In recent years, the stock trading industry has been transformed by apps like Robinhood, which make investing accessible to millions of users with just a few taps on their smartphones. Robinhood’s innovative approach, with its commission-free trading and user-friendly interface, has revolutionized the fintech world, making it a top choice for novice and experienced traders alike. As fintech continues to grow rapidly, creating an app similar to Robinhood can be a profitable venture for businesses aiming to tap into this booming market.

Building a trading app may seem daunting, but Miracuves Solutions simplifies the process. By offering ready-made app solutions that drastically reduce development costs and time, Miracuves Solutions ensures you can bring your app to market faster and at a fraction of the global cost. Whether you’re looking to offer commission-free trading, real-time market data, or user-friendly interfaces, this guide will show you how to build a Robinhood-like app in 2024, using the latest tools and strategies.

What is Robinhood and What Does It Do?

Robinhood is a pioneering fintech app that has transformed how people invest in stocks, ETFs, options, and cryptocurrencies. Launched with the mission to “democratize finance for all,” Robinhood allows users to trade without the traditional brokerage fees, making it incredibly popular among millennials and beginner investors. Its sleek, easy-to-navigate design makes stock trading accessible to everyone, even those without prior experience in the stock market.

At its core, Robinhood offers commission-free trading, meaning users can buy and sell stocks without paying hefty fees. This approach has attracted millions of users, many of whom are first-time investors looking for a simple platform to manage their portfolios. Beyond basic trading, Robinhood also provides features like fractional shares (where users can buy part of a stock), real-time market data, and instant deposits, giving users more flexibility and control over their investments.

The app is not just about trading stocks; it has expanded its offerings to include cryptocurrency trading, retirement accounts (via Robinhood IRA), and educational resources, making it a comprehensive tool for financial growth. The platform’s ability to combine user-friendly design with powerful features has set a new standard for fintech apps.

| Feature | Robinhood | eToro | TD Ameritrade |

|---|---|---|---|

| Commission-Free Trading | Yes | Yes | No |

| Cryptocurrency Trading | Yes | Yes | Yes |

| Fractional Shares | Yes | No | Yes |

| Real-Time Market Data | Yes | Yes | Yes |

| Instant Deposits | Yes | No | No |

| Educational Resources | Basic | Extensive | Extensive |

| Retirement Accounts (IRA) | Yes | No | Yes |

| Mobile App User Experience | Simple and Intuitive | Moderately Complex | Advanced |

Why Build This App?

The rise of stock trading apps like Robinhood has opened the doors to a new generation of investors, making financial markets more accessible than ever before. With the growing demand for mobile-first solutions, the fintech industry is booming, and building an app like Robinhood in 2024 presents an exciting opportunity for businesses to capitalize on this trend.

There are several compelling reasons to build a stock trading app. First, the commission-free trading model is highly attractive to users, particularly younger investors who are looking for low-cost, easy-to-use platforms. By offering a similar service, you can tap into this ever-growing user base, capturing a share of the expanding market.

Second, users are increasingly looking for all-in-one solutions for their financial needs. Apps like Robinhood not only offer stock trading but have expanded into cryptocurrency, retirement accounts, and educational resources. By building a comprehensive financial app, you can cater to a wide range of user needs and retain them within your platform for longer periods, driving higher user engagement and loyalty.

Lastly, the global shift towards mobile and digital services means that a well-designed app can quickly gain traction in various markets. Whether you’re targeting experienced traders or beginners, having a mobile platform allows you to reach users wherever they are, offering them a seamless experience to manage their investments on the go.

Building an app like Robinhood may seem complex, but with Miracuves Solutions, the process becomes straightforward and cost-effective. While the global cost for developing a stock trading app can reach upwards of $6000, Miracuves Solutions offers ready-made solutions at just 10% of the global cost—around $600. Additionally, what might take 1 month to develop globally can be done in as little as 10 days with Miracuves, allowing you to launch faster and start growing your user base right away.

| Development Stage | Global Cost Estimate | Miracuves Solutions Cost |

|---|---|---|

| App Design & Wireframing | $1500 | $150 |

| Backend Development | $2000 | $200 |

| Frontend Development | $1500 | $150 |

| Testing & QA | $500 | $50 |

| Deployment & Maintenance | $500 | $50 |

| Total Cost | $6000 | $600 |

How to Differentiate Your Stock Trading App from Others

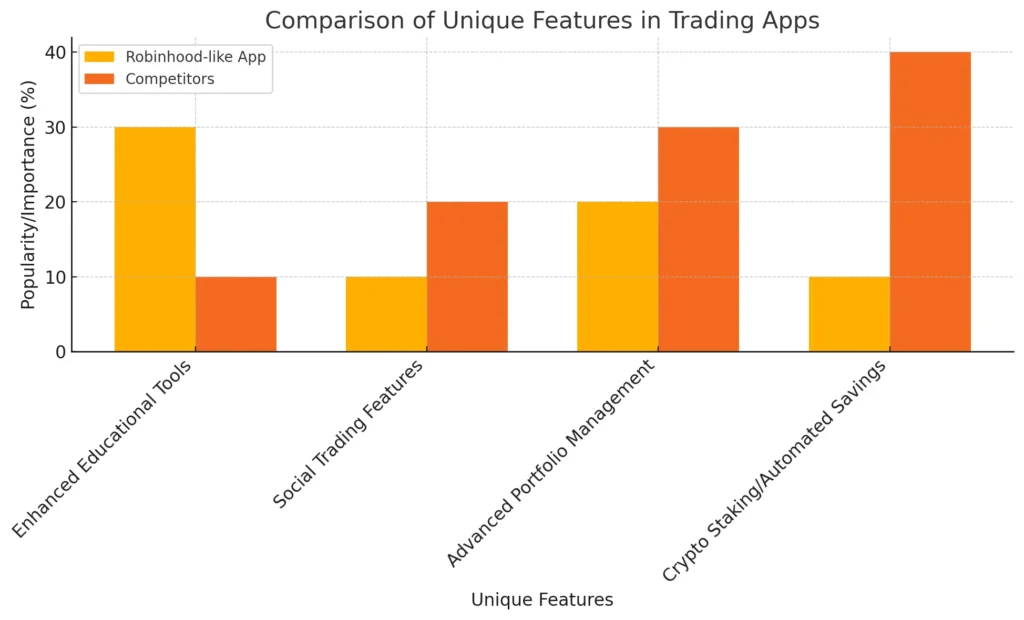

In the competitive world of fintech, building a stock trading app that stands out from the crowd is crucial for success. While apps like Robinhood, eToro, and TD Ameritrade have captured significant market share, there are still plenty of ways to differentiate your app and attract a loyal user base. The key lies in offering unique features and a better user experience that speaks directly to your target audience.

One way to set your app apart is by focusing on enhanced educational tools. While many trading apps offer some form of educational resources, providing in-depth, interactive tutorials, webinars, and personalized financial advice can be a game-changer. By integrating AI-driven advice or chatbot support for real-time help, you can cater to novice investors who are looking for guidance.

Another differentiating factor could be the introduction of social trading features, allowing users to follow and copy the trades of experienced investors. Social trading, a concept that has gained traction in recent years, encourages community-building within the app and adds an engaging social layer to investing.

Additionally, offering advanced portfolio management tools can appeal to more experienced traders. By integrating features like personalized performance tracking, tax optimization, and risk management strategies, you can attract high-net-worth individuals or seasoned investors who demand more control over their investments.

Lastly, consider adding cryptocurrency staking or automated savings plans to further diversify your app’s appeal. As interest in crypto continues to grow, allowing users to stake their assets or automatically invest their spare change into stocks or crypto could provide a unique value proposition.

Also check : How to Build App like E*Trade from Scratch – Complete Guide

Market Size, Growth, Revenue, and Business Model

| Region/App Category | Market Size (in Billion USD) | CAGR (2024-2028) |

|---|---|---|

| North America | $75 Billion | 12% |

| Europe | $50 Billion | 10% |

| Asia-Pacific | $40 Billion | 18% |

| Cryptocurrency Trading | $25 Billion | 22% |

| Commission-Free Trading | $20 Billion | 15% |

| Social Trading | $15 Billion | 20% |

The stock trading app market has experienced phenomenal growth in recent years, driven by increased demand for mobile financial solutions and the rise of retail investors. In 2024, the global fintech market, particularly in the investment app sector, is projected to grow significantly, fueled by both seasoned and novice investors seeking easy-to-use platforms like Robinhood. The ongoing shift toward digital finance is expected to see more users rely on mobile apps for managing investments, trading stocks, and even engaging in cryptocurrency.

The fintech industry is currently valued at over $179 billion, and the stock trading app segment is poised to capture a substantial portion of this. By offering features like commission-free trading and fractional shares, apps similar to Robinhood have made stock market access easier for millions. Market analysts predict that the total number of users for stock trading apps will exceed 200 million by 2025, with revenues growing at a compound annual growth rate (CAGR) of over 15%.

This strong growth is also attributed to rising interest in cryptocurrencies and the expansion of app features to include retirement accounts, automated investing, and social trading. Additionally, the younger, tech-savvy generation is increasingly looking for financial tools that offer real-time market data, personalized financial insights, and seamless user experiences, further driving the need for innovative app development.

In terms of revenue models, many apps, including Robinhood, generate profits through methods such as payment for order flow, premium subscriptions (e.g., Robinhood Gold), margin lending, and interest earned on uninvested cash. Building an app with these diverse revenue streams allows for more robust income potential while keeping the app accessible to users at little to no upfront cost.

According to a report by Statista, the global fintech market is expected to reach unprecedented levels.

Want to create a trading app like Robinhood?

Our team has the expertise to help you design a scalable

and secure platform.

Features of a Robinhood-like App

| Feature | Global Cost Estimate | Miracuves Solutions Cost |

|---|---|---|

| Commission-Free Trading | $1000 | $100 |

| Fractional Shares | $800 | $80 |

| Real-Time Market Data | $1500 | $150 |

| Advanced Security Features | $1200 | $120 |

| Instant Deposits/Withdrawals | $700 | $70 |

| Cryptocurrency Trading | $2000 | $200 |

| Educational Tools | $500 | $50 |

| Total Cost | $7700 | $770 |

Creating a stock trading app like Robinhood requires integrating essential features that enhance user experience and provide a comprehensive platform for managing investments. These features are crucial for both attracting users and ensuring they stay engaged with the app. Let’s break down the core features that any Robinhood-like app should include:

- Commission-Free Trading: One of the main attractions of Robinhood is the ability to trade without fees, making investing accessible to a broader audience. This feature is a must for any competitive trading app and appeals to beginner investors who want to grow their portfolios without incurring hefty brokerage fees.

- Fractional Shares: Fractional investing allows users to buy a portion of high-priced stocks like Apple or Amazon. This feature democratizes access to expensive stocks and lowers the barrier for entry, especially for new investors with smaller budgets.

- Real-Time Market Data: Offering users real-time updates on stock prices, trends, and market news is critical. This ensures users can make informed decisions quickly and accurately, especially in volatile markets.

- Advanced Security Features: Since the app handles sensitive financial data, robust security features like multi-factor authentication (MFA), data encryption, and biometric logins are essential to building trust with users.

- Instant Deposits and Withdrawals: Providing instant deposits enables users to start trading immediately, a feature that increases user engagement. Offering swift withdrawal options also enhances the overall user experience, making it seamless for users to access their funds.

- Cryptocurrency Trading: With the growing popularity of digital assets, enabling cryptocurrency trading within the app can attract a wider user base. Offering the ability to buy and sell popular cryptocurrencies like Bitcoin and Ethereum positions the app as a comprehensive trading platform.

- Educational Tools: A great way to engage users, especially beginners, is to include educational content like tutorials, articles, or videos on how the stock market works. Robinhood’s “Learn” feature is a good example, helping users make smarter investment decisions.

These features form the backbone of any successful stock trading app, allowing users to confidently manage their investments, whether they are trading stocks, ETFs, or cryptocurrencies.

Technical Requirements

Building a stock trading app like Robinhood involves choosing the right technology stack and infrastructure to ensure high performance, security, and scalability. Given the nature of trading apps, where users demand real-time updates and smooth transactions, the technology behind the app is critical to its success.

Here are the key technical components required to develop a stock trading app:

- Frontend Development: For a seamless user experience, the frontend should be built with React Native or Flutter, allowing the app to work smoothly across both iOS and Android platforms. These frameworks are ideal for creating dynamic user interfaces that are both responsive and interactive.

- Backend Development: The backend handles most of the app’s logic, including processing trades, storing user data, and managing transactions. A combination of Node.js and Python is commonly used to ensure speed and scalability. These technologies also allow for easy integration with APIs for real-time data and trade execution.

- APIs for Market Data: A real-time trading app requires access to up-to-date market data. Integrating APIs such as IEX Cloud, Alpha Vantage, or Yahoo Finance API ensures your users get instant updates on stock prices, charts, and other critical financial information.

- Payment Gateway Integration: Secure payment gateways like Stripe, Plaid, or PayPal must be integrated to handle deposits, withdrawals, and account funding. These gateways ensure seamless transactions while maintaining data security.

- Security and Compliance: Given the sensitive financial data involved, implementing security measures like OAuth 2.0, multi-factor authentication (MFA), and data encryption is essential. The app also needs to comply with financial regulations such as KYC (Know Your Customer) and AML (Anti-Money Laundering) to ensure legality in various regions.

- Cloud Infrastructure: Using Amazon Web Services (AWS) or Google Cloud ensures that the app can handle high traffic volumes, especially during peak trading hours. Cloud services offer scalability, allowing the app to grow alongside its user base.

- Database Management: For storing user data securely, databases such as PostgreSQL or MongoDB are ideal. These databases are known for their reliability and flexibility, which are critical when dealing with large datasets of user profiles, trade histories, and financial transactions.

By selecting the right technology stack, you ensure that your app will not only meet users’ expectations for speed and reliability but also scale effectively as your user base grows.

Design and User Interface (UI/UX)

When it comes to stock trading apps like Robinhood, the design and user interface (UI/UX) are critical for creating an engaging and intuitive user experience. The goal is to design an app that not only looks good but is also easy to navigate, ensuring users can perform complex actions like trading, depositing funds, and tracking their portfolio without any confusion. In the world of finance, where seconds can matter, a well-designed interface can mean the difference between a loyal user and a frustrated one.

Key UI/UX Elements for a Stock Trading App:

- Simple, Clean Interface: Stock trading can be overwhelming for beginners, so the app’s design should simplify the experience. Clean, minimal layouts, like those used by Robinhood, allow users to focus on the essential tasks without being distracted by unnecessary features. Every feature should be accessible within a few taps, making the app intuitive for both novice and experienced traders.

- Intuitive Navigation: The app should allow users to easily move between different sections, such as the trading dashboard, portfolio management, and market news. Incorporating a tab-based navigation system or a swipe interface can make navigation feel seamless.

- Real-Time Data Visualization: Since users rely heavily on market data, incorporating real-time charts and data visualization tools is essential. These features should be easy to read and update in real-time, giving users the confidence to make informed trading decisions. Interactive graphs, candlestick charts, and easy-to-read metrics are valuable components.

- Personalized User Experience: One way to set your app apart is by offering a personalized experience. Features like a customizable dashboard, where users can add or remove widgets, and personalized stock recommendations based on user behavior, can enhance engagement. Robinhood’s sleek, dark-mode interface is an example of tailoring user preferences.

- Security and Trust Signals: Since users are dealing with their finances, the UI/UX should emphasize security. Incorporating trust signals like a secure lock icon, notifications about account security, and easy access to privacy settings can reassure users that their financial data is safe.

- Responsive Mobile Design: Your app must be fully optimized for mobile devices since most users will access the platform via smartphones. The design should adjust seamlessly to different screen sizes while maintaining functionality and clarity.

A focus on these design principles ensures your trading app will not only look modern but will also provide a stress-free and engaging user experience. UI/UX plays a pivotal role in user retention, and getting this right can keep users coming back.

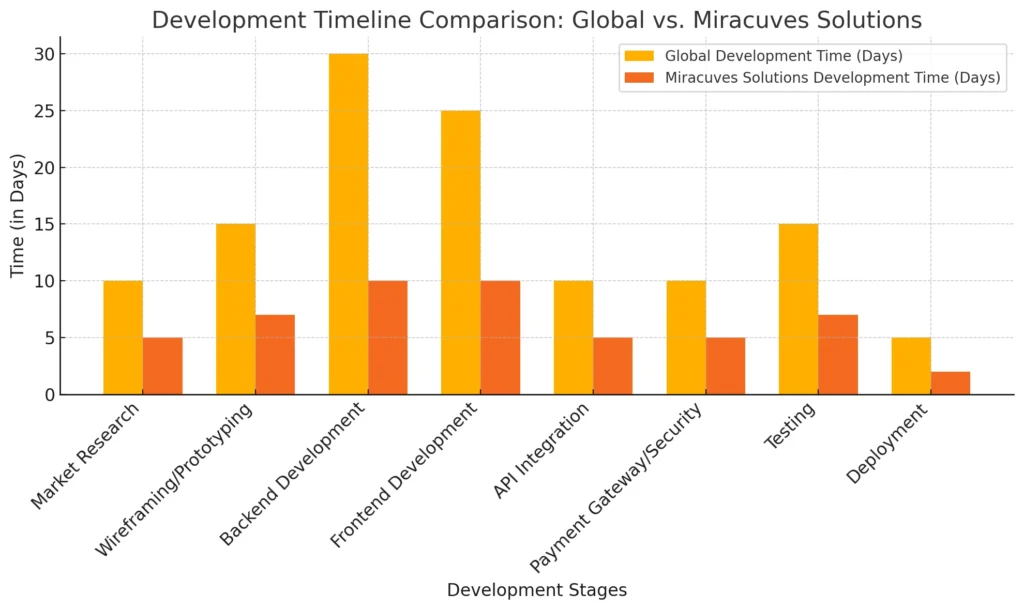

Development Process (Step-by-Step)

Building a stock trading app like Robinhood involves several well-defined steps that ensure the app is functional, secure, and scalable. The development process requires careful planning and execution, with attention to both user experience and regulatory compliance. Here’s a step-by-step breakdown of how to develop a trading app from idea to launch:

Step 1: Market Research and Requirement Analysis

Before you start developing your app, it’s important to understand the target audience, market trends, and competitors. Research helps you identify the core features that your app must include, and it also reveals gaps in the market where your app can stand out. This step lays the groundwork for building a product that will resonate with users.

Step 2: Wireframing and Prototyping

In this phase, your team designs the layout of the app by creating wireframes and prototypes. These are visual guides that help map out the app’s structure and user flow. Tools like Figma and Sketch are widely used for prototyping. This stage is crucial for understanding how users will navigate the app and for ensuring an intuitive user experience.

Step 3: Backend and Frontend Development

The development process is split into two key areas:

- Backend Development: This involves building the server-side components that manage user data, handle transactions, and connect with external APIs for real-time stock market information. Common technologies used include Node.js for handling server requests and Python for data processing.

- Frontend Development: The frontend is what users interact with directly. Technologies like React Native or Flutter are popular for creating mobile-friendly and cross-platform apps. The frontend should be responsive and easy to navigate.

Step 4: Integration of APIs

For real-time market data and trade execution, you need to integrate APIs like IEX Cloud, Alpha Vantage, or Yahoo Finance API. These APIs provide live stock prices, market news, and historical data, giving users the information they need to make trades in real-time.

Step 5: Payment Gateway and Security Integration

Next, you must integrate payment gateways like Stripe or Plaid for handling deposits, withdrawals, and other financial transactions. Alongside, security protocols like OAuth 2.0 for authentication and data encryption should be integrated to ensure the app is secure and compliant with regulations like KYC (Know Your Customer) and AML (Anti-Money Laundering).

Step 6: Testing and Quality Assurance (QA)

Once the app is developed, it’s essential to test it thoroughly to identify and fix any bugs or usability issues. This includes functionality testing, performance testing, and security testing to ensure the app can handle heavy traffic, real-time trading, and sensitive financial data.

Step 7: Deployment and App Store Optimization (ASO)

After testing, the app is ready for deployment. The app should be launched on both Apple’s App Store and Google Play Store. Along with deployment, App Store Optimization (ASO) is critical to ensure that your app is easily discoverable by users. Use relevant keywords, attractive visuals, and compelling descriptions to make your app stand out in the marketplace.

Step 8: Post-Launch Maintenance and Updates

Even after launch, the development process is not over. Regular updates are essential to introduce new features, fix bugs, and improve performance. Continuous maintenance ensures the app runs smoothly and remains competitive in a rapidly changing fintech landscape.

This step-by-step process ensures that every aspect of the app—from design and functionality to security and compliance—is thoroughly covered. It also helps you launch a fully functional, market-ready product in a structured and efficient manner.

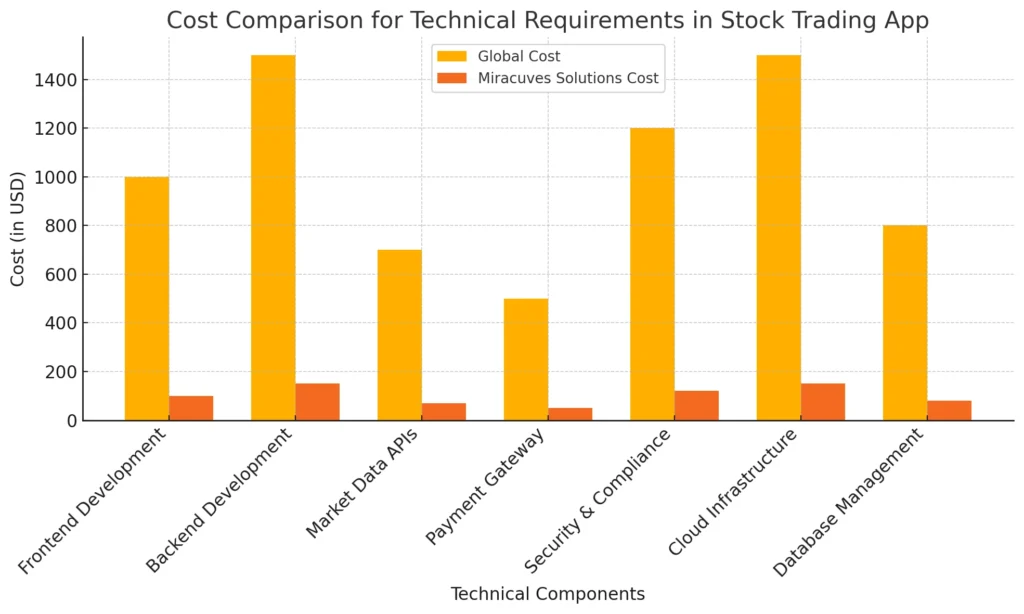

Cost Estimation and Timeframe

When it comes to building a stock trading app like Robinhood, cost and time are the two critical factors that every business must consider. The cost of developing such an app can vary significantly based on the features you wish to include, the development team you hire, and the location of your developers.

Globally, developing a feature-rich stock trading app can cost anywhere between $50,000 to $150,000, depending on the complexity and customization required. This includes expenses for design, backend development, API integrations, testing, and post-launch maintenance. However, with Miracuves Solutions, this cost is reduced drastically, offering you a ready-made solution at 10% of the global cost. So, if the global price is $6000, Miracuves can develop it for $600 without compromising on quality.

Breakdown of Global Cost vs. Miracuves Solutions Cost:

- App Design and Wireframing: Globally, this phase can cost between $5000 to $10,000, while Miracuves Solutions offers the same for $150.

- Backend and Frontend Development: This is the most intensive part of development, typically costing between $20,000 to $50,000 globally. With Miracuves Solutions, these costs drop to $200.

- API Integration: Incorporating real-time market data and trading functionality can cost around $10,000, but Miracuves offers this for $150.

- Testing and Quality Assurance: QA is critical for any fintech app, and globally it can range from $5000 to $10,000, whereas Miracuves completes it for $50.

- Deployment and Post-Launch Maintenance: Globally, this can range from $5000 to $15,000, while Miracuves Solutions can provide it for just $50.

Timeframe Comparison

Globally, the development timeframe for such an app can take anywhere from 3 to 6 months, depending on the scope of the project. However, Miracuves Solutions reduces this time dramatically by providing a fully functional app in just 10 days, compared to the typical 1 month globally.

By choosing Miracuves Solutions, you not only save significant costs but also gain a huge competitive advantage by launching your app much faster, allowing you to capitalize on the growing demand for stock trading platforms.

Monetization Strategies

Monetizing a stock trading app like Robinhood involves implementing various revenue streams that can sustain the app’s growth while providing value to users. The key to a successful monetization strategy lies in balancing profitability with user satisfaction. Here are some effective strategies to consider:

- Commission-Free Trading: This model, popularized by Robinhood, attracts a large user base by offering zero-commission trades. However, the app can still generate revenue through other means, such as payment for order flow, where brokerage firms pay to execute trades. This allows users to trade without fees while the app profits from the volume of transactions.

- Premium Subscriptions: Introducing a tiered subscription model can provide users with additional features for a monthly fee. For instance, a premium version of the app could offer advanced trading tools, lower latency on trades, enhanced market data, or personalized investment advice. This strategy not only generates consistent revenue but also incentivizes users to upgrade for a better trading experience.

- Interest on Cash Balances: Many trading apps earn a substantial portion of their revenue by earning interest on uninvested cash in user accounts. By offering users the option to leave their cash in the app, you can capitalize on the interest generated from those funds, similar to how traditional banks operate.

- Margin Trading and Lending: Allowing users to trade on margin can create additional revenue streams. By charging interest on borrowed funds, you can generate income while providing users the leverage they need to increase their investment potential. This requires careful regulation compliance but can significantly enhance profitability.

- In-App Advertising: Another potential revenue stream is through carefully placed advertisements within the app. While this must be done delicately to avoid disrupting the user experience, partnering with relevant financial services or products can provide an additional source of income.

- Educational Content and Courses: Providing premium educational resources can be another monetization avenue. Offering in-depth courses, webinars, or e-books on trading strategies, investment tips, and market analysis can attract users willing to pay for knowledge that enhances their trading skills.

- Affiliate Marketing: By partnering with financial institutions or services, you can earn referral fees when users sign up for these services through your app. For example, promoting investment funds, ETFs, or financial planning services can be lucrative.

By implementing a combination of these monetization strategies, your stock trading app can not only remain competitive but also create a sustainable revenue model that supports long-term growth and innovation.

Launching and Marketing the App

Successfully launching and marketing your stock trading app is crucial to its adoption and growth in a competitive landscape. With the right strategies, you can attract users, create buzz, and establish your app as a trusted platform for trading. Here are some effective steps to consider during your launch and marketing efforts:

- Pre-Launch Hype: Building excitement before your app’s release can significantly boost initial downloads. Use social media platforms, content marketing, and email newsletters to share sneak peeks, features, and updates. Consider creating a landing page where interested users can sign up for updates or exclusive early access, creating a community before your app even launches.

- App Store Optimization (ASO): Just as search engine optimization helps websites rank higher in search results, ASO helps your app become more discoverable in app stores. Optimize your app’s title, description, and keywords to improve its visibility. Use attractive visuals, engaging screenshots, and compelling descriptions to encourage downloads.

- Influencer Marketing: Collaborating with financial influencers or popular figures in the fintech space can dramatically expand your reach. These influencers can share their experiences with your app, showcasing its benefits to their followers and driving traffic to your app. Authentic endorsements from trusted voices can greatly enhance credibility.

- Content Marketing: Create valuable content that educates users about investing, trading strategies, and financial literacy. Blogs, videos, and infographics can draw traffic to your app and position your brand as a knowledgeable leader in the fintech industry. Sharing insights on market trends can engage users and encourage them to download your app for further exploration.

- Referral Programs: Encourage existing users to refer friends and family by offering incentives, such as cash bonuses or reduced trading fees for successful referrals. This word-of-mouth marketing can lead to organic growth as users promote your app to their networks.

- Social Media Engagement: Establish a strong presence on platforms like Twitter, Instagram, and LinkedIn. Share updates, tips, and market insights while interacting with your audience. Building a community around your app can foster loyalty and encourage users to spread the word.

- User Feedback and Continuous Improvement: Once your app is live, actively seek feedback from users to identify areas for improvement. Regularly update your app based on user suggestions and industry trends to enhance the user experience. A responsive approach can lead to higher user satisfaction and retention.

- Paid Advertising: Consider investing in targeted ads on social media platforms or Google Ads to reach potential users. Focus on demographics that align with your target audience, such as young investors or tech-savvy individuals.

Launching and marketing your app effectively sets the foundation for its success in the competitive world of stock trading. By combining organic and paid strategies, you can create a buzz around your app, attract users, and establish a loyal customer base that grows over time.

Legal and Regulatory Considerations

Launching a stock trading app like Robinhood involves navigating a complex landscape of legal and regulatory requirements. Given that financial services are heavily regulated, ensuring compliance is crucial to protect your business and your users. Here are the key considerations to keep in mind when developing and launching your app:

- Know Your Customer (KYC): KYC regulations require you to verify the identity of your users before allowing them to trade. This process typically involves collecting personal information such as names, addresses, and Social Security numbers. Implementing robust identity verification systems not only ensures compliance but also builds trust with your user base.

- Anti-Money Laundering (AML): Compliance with AML regulations is essential to prevent your platform from being used for illegal activities. This involves monitoring transactions for suspicious activity and reporting any anomalies to the relevant authorities. Establishing clear policies and using automated systems can help you stay compliant while safeguarding your app.

- Securities and Exchange Commission (SEC) Regulations: If your app facilitates trading in stocks or securities, you’ll need to comply with SEC regulations. This includes registering as a broker-dealer or partnering with a licensed broker-dealer. Understanding the rules governing trading practices, disclosures, and reporting requirements is vital to avoid legal pitfalls.

- Data Privacy Laws: Given the sensitive nature of the financial information you’ll handle, adhering to data privacy laws is paramount. Regulations such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the U.S. dictate how you collect, store, and use personal data. Implementing strong data protection measures will not only keep you compliant but also enhance your app’s credibility.

- User Agreements and Disclosures: Drafting clear user agreements, terms of service, and disclosures is essential. These documents outline the rights and responsibilities of both the users and your company. They should also include information about fees, risks associated with trading, and procedures for handling disputes.

- Licensing Requirements: Depending on your jurisdiction, there may be specific licensing requirements for operating a financial app. This can include obtaining necessary licenses to operate as a broker-dealer, investment advisor, or money transmitter. Researching local regulations and ensuring you meet all legal requirements is crucial before launching your app.

- Ongoing Compliance Monitoring: Legal and regulatory landscapes are constantly evolving, especially in the fintech industry. Establishing a compliance program to monitor changes in laws and regulations will help you adapt your business practices accordingly. Regular audits and reviews can ensure that your app remains compliant over time.

Navigating the legal landscape may seem daunting, but it’s a necessary part of developing a stock trading app. By prioritizing compliance and implementing robust legal strategies, you can protect your business and build a trustworthy platform that users feel confident using.

To ensure compliance, refer to the guidelines provided by the Securities and Exchange Commission (SEC).

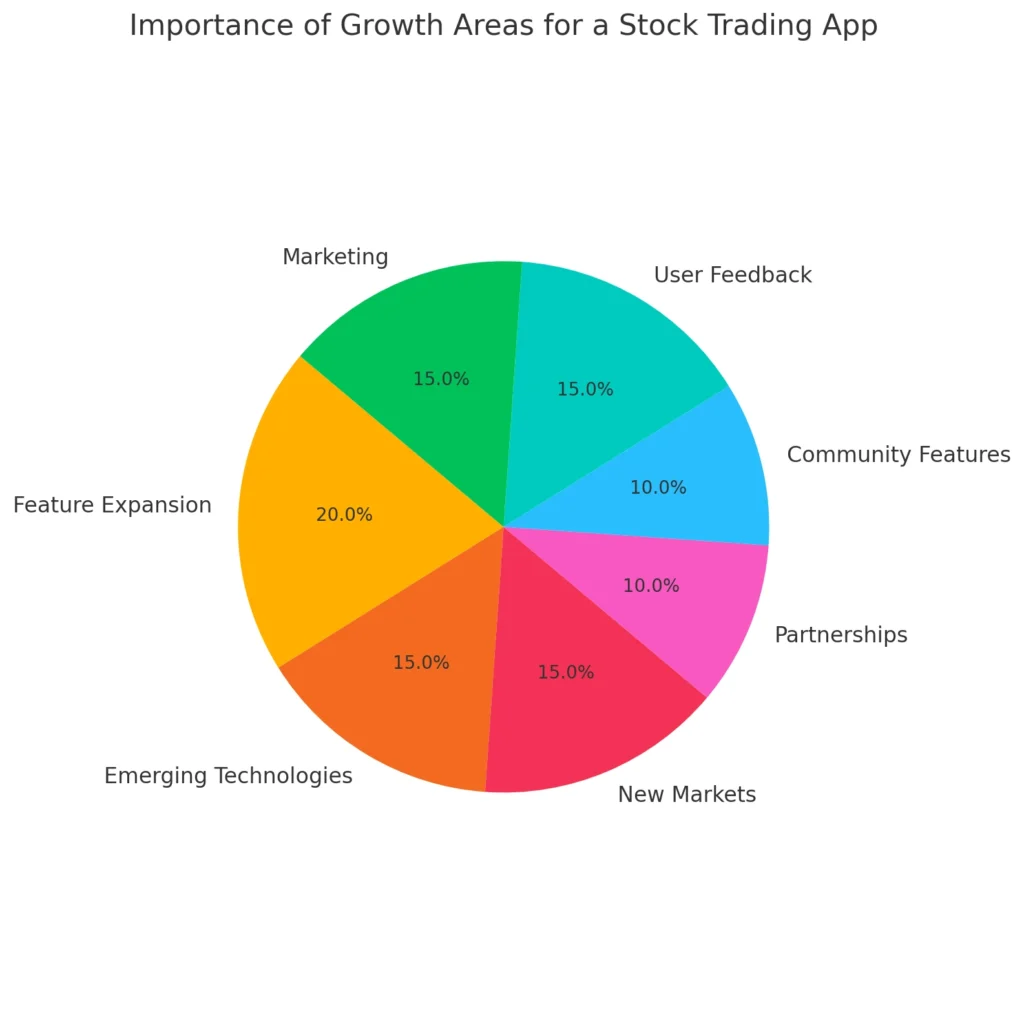

Future Growth of the App

The potential for growth in the stock trading app market is immense, and with the right strategies in place, your app can evolve to meet the changing needs of users while adapting to market trends. As technology advances and user preferences shift, here are some avenues to explore for future growth:

- Feature Expansion: Continuously enhancing your app with new features is crucial for keeping users engaged. Consider integrating advanced trading tools such as options trading, futures, and margin trading. You can also introduce features like AI-driven investment advice, personalized portfolio analysis, and more robust analytical tools to cater to both novice and experienced traders.

- Incorporating Emerging Technologies: Leveraging technologies like artificial intelligence (AI) and machine learning can significantly enhance user experience. AI can be used to provide personalized recommendations, predictive analytics, and automated trading options based on user behavior and market conditions. Blockchain technology could also be integrated for secure, transparent transactions.

- Expanding into New Markets: As global interest in investing grows, consider expanding your app’s reach into international markets. Tailor your offerings to suit different regions by providing localized content, compliance with local regulations, and support for local currencies. This strategy can open up new revenue streams and increase your user base.

- Partnerships and Integrations: Forming strategic partnerships with financial institutions, data providers, or fintech companies can enhance your app’s offerings. Collaborating with investment firms to offer users access to expert advice or integrating additional financial services can create a more comprehensive financial ecosystem.

- Enhanced Community Features: Building a community around your app can significantly increase user loyalty. Features such as forums, social trading, and user-generated content can create a sense of belonging and encourage users to interact and share insights. This not only helps in user retention but also enhances the overall trading experience.

- Continuous User Feedback Loop: Establishing a process for collecting and analyzing user feedback is vital for ongoing improvement. Regularly engaging with your users through surveys, app reviews, and direct communication can help you identify areas for enhancement and ensure that your app evolves in line with user needs.

- Marketing and Brand Building: As your app grows, a strong marketing strategy becomes increasingly important. Investing in brand building, content marketing, and social media engagement can create a recognizable brand that resonates with users. Sharing success stories, educational content, and market insights can position your app as a thought leader in the fintech space.

By focusing on these growth strategies, your stock trading app can not only adapt to the dynamic financial landscape but also thrive in a competitive environment. The key is to remain flexible and responsive to user needs, technological advancements, and market trends to ensure long-term success.

Why Do You Trust Miracuves Solutions for Your Next Project?

When it comes to building a stock trading app like Robinhood, choosing the right development partner is crucial for your project’s success. Miracuves Solutions stands out as a reliable choice for several compelling reasons:

- Cost-Effective Solutions: One of the biggest challenges in app development is managing costs. Miracuves Solutions offers ready-made app solutions at a fraction of the global cost—just 10% of what you might typically spend. For example, while the global cost for developing a feature-rich stock trading app can soar to $6000, you can achieve the same quality with Miracuves for just $600.

- Rapid Development Time: Time-to-market is essential in the competitive fintech space. With traditional development often taking 1 month or longer, Miracuves Solutions can deliver your app in just 10 days. This rapid turnaround allows you to capitalize on market opportunities and user demand quickly.

- Comprehensive Features: The ready-made solutions provided by Miracuves come packed with all the essential features that users expect from a stock trading app, such as commission-free trading, real-time market data, and advanced security measures. You won’t have to sacrifice quality for speed; everything is built to meet industry standards.

- Customization Options: While Miracuves offers ready-made solutions, you also have the flexibility to customize features to better suit your target audience. This means you can add unique functionalities that set your app apart while benefiting from a solid foundational framework.

- Expert Support: The team at Miracuves Solutions is composed of experienced developers and fintech experts who understand the intricacies of app development and the regulatory landscape. This expertise ensures that your app is built with best practices in mind, helping you navigate the challenges of the fintech industry.

- Scalability: As your user base grows, your app needs to scale seamlessly. Miracuves Solutions designs its applications with scalability in mind, ensuring that your platform can handle increased traffic and additional features without compromising performance.

- Ongoing Maintenance and Support: Launching your app is just the beginning. Miracuves provides ongoing maintenance and support, helping you to keep your app updated and functioning smoothly as technology and user expectations evolve.

By choosing Miracuves Solutions, you’re not just selecting a development partner—you’re opting for a comprehensive, cost-effective, and efficient pathway to bring your stock trading app vision to life. With a focus on quality, speed, and customization, Miracuves is equipped to help you succeed in the competitive fintech landscape.

Conclusion

In today’s fast-paced financial landscape, creating a stock trading app like Robinhood offers immense opportunities for innovation and growth. The demand for accessible, user-friendly trading platforms is rising, driven by a new generation of investors eager to engage with the stock market. By leveraging the insights shared in this guide, you can develop a competitive app that not only meets user expectations but also stands out in a crowded marketplace.

Choosing Miracuves Solutions for your app development can significantly enhance your journey. With their cost-effective solutions, rapid development timeline, and comprehensive features, you can bring your vision to life without compromising on quality. The ability to customize your app to cater to specific user needs ensures that your platform can evolve alongside market trends.

Moreover, the emphasis on security, compliance, and ongoing support positions your app for long-term success, making it a trustworthy choice for users. By focusing on innovative features, effective marketing strategies, and user engagement, your app can carve out a significant share of the stock trading market.

As you embark on this journey, remember that the key to success lies in understanding your users, staying adaptable, and continually enhancing your app based on feedback and industry advancements. With the right tools and partners, the future of your stock trading app can be incredibly bright.

Ready to build a trading app like Robinhood?

Our expert team can help you develop a secure, user-friendly investment platform that empowers users to trade stocks, options, and crypto.

FAQs

How much does it cost to build an app like Robinhood with Miracuves Solutions?

Building a stock trading app with Miracuves Solutions can cost around $600, significantly lower than the global average of $6000.

How quickly can I launch a Robinhood-like app?

With Miracuves Solutions, you can expect to launch your app in just 10 days, compared to the typical 1 month for traditional development.

What customization options are available with ready-made solutions?

Miracuves Solutions allows for extensive customization, enabling you to tailor features and functionalities to meet the specific needs of your target audience.

What security measures are included in the app?

The app includes advanced security features like multi-factor authentication (MFA), data encryption, and compliance with KYC and AML regulations to protect user information.

How scalable is a ready-made Robinhood-like app?

The app is designed for scalability, allowing you to accommodate a growing user base and integrate new features without compromising performance.

Explore our finance and investment app solutions offered by Miracuves – crafted for security, speed, and smart financial management:

NeoBank Like App – A digital-first banking experience with easy account setup, virtual cards, real-time spend tracking, and user-friendly design like app.

Banking Like App – A modern digital banking experience with secure transactions, account management, and intuitive controls like app.

Wise Like App – A global money transfer tool with low fees, multi-currency wallets, and real-time exchange rates for seamless international payments like app.

Revolut Like App– Modern financial services inspired by Revolut, offering multi-currency accounts, instant transfers, budget tracking, and seamless card management in one sleek experience.

Transfer Now Like App– Smart money transfer services modeled after Transfer Now, delivering fast, secure, and easy international and domestic transactions with real-time tracking and user-friendly features.