Let’s be honest—no one enjoys standing in line at a bank, juggling forms, IDs, and their sanity. That’s why digital banking isn’t just a trend—it’s a lifestyle shift. From teens to tech-savvy seniors, everyone’s tapping into apps that let them send money, check balances, and invest—without ever stepping into a branch.

And it’s not just about convenience. With fintech innovation booming and Gen Z demanding smarter money management, digital banks (a.k.a. neobanks) are stepping up. But here’s the real tea: how are these banks—many offering “no fees” and shiny dashboards—actually making money?

That’s what we’re diving into. And if you’re building (or dreaming of building) your own digital bank clone, Miracuves is your backstage pass to scalable, smart, and seriously profitable banking platforms.

What Is a Digital Bank, Really?

A digital bank is a tech-first banking platform that offers traditional banking services—checking accounts, savings, payments, even lending—but with a twist: no physical branches.

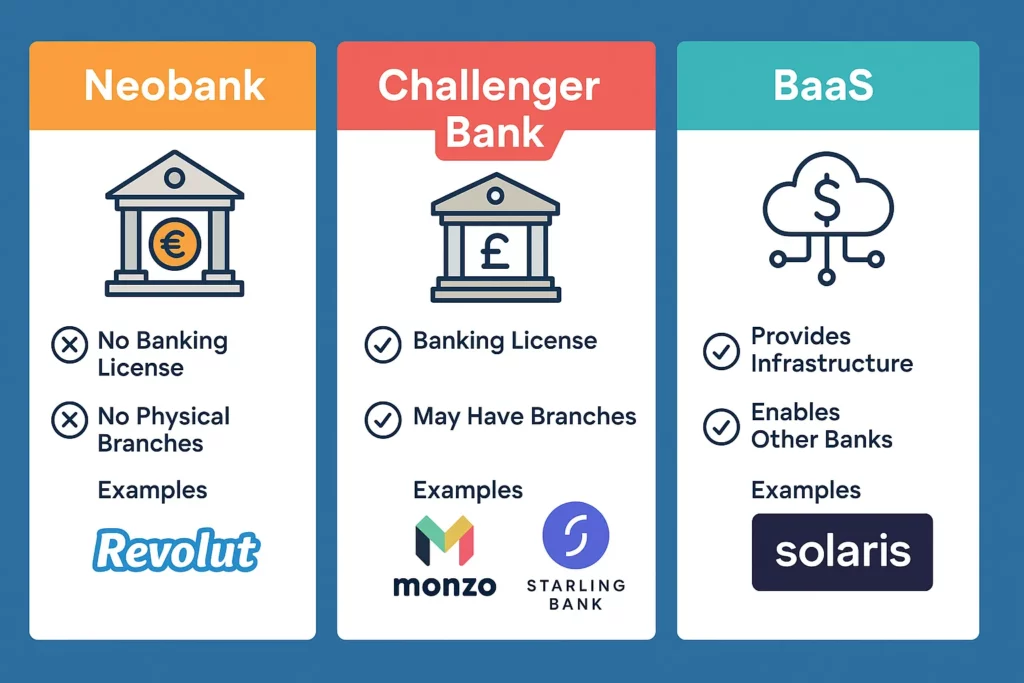

Types of Digital Banks:

- Neobanks – 100% online, no banking license (they partner with licensed banks)

- Challenger Banks – licensed banks disrupting legacy banks (like Monzo, Revolut)

- Banking-as-a-Service (BaaS) – platforms offering modular banking infrastructure

Core Revenue Streams for Digital Banks

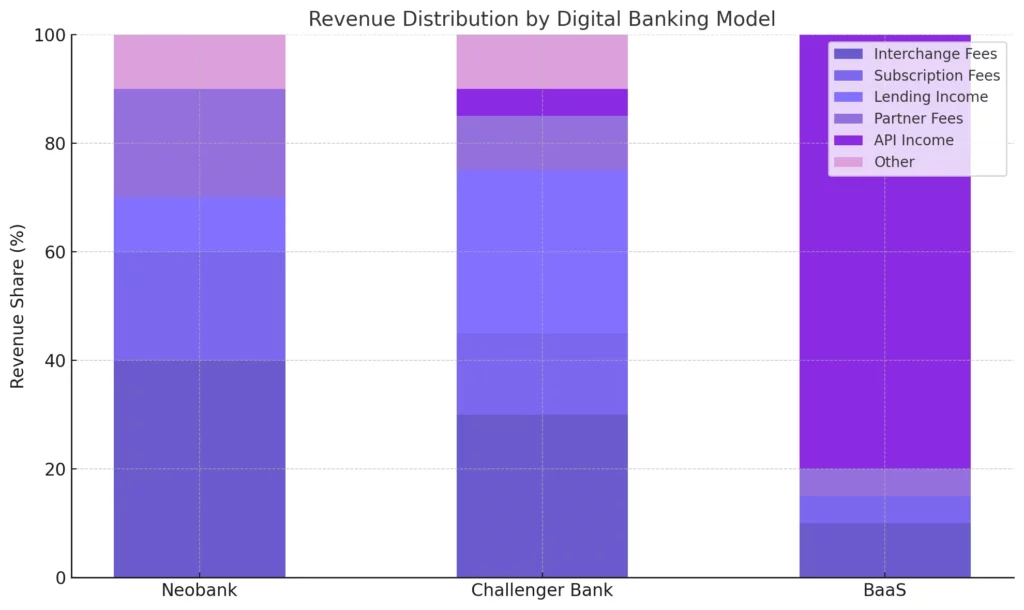

1. Interchange Fees

- When users swipe their debit card, merchants pay a fee. A chunk of that fee lands in the neobank’s pocket—usually around 0.2% to 1.5% per transaction.

- The more your users swipe, the more passive revenue your platform earns.

2. Subscription Plans

- Many digital banks offer freemium models with tiered features—like budgeting tools, faster transfers, or crypto wallets.

- Example: Revolut’s paid plans start at $9.99/month.

3. Lending & Credit Products

- Loans, overdrafts, BNPL (Buy Now Pay Later)—these services generate interest income and origination fees.

- Some digital banks even monetize credit scoring tools for embedded lending.

4. Partner Marketplace Fees

- Neobanks often integrate third-party offers (insurance, investments, travel deals) and earn referral fees or commissions when users engage.

- It’s affiliate marketing—but smarter and in-app.

5. Foreign Exchange & Crypto Spreads

- Banks like N26 or Wise offer FX and crypto conversion at “near-market rates”—but there’s a margin baked in.

- Small spreads on high volumes = serious profits.

6. Wealth & Investment Services

- From robo-advisors to ETF purchases, digital banks charge management or transaction fees.

- Even micro-investing (like Acorns-style roundups) can be a goldmine at scale.

7. Data Monetization & APIs

- With proper anonymization and consent, user behavior data can be licensed or used to improve product targeting—especially for B2B clients.

- BaaS platforms monetize APIs directly by charging fintechs for usage.

Why This Model Works

Here’s the kicker: digital banks run lean. No branches. Automated systems. Cloud-native infrastructure. That means:

- Lower costs per customer

- Higher scalability

- Faster time-to-market for new features

And thanks to open banking regulations, they’re able to integrate and monetize smarter—faster—than traditional banks.

How to Build a Profitable Digital Banking Platform

Focus Areas:

- Onboarding – Make it frictionless. KYC + UX = 🔑

- Trust & Security – 2FA, biometric logins, encryption

- Engagement – Push nudges, spending insights, rewards

- Retention – Subscriptions, gamified savings, cashback

Build Your Own Digital Banking App

With Miracuves, you get pre-built, customizable digital bank clones with modern tech stacks, wallet integration, analytics dashboards, and monetization modules—all built to scale.

Conclusion

Digital banks are not just banking smarter—they’re banking richer. The business model thrives on volume, automation, and value-added services. And the best part? You don’t need a skyscraper to launch one—just a smart idea, a sharp team, and a scalable tech partner.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQ’s

1) How do digital banks make money with no fees?

They earn from card swipe fees, partner commissions, and upselling premium services—even if basic accounts are free.

2) Do I need a banking license to launch a digital bank?

Not necessarily. Many neobanks partner with licensed banks or use Banking-as-a-Service (BaaS) providers.

3) What’s the difference between a neobank and a traditional bank?

Neobanks are digital-only, tech-driven, and focus heavily on UX. Traditional banks have branches and legacy systems.

4) Is it profitable to launch a digital banking app?

Yes, especially with the right revenue model and scale. Many neobanks turn profitable by year 3–4.

5) What features are essential for a digital bank app?

KYC, instant transfers, virtual cards, smart budgeting, rewards, FX/currency support, and crypto are increasingly standard.

6) How fast can I build one with Miracuves?

With our pre-built clones, you can launch a working MVP in 30–45 days, fully branded and monetization-ready.