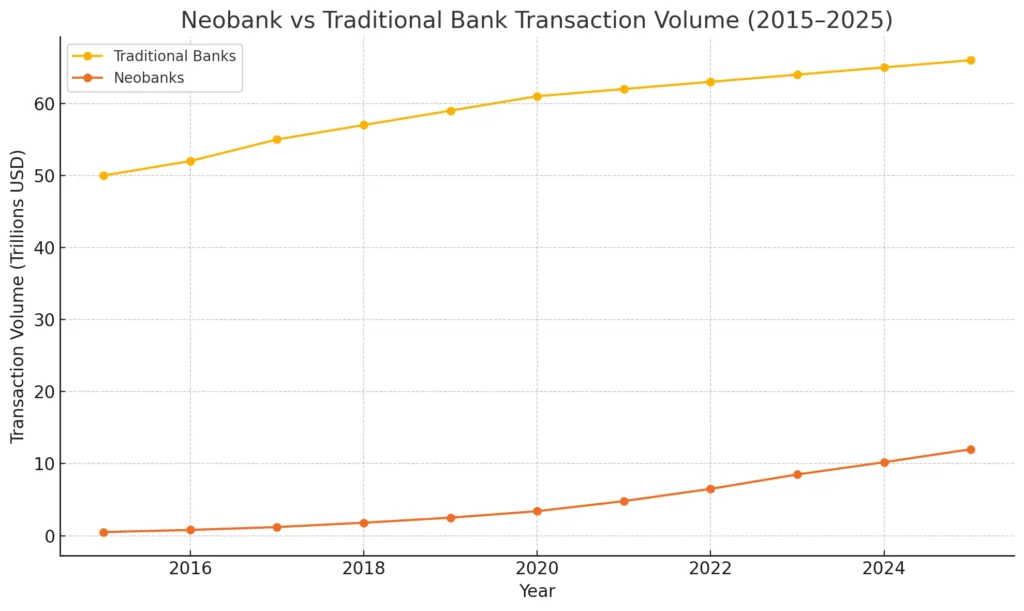

Let’s be real. The idea of starting a bank used to sound like something only Wall Street sharks or government suits could pull off. Now? If you’ve got an app idea, a little capital, and the right dev team, you can build your own digital bank—one that’s smarter, faster, and way more user-friendly than the banks of old.

In fact, we’re seeing startups and solopreneurs launch niche-focused neobanks for everything from freelancers to teenagers. And these apps? They’re not just digital wallets. They’re full-blown financial ecosystems raking in millions—without the massive physical overhead of traditional banking.

But how exactly do these digital banks make their money? Spoiler: It’s not just interest margins. In this blog, we’ll crack open the revenue model vault and show you the multiple streams fintech founders are tapping into. And yep—if you’re looking to build your own neobank, Miracuves can help you launch fast, monetize smarter, and scale like a beast.e Digital Banking Boom: Why Now?

2025 is the era of embedded finance. From Gen Z budgeting apps to small business neobanks, the demand for custom digital finance tools is exploding. According to Statista, the global neobank market is projected to hit $2.1 trillion in transactions by 2025.

A few drivers behind this:

- Smartphone adoption and mobile-first behaviors

- Distrust of traditional banks, especially among younger users

- Speed, UX, and transparency becoming must-haves

- Open Banking and API-powered financial integrations

Core Revenue Streams for Digital Banks

Interchange Fees

Every time a user swipes their debit card, a small % goes to the digital bank. It’s tiny per transaction, but with scale? It adds up big time.

Interest on Deposits (Net Interest Margin)

Digital banks park deposited funds into interest-generating accounts or lend them out (directly or via partner banks), and pocket the spread between what they earn and what they pay users.

Subscription Models

Think of it like Netflix for banking. Users pay for premium features: higher withdrawal limits, cashback rewards, financial insights, etc.

Lending Products & Credit Services

From BNPL (Buy Now Pay Later) to microloans and credit lines, digital banks earn interest, late fees, and sometimes service fees.

Investing & Wealth Management Tools

Some digital banks offer robo-advisors, crypto wallets, or investment portfolios. They earn via fees, AUM (assets under management), or transaction commissions.

FX & Cross-border Transaction Fees

Frequent among global users and freelancers, these are charges on international transfers or currency conversion. Lower than old-school banks, but still profitable.

White-label Services & APIs

Some banks monetize by offering their core banking platform as a white-label solution for other startups. BaaS (Banking as a Service) is booming.

Bonus Revenue Opportunities

- Referral Fees: Earned when users sign up for partner products (insurance, loans, etc.)

- Ad Monetization: Promoting third-party fintech tools within the app

- Data Insights: Monetized (with consent) to provide aggregated financial trends to third parties (not user-specific data!)

Challenges & Compliance Factors

Revenue is sweet, but digital banks must balance innovation with regulation. KYC/AML laws, GDPR, PCI-DSS, and banking licenses are non-negotiables.

Not all regions support neobanking equally. EU is friendlier than the U.S., while India and LATAM are rapidly evolving.

Explore our Neobank Services.

Conclusion:

Digital banks are redefining how money moves, saves, and grows. Their secret sauce? A layered, flexible revenue model that scales as users scale.

From micro-fees on swipes to premium plans and ecosystem plays, fintech founders are proving there’s more than one way to print digital money.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

1) How do neobanks make money without charging users?

Mostly via interchange fees, referral fees, and interest spreads from deposited funds.

2) Are digital banks profitable?

Some are. Profitability depends on user base size, churn rate, and how diversified the revenue streams are.

3) What’s the most scalable revenue stream for a digital bank?

Subscription models and interchange fees scale well with user growth.

4) Can I launch a bank without a license?

You need a license or must partner with a licensed bank. Regulatory compliance is critical.

5) Are investing tools necessary for digital banks?

Not necessary, but they boost retention and offer another monetization path.

6) Is it legal to monetize user financial data?

Only anonymized, aggregated data—with full user consent and legal compliance.