You’ve finally built your digital banking app, and it’s ready to take on the world. It’s sleek, user-friendly, and offers all the financial tools people need. But now comes the big question—how do you get people to actually use it? Launching your app is only half the battle. The real challenge begins with marketing it effectively. Without the right strategy, even the most innovative app can remain a hidden gem. But don’t worry; we’ve got you covered.

When you think about marketing a digital banking app, what comes to mind? Maybe ads, social media buzz, or influencer campaigns? Sure, those are part of the equation, but there’s much more to it. The key is understanding your target audience and engaging them in a way that builds trust—something absolutely crucial in the world of finance. Getting it right means not only attracting users but retaining them for the long haul.

At Miracuves, we understand how crucial a strong marketing strategy is for your digital banking app’s success. We’ve helped countless startups turn their app ideas into revenue-generating platforms, and now, we’re ready to share some of the secrets that can help you succeed in the competitive world of digital banking.

How to Market Your Digital Banking App: 7 Essential Steps

1. Identify Your Target Audience and Niche

Before diving into any marketing tactics, it’s vital to understand who you’re targeting. Are you going after young, tech-savvy millennials looking for an easy way to save and invest, or do you have a more specialized demographic, such as small business owners needing streamlined financial tools? The more precisely you define your target audience, the easier it will be to craft personalized marketing strategies that resonate.

Once you’ve identified your audience, think about what sets your digital banking app apart from the competition. Do you offer features that other apps lack, such as customizable saving plans or AI-powered financial advice? Position your app around these unique features to stand out in the crowded market.

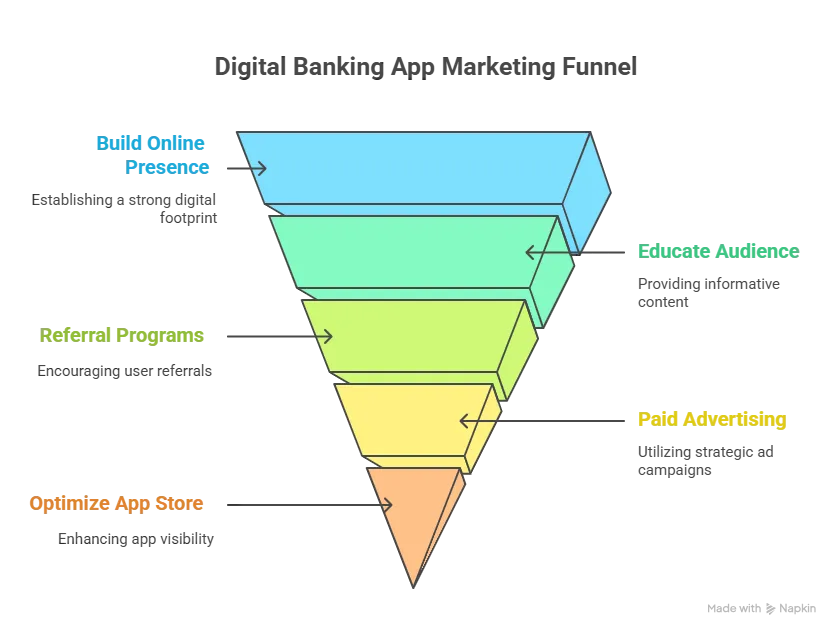

2. Build a Strong Online Presence

Having a solid online presence is non-negotiable for any digital product, especially a banking app. The key here is consistency across all platforms. Whether you’re on social media, running search engine ads, or sending out email campaigns, ensure your branding is unified and your messaging clear.

Social media plays a major role in building trust and loyalty. Think about leveraging platforms like Instagram, Facebook, and Twitter, where financial tips and updates can be shared. Additionally, YouTube can be a game-changer with explainer videos, customer testimonials, and behind-the-scenes content.

3. Use Content Marketing to Educate Your Audience

A major pain point for many users when it comes to digital banking apps is trust. People are understandably cautious about handling their finances online, so it’s crucial to educate them about the benefits and security features your app offers. Content marketing is a great way to do this.

Write informative blog posts, create how-to videos, and host webinars on personal finance topics that will help potential users feel confident about using your app. You could even team up with finance influencers or experts to create content that speaks directly to your audience’s needs.

4. Focus on Referral and Affiliate Programs

Referral programs are a highly effective way to boost user acquisition. People trust recommendations from friends and family more than any ad campaign, so giving your users an incentive to refer others is a win-win. Whether it’s a cash bonus, free premium features, or other rewards, ensure that the process is seamless and easy.

Affiliate marketing is another avenue to explore. Partner with bloggers, influencers, and financial websites who can promote your app in exchange for a commission on each new sign-up. It’s a scalable strategy that helps drive high-quality traffic.

5. Leverage Paid Advertising Strategically

While organic growth is crucial, there’s no denying that paid advertising can expedite your app’s growth. Google Ads and Facebook Ads are two of the most popular options. For digital banking apps, highly targeted campaigns are the way to go. You can filter audiences based on their interests, demographics, and even behavior patterns, ensuring that your ads are reaching the right people.

However, don’t just throw money at ads and hope for the best. Focus on crafting compelling ad creatives that highlight your app’s unique features, such as its security, ease of use, or low fees. Testing various creatives and ad formats will allow you to optimize your spend and maximize your ROI.

6. Optimize for App Store Visibility (ASO)

App Store Optimization (ASO) is one of the most effective ways to increase your app’s visibility in crowded app stores. Just like SEO, ASO involves optimizing your app’s title, description, and keywords to ensure it ranks higher in search results. Incorporating relevant terms, like “digital banking,” “secure payments,” or “financial management,” can make a huge difference.

In addition to keywords, reviews and ratings play a crucial role. Encourage happy users to leave positive feedback on app stores, as this can significantly improve your app’s reputation and searchability.

7. Measure, Optimize, and Scale

Lastly, never stop optimizing. Use analytics tools to track user engagement, sign-up rates, and the overall success of your marketing campaigns. What’s working? What’s not? Is there a segment of your audience that’s more likely to convert? Use these insights to tweak your marketing approach.

As you grow, consider scaling your campaigns to reach even more users. Explore new marketing channels, adjust your strategies based on feedback, and continue offering value to your users.

As digital banking continues to grow globally, understanding market trends is crucial for effective app marketing. According to a recent report on Statista, the digital banking market is expected to see significant growth, which highlights the tremendous potential for your app to succeed. Leveraging this growth through strategic marketing can give your app the edge it needs in a competitive market.

Conclusion

Marketing a digital banking app isn’t a one-size-fits-all approach. By identifying your audience, building trust, and staying active in digital spaces, you’ll set yourself up for long-term success. Keep pushing the boundaries of your marketing strategy, and soon enough, your app will be the go-to solution for financial needs.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

1. What’s the most effective way to attract users to my digital banking app?

The best way to attract users is through targeted marketing strategies like referral programs, paid advertising, and content marketing. Make sure you are engaging with your audience consistently.

2. How can I build trust with users in the digital banking space?

Transparency and education are key. Create content that highlights the security measures your app has in place and provide tips on how users can manage their finances more effectively.

3. What are the best platforms for marketing my app?

Platforms like Instagram, Facebook, and YouTube are excellent for engaging with a broad audience. Consider paid ads on Google and social media, and collaborate with influencers for added visibility.

4. How important is App Store Optimization (ASO)?

ASO is extremely important. It helps increase your app’s visibility and ensures that users can find your app easily in the crowded marketplace.

5. What’s a good way to track the effectiveness of my marketing campaigns?

Use analytics tools like Google Analytics or in-app analytics to track user engagement, conversions, and other metrics. This will allow you to adjust your campaigns for maximum effectiveness.

6. How can I scale my marketing efforts as my app grows?

Once your app gains traction, you can scale by investing more in ads, expanding to new platforms, and refining your strategies based on user feedback and data insights.