offer compliance toggles (e.g., region-based KYC).

3. Liquidity Problems

Jumpstart activity with initial market makers or your own team creating trades.

4. Server Downtime

Opt for cloud-native, scalable hosting solutions from Day 1.

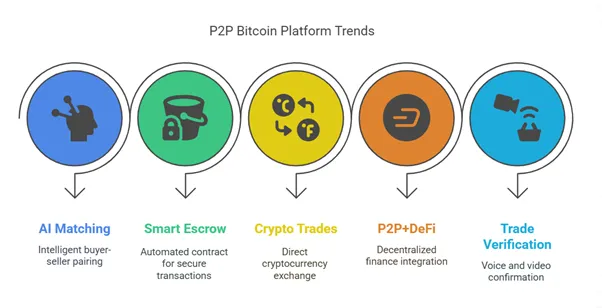

The Future of P2P Bitcoin Trading: Trends to Watch

- AI-Powered Matching Engines

Think Tinder, but for BTC deals. - Decentralized Escrow (Smart Contracts)

Eliminating platform dependency entirely. - Crypto-to-Crypto P2P

BTC for ETH? Peer-to-peer swap markets are gaining traction. - P2P + DeFi Hybrid Models

Yield farming meets trading? It’s already happening. - Voice/Video Verification for Trades

Zoom + Blockchain = More trust, less fraud.

Conclusion: Why You Should Act Now

P2P Bitcoin trading isn’t just a phase — it’s a movement. The world is hungry for permissionless finance, and this model puts control back in the hands of users. With minimal entry barriers, diverse monetization options, and global appeal, the P2P route might be the smartest play in your crypto startup playbook.

Don’t wait until someone else builds your idea first.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

1. What is P2P Bitcoin trading?

It’s a direct exchange of Bitcoin between users without relying on centralized exchanges. Think user-to-user, powered by escrow.

2. Is it safe to trade Bitcoin on P2P platforms?

Yes, when proper escrow and identity verification systems are in place. Always check reviews and platform reputation.

3. How do P2P platforms earn money?

Mostly through transaction fees, premium ads, and affiliate referrals. Some offer VIP services or memberships.

4. Can I build my own P2P crypto platform?

Absolutely! With platforms like Miracuves, you can build or clone successful models like LocalBitcoins with customization.

5. What’s the legal status of P2P Bitcoin trading?

Depends on the region. Some countries support it, while others impose restrictions. It’s wise to consult a legal advisor.