Picture this: you’re sipping coffee at 2 AM, scrolling through Twitter, and suddenly stumble upon yet another token launch that raised millions… in minutes. Your brain’s like, “Why am I not doing this already?” If you’ve ever flirted with launching a decentralized IDO (Initial DEX Offering) platform, you’re not alone. The appeal is undeniable—borderless fundraising, democratized access, and insane market velocity. But there’s a catch: how do you make money while keeping it decentralized?

In the Web3 world, everyone’s building but few are profiting sustainably. Sure, we’ve all heard the buzzwords: community-first, DAO-powered, gas-efficient. But when it comes to putting actual dollars (or crypto) into your wallet as a platform owner, the conversation gets suspiciously quiet. Spoiler: tokenomics alone won’t save you. You need a real, replicable, and scalable revenue model that works even in a bear market.

That’s where this blog steps in. We’ll break down the clever (and sometimes sneaky) ways decentralized IDO launchpads rake in revenue—without compromising their mission. And if you’re dreaming of launching your own platform fast and profitably? Miracuves has your back, offering tailor-made clone solutions that are secure, scalable, and ready to monetize.

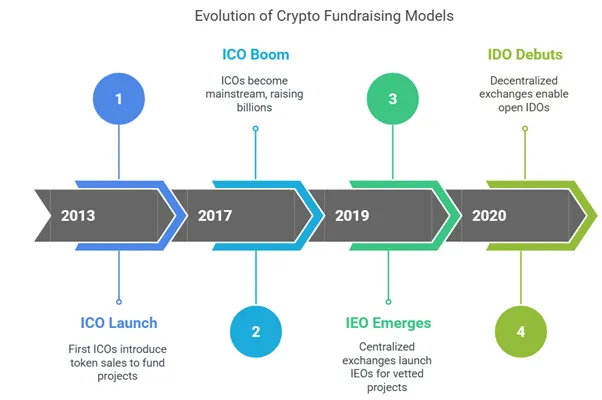

Understanding the IDO Launchpad Landscape

What Is an IDO Launchpad, Really?

An IDO Launchpad is like Kickstarter meets crypto, but with fewer rules and way more FOMO. It allows blockchain projects to launch their tokens directly to a decentralized market via DEXs (like Uniswap or PancakeSwap). No middlemen, no VC gatekeepers—just pure peer-to-peer funding.

Why Everyone’s Obsessed With It

- Low entry barrier: Startups can raise funds quickly with minimal upfront costs.

- Fast liquidity: Tokens get listed almost instantly on decentralized exchanges.

- Hype-driven virality: Thanks to Telegram, Reddit, and X (RIP Twitter), projects go viral in hours.

Core Revenue Streams for IDO Launchpads

Let’s talk cashflow. Here’s how your launchpad can turn those web3 vibes into revenue.

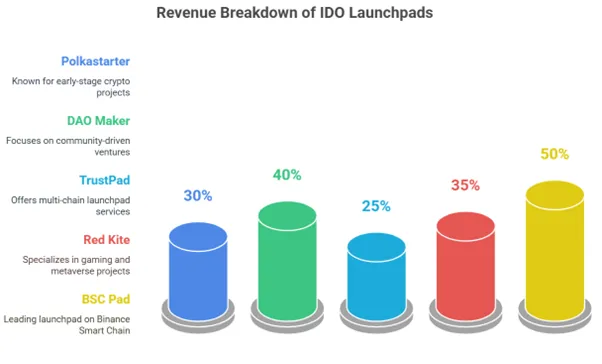

1. Token Listing Fees

You charge projects a fee to launch their token on your platform. Simple, straightforward, and surprisingly effective. Some platforms like Polkastarter and TrustPad reportedly charge between $5,000 to $25,000 per IDO.

2. Token Allocation Fees

Take a slice of the pie. Most IDO platforms charge 1-5% of the total funds raised during a token sale. This aligns your revenue with the project’s success—win-win.

3. Native Token Utility & Appreciation

Here’s where the crypto magic happens. You issue your own native token (like POLS for Polkastarter) and create strong use-cases:

- Required to participate in IDOs

- Used for staking or governance

- Burn-and-mint mechanics to manage supply

If structured well, token demand can drive price appreciation—indirect revenue, but real value.

4. Staking Yields & Pool Access Fees

Make participants stake your token to get access to exclusive pools. You can then monetize:

- Early access fees

- Staking rewards with performance fees

- Tiered staking for VIP treatment (like guaranteed allocation)

5. Subscription Models

Not all revenue has to be tokenized. Offer premium access for:

- Analytics dashboards

- Early project whitelists

- Private Discord or Telegram groups

Charge in fiat or crypto—just keep it slick and useful.

Advanced Monetization Playbooks

Token Launch-as-a-Service (TLaaS)

Help other startups launch tokens end-to-end for a flat or tiered fee. Think white-glove service meets decentralization. Great for non-technical teams.

DAO Advisory & Incubation Services

Startups are thirsty for guidance. Provide DAO governance setup, community building, and tokenomics modeling for equity, tokens, or fees.

Liquidity Mining Campaigns

Earn a share by organizing liquidity incentives (like “add $10K to the pool, get rewarded”). You earn a coordination or facilitation fee.

Cross-Chain Bridge Fees

Integrate with cross-chain token bridges. Earn transaction fees on each swap that enables users to participate from multiple ecosystems.

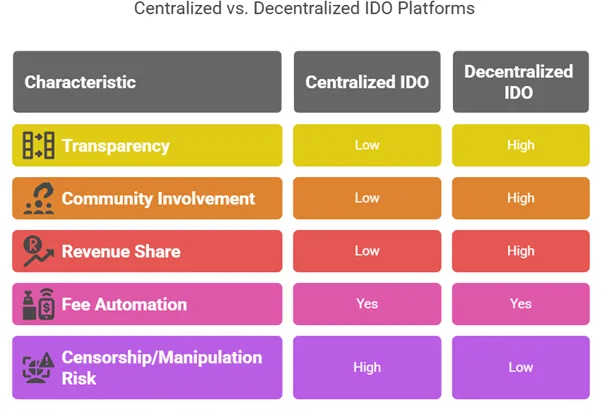

The Decentralization Dilemma: Monetize Without Losing Trust

Let’s be real—no one wants a “decentralized” launchpad that feels like a centralized cash grab. So here’s how to balance:

- Transparent Fees: Publish all fee structures upfront. Use smart contracts to automate collection.

- Community Voting: Let your DAO vote on major fee changes.

- Revenue Sharing: Reward stakers with a portion of platform earnings to align incentives.

Why Design Still Rules in Web3

The fastest way to lose revenue? A clunky interface. Your users might be crypto-natives, but they still expect buttery-smooth onboarding.

- Mobile-optimized flows

- Social sign-ins (Google, Apple, MetaMask)

- Transaction previews and gas fee estimators

Future-Proofing: What’s Next for IDO Revenue?

- AI-powered project scoring to pre-screen scams and boost credibility

- Social-Fi integrations for influencers to earn through referrals

- Layer 2 adoption to slash gas fees and widen access

- NFT collabs to add gamified pre-sale experiences

The Web3 space is evolving at breakneck speed, but the fundamentals of monetization remain grounded in delivering real value.

Conclusion

Building a decentralized IDO launchpad is more than just riding the Web3 hype—it’s about crafting a platform that delivers real value while generating sustainable income. The most successful launchpads don’t rely on a single revenue stream; they mix and match—charging listing fees, earning from token allocations, unlocking premium access through staking, and leveraging their own token ecosystems. What sets thriving platforms apart isn’t just tech—it’s trust, transparency, and killer UX.

The Web3 audience is savvy and expects frictionless onboarding, smart contract transparency, and incentives that actually reward participation. As innovation in DeFi continues, integrating AI tools, Layer 2 scalability, and social referral features will be key to staying ahead. And remember, you don’t have to start from scratch.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

1.What is the best revenue stream for an IDO launchpad?

Most profitable models combine listing fees, allocation fees, and staking rewards. Native tokenomics add long-term sustainability.

2.Can you charge fiat on a decentralized launchpad?

Yes, via integrations with services like MoonPay or Ramp, you can accept fiat for premium services or analytics access.

3.How do native tokens generate revenue?

Indirectly. They create network effects. The more people need and hold your token, the more valuable your ecosystem becomes.

4.Is it possible to remain decentralized and still profitable?

Absolutely. Use DAOs for governance and transparency for trust while automating fees via smart contracts.

5.How do you handle regulatory risks?

Structure fees carefully and avoid direct custodianship of funds. Consult legal experts before launch—always.