Not too long ago, I watched a friend of mine try to explain decentralized finance to his mom using pancake metaphors. It didn’t go well. But one thing stuck: “You mean I don’t need a bank or a middleman?” Ding ding ding. That’s what decentralized crypto exchanges (DEXs) are all about—cutting out the suits, the fees, and the friction.

Now, if you’ve been around the startup block or you’ve got a crypto dream brewing in your Notion doc, you’ve probably realized this: DEXs aren’t just tech marvels. They’re revenue machines. And not in the boring Wall Street way—but in the “permissionless innovation” kind of way.

From automated market makers to yield farming twists, decentralized exchanges are rewriting the rules of trading. If you’re thinking about building a DEX clone or launching your own DeFi ecosystem, Miracuves can help you turn that vision into a scalable, monetization-ready platform.

Why DEXs Are Flipping the Finance World on Its Head

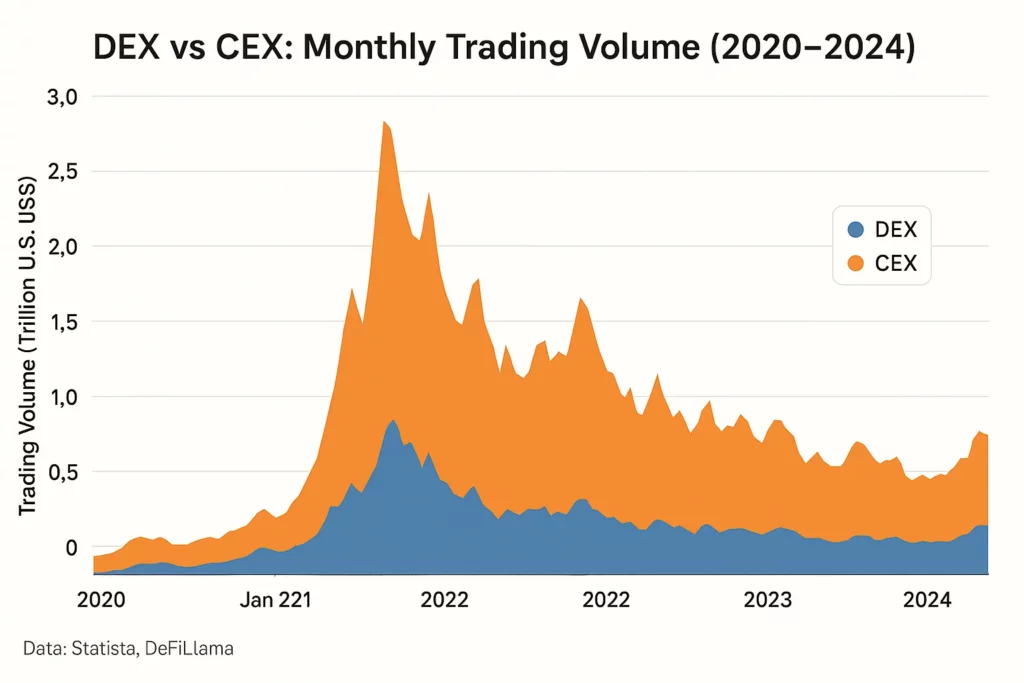

Centralized exchanges like Coinbase and Binance might still dominate the headlines, but DEXs like Uniswap, SushiSwap, and PancakeSwap are quietly eating up market share. As of 2024, DEXs are handling over $150 billion in monthly trading volume. No KYC. No custody. Just smart contracts and user control.

The DEX surge is fueled by:

- Distrust in traditional financial institutions

- Regulatory gray zones (and we mean gray)

- Growing user appetite for autonomy and privacy

Business Models Behind Decentralized Exchanges

1. Liquidity Provider (LP) Fee Model

This one’s the bread and butter of most AMM-based DEXs. For every trade, a small fee (usually 0.3%) is charged and distributed to liquidity providers. Your platform can retain a slice of that fee to fund development or token burns.

Think of it like Airbnb taking a cut from hosts every time someone books a stay.

Example: Uniswap’s LPs earn from swap fees, but Uniswap Labs also collects protocol fees.

2. Token Launchpad / IDO Model

Startups are hungry for launchpads. DEXs double as platforms for Initial DEX Offerings (IDOs), helping new tokens get traction. You charge listing fees or take a percentage of the raised capital.

Add KYC modules or whitelist tiers for premium access to IDOs.

Example: Polkastarter and TrustSwap charge launch fees + take a % of token supply

3. Staking & Yield Farming Protocols

Let users stake your native token or LP tokens to earn rewards. While users farm yield, you collect protocol fees, manage token inflation, and create token demand.

Yield farming isn’t dead—it just got smarter. Layer in time-lock bonuses or auto-compound features.

Example: PancakeSwap’s CAKE staking vaults, Sushi’s Onsen farms

4. DAO Governance & Treasury Allocation

If your DEX is governed by a DAO (Decentralized Autonomous Organization), treasury management becomes key. The DAO can vote to fund protocol upgrades, invest in grants, or even distribute dividends from treasury profits.

Many DEXs allocate up to 10–20% of protocol fees to a treasury controlled by token holders.

Example: Curve DAO uses veCRV holders to vote on reward distributions

5. Cross-Chain Swap Fees

With multi-chain support becoming a must-have, DEXs that enable cross-chain trading charge bridge fees, gas subsidies, or slippage protection fees.

Example: THORChain charges swap fees across Bitcoin, Ethereum, and other chains, while retaining a treasury fee.

Cost Comparison – Cross-Chain vs Single-Chain DEX Transactions

| DEX Type | Action | Gas/Bridge Fee | Slippage | Execution Time | Notes |

|---|---|---|---|---|---|

| Single-Chain (e.g., Uniswap on Ethereum) | ETH → USDC swap | $8–$25 | Low (0.1%–0.3%) | ~15–30 sec | Higher gas fees on ETH; no bridging delay |

| Single-Chain (e.g., PancakeSwap on BNB) | BNB → BUSD swap | <$0.50 | Low | ~3–5 sec | Cheap but limited to BNB chain assets |

| Cross-Chain (e.g., THORChain) | BTC → ETH swap | $15–$35 | Moderate (0.5%) | ~2–10 min | Involves bridge validators; more confirmation steps |

| Cross-Chain (e.g., Osmosis) | ATOM → USDC (via IBC) | $1–$3 | Moderate | ~1–5 min | Uses IBC; minimal slippage with good liquidity |

6. Premium Analytics or API Access

Want to serve developers, trading firms, or power users? Offer them pro analytics dashboards, trading APIs, or historical data feeds—for a fee.

Revenue tip: Introduce a subscription model for institutional-grade tools.

Example: dYdX offers API-based algo trading access for power users

7. NFT Marketplace Add-Ons

DEXs can bolt on NFT swap modules or integrate NFT collateralized lending. Monetize through minting fees, listing commissions, or cross-selling staking opportunities.

Example: LooksRare combines NFT trading + token farming

8. Advertising & Sponsored Pools

You’ve got eyeballs—sell attention. Run sponsored yield pools, featured IDOs, or banner slots in your dashboard. Make it subtle, tasteful, and community-approved.

Example: A DeFi project pays to be “pool of the week” or featured farm

Want to Build a DEX That Prints Value?

Great news — you don’t have to start from scratch. At Miracuves, we specialize in building crypto exchange app clones and DeFi platforms tailored for monetization and performance. Whether you want a Uniswap-style AMM, a cross-chain bridge DEX, or a launchpad-focused platform, we help you build, deploy, and scale—fast.

Build Your Own Crypto Exchange Platform with Miracuves

Conclusion

Decentralized exchanges aren’t just crypto playgrounds anymore—they’re serious fintech businesses. From fees and farming to governance and growth hacking, there’s a business model for every type of DeFi founder.

And hey, if you’ve got the idea but not the code yet—Miracuves is ready to help you build that revenue-generating, decentralized beast.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

Can I legally launch a decentralized exchange?

Yes, but check your local regulations. DEXs are often less regulated than CEXs, but that doesn’t mean you can skip legal prep.

How does a DEX make money without custody of funds?

Through transaction fees, token staking, cross-chain bridges, and more—all while smart contracts handle custody.

What’s the difference between AMM and order-book DEXs?

AMMs use liquidity pools, while order-book DEXs match buyers and sellers like traditional exchanges.

Do I need a native token to monetize a DEX?

Not always, but having a token enables staking, governance, rewards, and deeper ecosystem plays.

How do DAOs impact DEX business models?

DAOs can control treasury, fees, and platform decisions—giving power (and profit) back to the community.

Is it possible to build a DEX clone like Uniswap or PancakeSwap?

Absolutely—and Miracuves can help you build one that’s optimized for performance, scale, and monetization.