Remember the days when launching a startup meant knocking on VC doors, pitching like your life depended on it, and praying someone believed in your idea? Fast forward to the Web3 age, and now creators, builders, and degens have a new playground: Decentralized Crypto Launchpad. These platforms are flipping the script—no gatekeepers, no slow funding cycles, just a community-driven rocket ship waiting to take off.

If you’re a startup founder or digital rebel eyeing the blockchain horizon, this isn’t just a trend—it’s your ticket to early adopters, real liquidity, and a tribe that actually wants you to win. From fair token distribution to instant liquidity pools, launchpads give creators superpowers that VCs can’t offer.

But let’s be real—building one isn’t just about throwing smart contracts together. It’s about nailing the business model that keeps users engaged, investors happy, And that’s where Miracuves, a leading app clone development company, becomes your secret weapon.

What Is a Decentralized Crypto Launchpad Anyway?

A decentralized crypto launchpad is a blockchain-based platform where early-stage crypto projects raise capital by offering their native tokens directly to users. No banks. No brokers. Just smart contracts and the power of community.

Projects typically launch via:

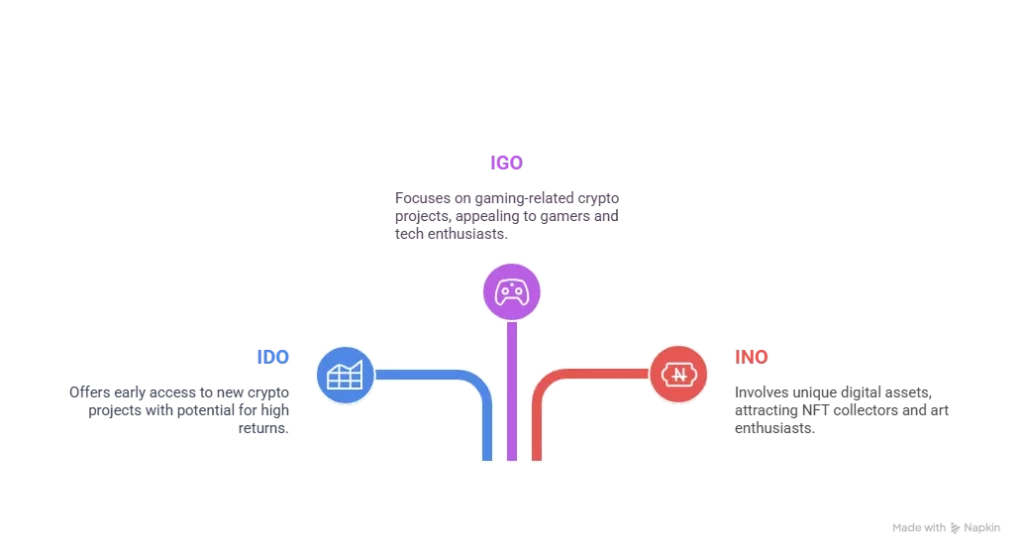

- IDO (Initial DEX Offering)

- IGO (Initial Game Offering)

- INO (Initial NFT Offering)

- And more new acronyms we haven’t invented yet.

Core Revenue Streams of Crypto Launchpads

Let’s talk turkey. Or tokens.

1. Token Listing Fees

Projects pay a fee (in ETH, BNB, or native platform token) to be listed. This can range from $10,000 to $100,000 depending on platform reputation.

2. Token Allocation Commissions

Launchpads often take a small cut of the token supply—anywhere between 1% to 5%. Once the project pumps post-listing, this turns into a tidy profit.

3. Staking and Tiered Access Models

Users stake native tokens to gain tiered access to launches. The more you stake, the better your chances of early access.

- Bronze Tier: 500 tokens

- Silver Tier: 2,000 tokens

- Gold Tier: 5,000 tokens

4. Yield Farming Pools

Many platforms let users farm project tokens by providing liquidity, which generates platform fees and keeps users sticky.

5. NFT Sales & Whitelisting Auctions

Some Decentralized Crypto Launchpad host NFT-based whitelisting spots. Think of it like buying a VIP ticket to a token sale.

6. Cross-Chain Integration Services

Projects wanting to go multi-chain (Ethereum, BSC, Solana, Polygon) often pay extra for cross-chain launch support.

The Tokenomics Game: More Than Just HODL

Your launchpad’s native token isn’t just digital confetti—it’s the beating heart of your platform.

Functional Roles:

- Governance: Token holders vote on which projects get listed.

- Utility: Used for staking, paying fees, or accessing launches.

Burn & Buybacks: To control supply and add deflationary value.

Decentralization: Real or Just a Buzzword?

Let’s get honest: some “decentralized” launchpads are just centralized startups with a DAO badge. But the true stars:

- Let users vote on listings

- Use smart contracts for fund management

- Offer multi-signature security

If you want community trust (and retention), go full DAO, not just DINO (Decentralized In Name Only).

Market Trends & Why Now Is the Time

- According to Statista, global blockchain funding topped $26.8 billion in 2024.

- Interest in community-led funding is at an all-time high, with platforms like CoinList reporting 5x user growth year-over-year.

Gen Z investors are skipping Wall Street and going full DeFi—meaning launchpads are their new Nasdaq.

Must-Have Features for a Winning Launchpad App

If you’re building from scratch—or cloning a winner—your app needs:

- KYC/AML Modules (even decentralized projects can be compliant)

- Multi-wallet support (MetaMask, Trust Wallet, Ledger)

- Real-time dashboards for project metrics and fundraising progress

- Responsive UI for both mobile and desktops

Token vesting schedules to protect investors from pump-n-dumps

Business Model Variations

Different platforms cater to different tribes.

| Launchpad Type | Focus Area | Monetization Tactic |

| DAO-based | Community Voting | Governance token staking |

| NFT-centric | Gaming/NFTs | NFT auctions, royalties |

| Incubator-backed | Premium Projects | High listing fees, mentorship |

| Meme-token playground | Hype Coins | Fast listing, viral referrals |

Conclusion :

Decentralized crypto launchpads are the crowdfunding portals of the future—faster, fairer, and funkier than anything Web2 could’ve dreamed up. But behind every successful launchpad is a smart business model that keeps the ecosystem thriving.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

What makes a crypto launchpad “decentralized”?

It uses smart contracts, community voting, and DAO structures to avoid central authority. No single entity controls fund flows or project decisions.

How do launchpads make money?

Via token listing fees, allocation commissions, staking programs, and sometimes NFT sales or farming rewards.

Do I need a native token to run a launchpad?

Yes. It’s essential for staking, governance, and overall platform utility. Plus, it drives long-term value and user engagement.

Can I build a launchpad clone without coding?

Absolutely. Miracuves offers white-label crypto launchpad solutions so you can hit the ground running—no Solidity wizardry required.

Are crypto launchpads legal?

Depends on the jurisdiction. Many comply with KYC/AML norms while staying decentralized. Always check your region’s crypto laws.

What’s the best launchpad for NFTs?

Platforms like Seedify or GameFi are tailored for NFTs and gaming. But you can create your own niche launchpad with custom features too.