Let’s face it—building a fintech app in 2025 isn’t just a tech trend; it’s practically a rite of passage for anyone dreaming of disrupting the finance world. Whether you’re an ambitious startup founder, a digital nomad exploring side hustles, or a creator-turned-entrepreneur, the idea of launching a money-moving app probably crossed your mind while sipping that overpriced cold brew. After all, with the rise of digital wallets, micro-lending, and instant payments, who wouldn’t want a slice of this lucrative pie?

But here’s the kicker—building a fintech app is not a weekend hackathon project. It’s a full-scale endeavor that demands more than just code and caffeine. Between regulatory hurdles, iron-clad security, user experience flows, and backend integrations, the real cost of a fintech app can spiral faster than your phone’s battery at 5%. You think it’s about the code? Think again—it’s about trust, scalability, and making sure your users’ money stays where it should.

So, how much does it really cost to build a fintech app in 2025? Well, buckle up because we’re breaking it down for you—no fluff, just straight talk. And if you’re wondering where to even begin, let’s just say Miracuves has been there, done that, and has the playbook ready for innovators like you.

The Real Cost Breakdown: Beyond Just the Code

1. The Minimum Viable Product (MVP) Stage: Your Launchpad, Not a Luxury

Let’s start with the MVP. Building a fintech MVP isn’t like throwing together a food delivery app or a fitness tracker. You’re dealing with money—the stakes are higher, and so are the costs. A typical fintech MVP in 2025 (think payment app, micro-investment tool, or P2P lending platform) will set you back anywhere from $50,000 to $150,000, depending on complexity.

Here’s why:

- Security First: Encryption, fraud detection, KYC (Know Your Customer)—these aren’t optional. They’re the backbone.

- Compliance & Regulations: Fintech is heavily regulated. You’ll need legal support, certifications, and often, third-party audits.

- APIs Galore: From Plaid and Stripe to regulatory sandboxes, expect integration costs to stack up.

- UX/UI Design: Finance is complex. Your app needs to feel as smooth as Venmo but as secure as your grandma’s cookie jar.

2. Feature Costs: From Core Functions to Killer Add-Ons

Here’s where the rubber meets the road. Features like user onboarding, transaction history, fund transfers, and notifications are standard. But in 2025, users expect more—AI-powered budgeting tools, real-time currency conversion, even crypto wallets.

Here’s a quick breakdown:

| Feature | Estimated Cost (USD) |

| User Authentication (KYC/AML) | $10,000–$25,000 |

| Payment Gateway Integration | $15,000–$30,000 |

| Data Encryption & Security | $8,000–$15,000 |

| Advanced Analytics (AI/ML) | $20,000–$40,000 |

| Crypto Wallet Integration | $25,000–$50,000 |

Contextual Tip: Start with a core feature set and add advanced modules later. That’s how apps like Robinhood scaled without breaking the bank.

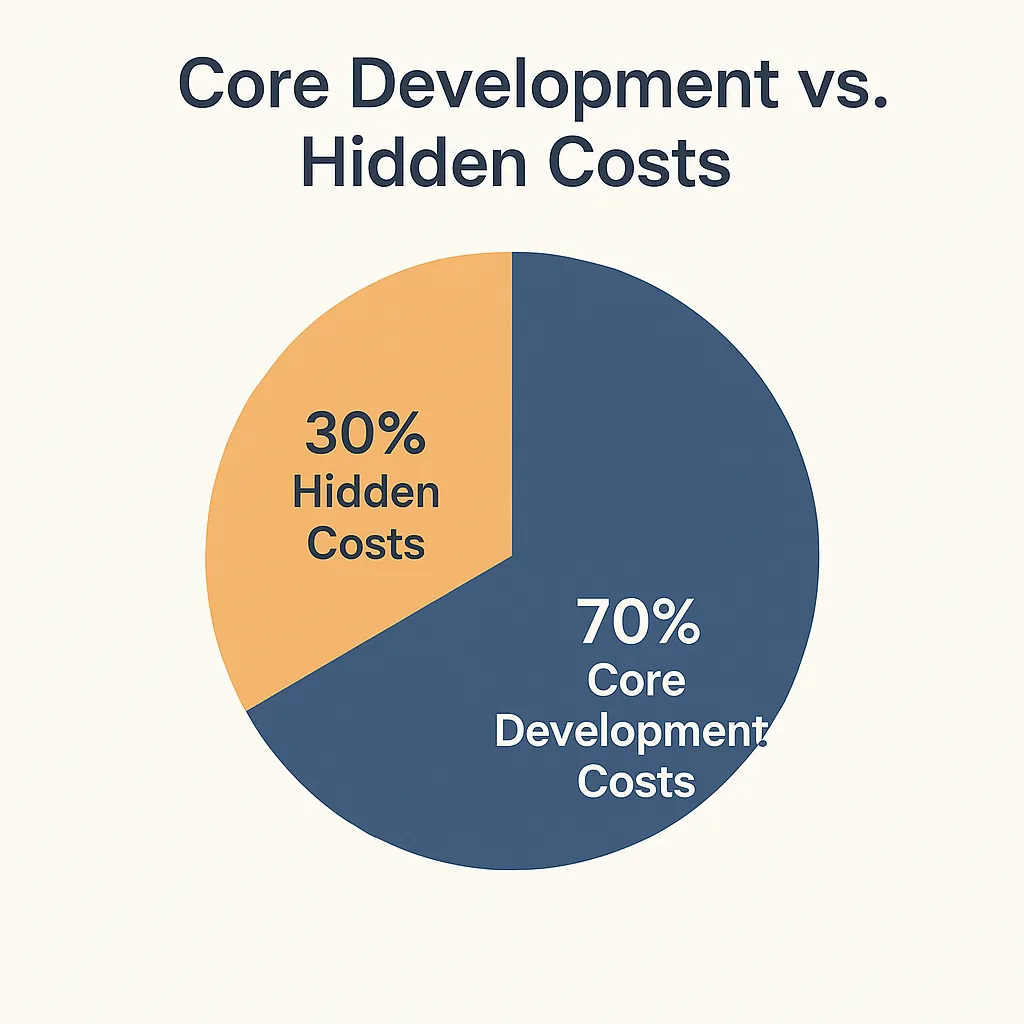

3. The Hidden Costs You Can’t Ignore

Ah, the things no one tells you:

- Compliance Costs: Licensing, audits, and legal paperwork can easily add $10,000–$50,000.

- Maintenance & Updates: Fintech isn’t static. Expect to spend 15–20% of your initial build cost annually just to keep the app running smoothly.

- Customer Support: A fintech app without 24/7 support is a ticking time bomb. Budget at least $5,000–$10,000 monthly for a small team.

- Marketing & User Acquisition: Even the slickest app is useless if no one knows about it. Paid ads, influencer campaigns, and PR can drain $10,000–$50,000 per month.

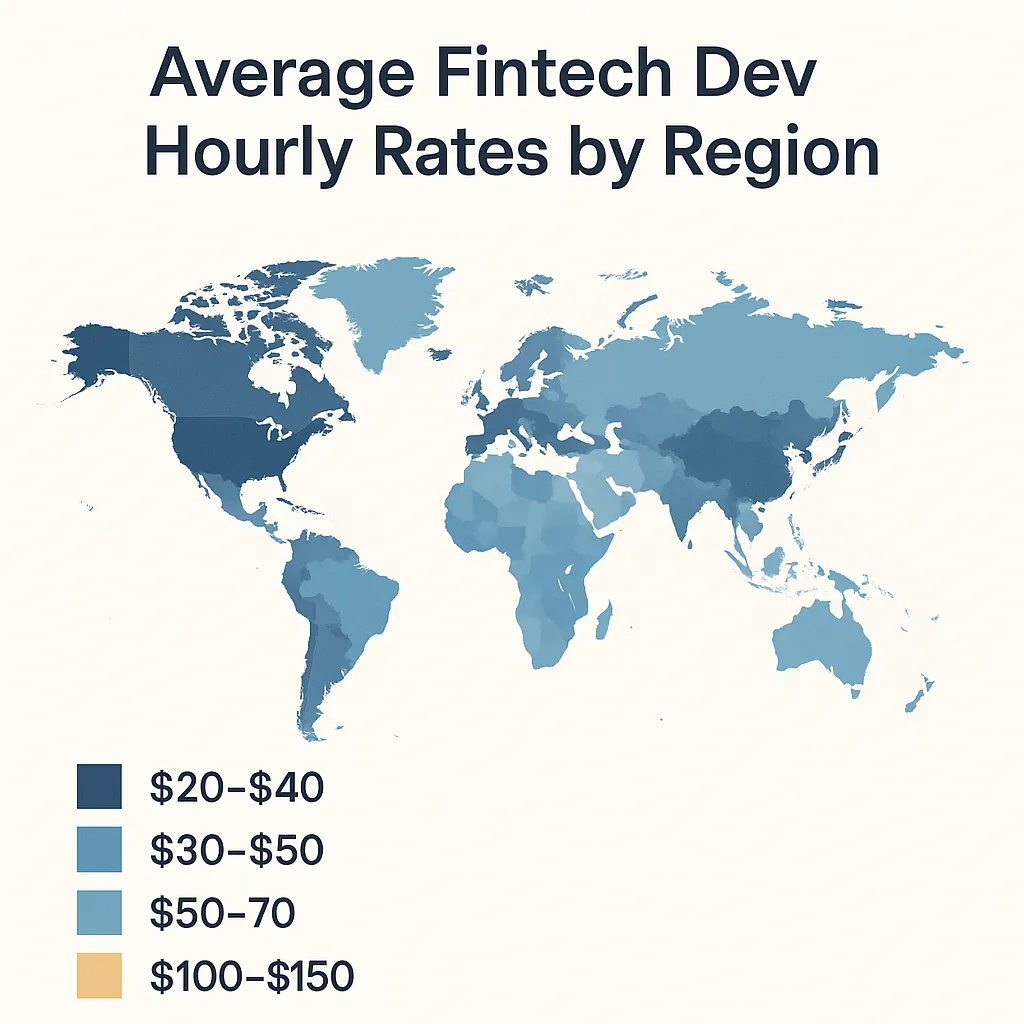

4. Regional and Team-Based Cost Variations: Who Builds It Matters

Let’s talk teams. A U.S.-based dev shop? Expect premium rates—$100–$250/hour. Eastern Europe or India? You’ll find talent at $30–$80/hour without compromising quality. The catch? Time zones and communication.

Building with a team like Miracuves gives you a hybrid model—global talent, startup-friendly pricing, and the get-it-done mindset that founders crave.

5. Case Studies: Real-World Fintech Cost Snapshots

- CashApp Clone: Approx. $150,000–$250,000 for a feature-rich MVP, built over 6–8 months.

- Crypto Trading App: Starts around $200,000 with heavy regulatory compliance, scaling to $500,000+ for high-frequency trading features.

- Neobank Platform: Think $300,000–$600,000, depending on integrations and partnerships.

Final Thoughts: The Price Tag Is Just the Beginning

Building a fintech app in 2025 isn’t cheap, but it’s doable—especially if you’re smart about scope, team, and market positioning. The key is starting lean, learning fast, and scaling with confidence.

Ready to make your mark in fintech? At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

How long does it take to build a fintech app?

Typically, a robust MVP takes 4–8 months. Complex features, compliance checks, and scaling can push timelines up to a year or more.

What’s the biggest cost driver in fintech development?

Security, compliance, and third-party integrations (like payment gateways and KYC) usually eat up the biggest chunks of the budget.

Can I build a fintech app with a no-code tool?

For simple prototypes, yes. But for real-world, secure apps handling sensitive data, custom development is the way to go.

What’s the cheapest way to launch a fintech app?

Start small. Focus on core features, test with early adopters, and scale gradually. Partnering with an experienced team helps avoid costly missteps.

Do I need a license to run a fintech app?

Most countries require specific licenses for financial services. Always consult a legal expert before launching.

How can I monetize a fintech app?

Popular strategies include transaction fees, premium features, subscription models, and partnerships with banks or financial institutions.