Let’s be honest—there’s something electric about watching an idea take shape into a real product, especially in the fast-paced world of crypto. For many startup founders, the dream of building the next Paxful clone feels like a golden ticket to the digital age. You imagine a sleek platform where users swap Bitcoin like baseball cards, where crypto becomes as simple as sending a text, and where you’re the one standing on the stage talking about your “unicorn.”

But here’s the thing—dreams get messy. Between tight budgets, aggressive timelines, and the pressure to “go live” yesterday, it’s easy to fumble the fundamentals. Many entrepreneurs rush headlong into clone app development, skipping the strategic parts that separate a true Paxful rival from just another crypto marketplace with a pretty UI. It’s not just about features; it’s about building a platform that users trust with their money—and their time.

At Miracuves, we’ve seen firsthand how startups struggle and where they shine. So let’s pull back the curtain and talk about the top five mistakes we see startups make when trying to build a Paxful clone. If you’re serious about creating a crypto platform that’s more than just a flash in the pan, these are the pitfalls to dodge.

1. Chasing Features Without Understanding the Core Problem

A lot of startups get stuck in a “feature frenzy.” They think: “Paxful has an escrow system, let’s add that! Paxful does gift cards, we should too!” But here’s the deal—features don’t build trust, solving real problems does.

The core of Paxful’s success isn’t just the bells and whistles; it’s how they make peer-to-peer (P2P) crypto trading safe and convenient. Their escrow service protects users from scams. Their dispute resolution builds confidence. Before you stack on features like payment methods or multi-language support, ask yourself:

- Does this solve a real user pain point?

- How does it reduce friction in the buying/selling journey?

- Can we actually support these features operationally?

2. Ignoring Regulatory Compliance and KYC Early On

Let’s talk about the elephant in the room: compliance. Crypto is cool until the regulators come knocking. Too many startups think they’ll “figure out KYC/AML later”—bad idea. If you don’t bake compliance into your Paxful clone from day one, you’re building on shaky ground.

For instance, Paxful has strict identity verification, transaction monitoring, and even regional restrictions. Ignoring this in your clone means you’re inviting fraud, chargebacks, and worse—legal action that can sink your entire platform. It’s not glamorous, but legal frameworks like GDPR, PCI DSS, and FATF recommendations are as crucial as your fancy UX.

According to CB Insights’ report on Crypto Regulation Trends, compliance requirements for crypto startups are intensifying globally, making KYC/AML frameworks more essential than ever.

3. Underestimating Scalability and Security Needs

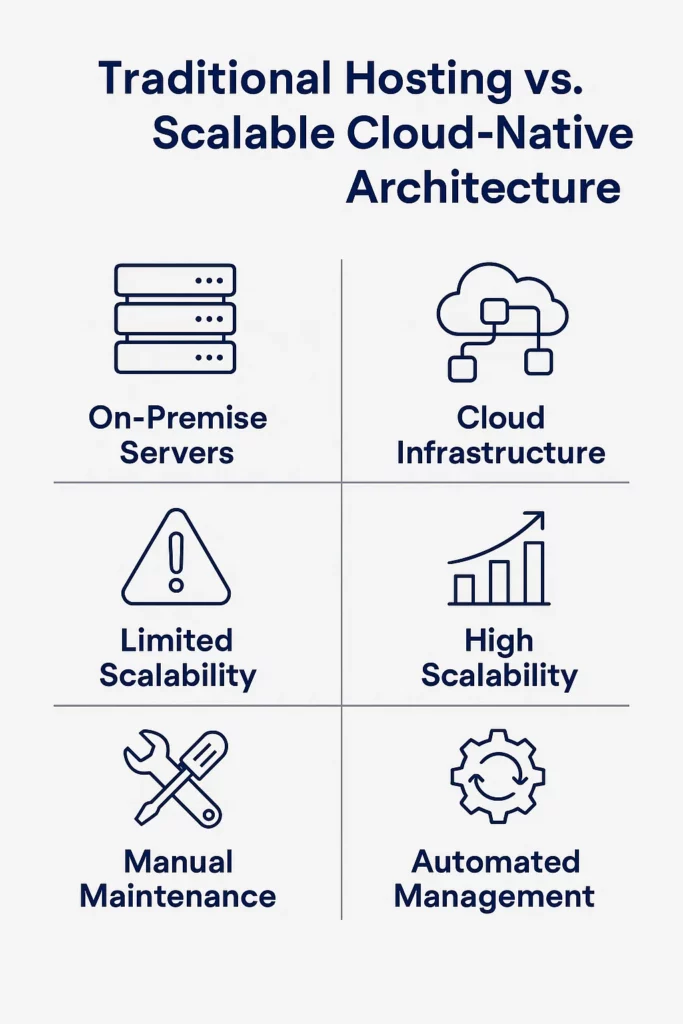

You’re not building a basic website—you’re building a financial platform. A place where real money moves hands, and the stakes are high. Yet, we see founders deploying a Paxful clone on shared hosting or with off-the-shelf scripts that buckle under load.

Here’s a harsh truth: if your clone isn’t built for scalability, you’ll crash the moment users flood in. Think horizontal scaling, cloud infrastructure, load balancers, and microservices architecture. And don’t even get me started on security. If you’re not implementing multi-factor authentication, encrypted data storage, anti-DDoS measures, and regular penetration testing, you’re setting yourself up for disaster.

4. Overlooking the Power of Community and User Support

Crypto thrives on community. Paxful didn’t grow just because of its tech stack—it grew because it empowered users. They have a robust affiliate program, a responsive customer support team, and a community-driven approach that fosters trust.

Many startups forget this human element. They think a sleek UI will compensate for slow customer support, unclear policies, or poor conflict resolution. But in crypto, reputation is everything. If your users can’t get help when they need it, they’ll jump ship to competitors like LocalBitcoins or Binance P2P.

Pro Tip: Build a Telegram group, Discord server, or community forum from day one. Let your early users shape the product.

5. Failing to Monetize Smartly

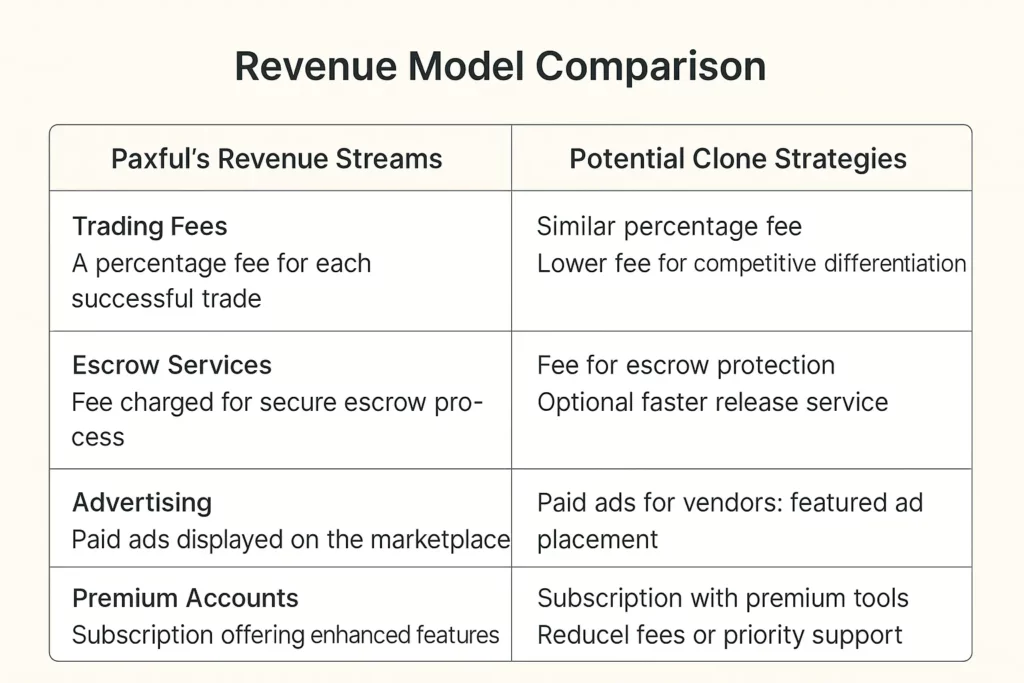

Building a Paxful clone is one thing—making it profitable is another. Many startups slap on a flat transaction fee and call it a day. But smart monetization goes deeper:

- Think tiered fee structures for high-volume traders.

- Offer premium listings or verified vendor badges for extra revenue.

- Introduce value-added services like gift card arbitrage, fiat conversions, or crypto education tools.

If you rely on just one revenue stream, you’re vulnerable to market shifts. Remember, Paxful’s revenue comes from multiple channels, including merchant fees, affiliate earnings, and more. Diversify your income streams from day one.

Conclusion

Building a Paxful clone is a thrilling ride—but it’s also a high-stakes game. The startups that win are the ones who plan smart, build for trust, and think long-term, not just quick wins. Don’t fall into the trap of chasing shiny features or underestimating the gritty stuff like compliance and scaling.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

Q1: What is a Paxful clone exactly?

A Paxful clone is a crypto marketplace platform that mimics Paxful’s core functionality—allowing users to buy, sell, and trade cryptocurrencies in a peer-to-peer setup.

Q2: How much does it cost to build a Paxful clone?

Costs vary depending on features, complexity, and tech stack. A basic MVP might cost between $20K–$50K, while a full-featured platform with advanced security can go much higher.

Q3: How long does it take to build a Paxful clone?

Timelines depend on scope, but typically it takes 3–6 months to develop, test, and launch a stable Paxful clone.

Q4: Do I need a development team or can I do it solo?

Building a secure, scalable crypto platform is complex. It’s highly recommended to partner with experienced developers like Miracuves.

Q5: Can I add custom features to my Paxful clone?

Absolutely. Features like multi-language support, custom payment gateways, or NFT trading can be added based on your target audience’s needs.

Q6: Is it legal to launch a Paxful clone?

It’s legal if you comply with relevant laws and regulations, including KYC/AML. Always consult legal experts for the countries you operate in.