Ever sent money abroad and felt like your wallet took a bigger hit than it should? Yeah, we’ve all been there. You start with a crisp $1000, but by the time it lands in your friend’s account across the world, it feels like it’s been on a budget airline—extra fees, hidden charges, and surprise taxes along the way. It’s like that time you ordered a burger online, and by the time it arrived, you had paid for delivery, packaging, and maybe even the air it was shipped in.

For digital entrepreneurs, creators, and startups scaling globally, these money transfer fees aren’t just annoying—they’re a real threat. Every dollar lost to hidden costs chips away at profits, growth, and the freedom to build that next big thing. Think of a creator who needs to pay their freelance editor in another country, or a startup paying SaaS subscriptions to global vendors. These fees add up fast, and suddenly, the dream of global reach feels like a game of financial Jenga—pull out one wrong piece, and the whole tower could tumble.

But here’s the kicker: most of these costs aren’t even obvious. That’s where the real trap lies. So today, let’s peel back the curtain and break down these sneaky fees—so you can stop burning cash and start building smart. At Miracuves, we empower businesses to navigate these challenges with scalable, monetization-ready app solutions. Let’s dive in.

Why Are Cross-Border Transfers So Expensive?

The Illusion of “No Fees”

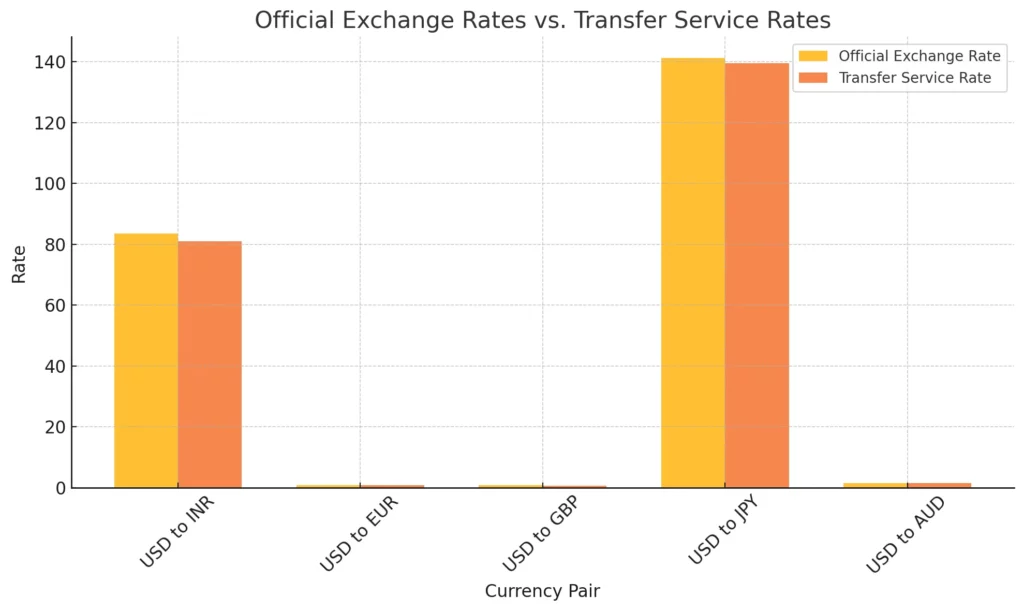

You know those apps that proudly flash zero fees on their homepage? Well, that’s marketing 101. In reality, most money transfer services make their money in the exchange rate margins—a tiny tweak here, a small nudge there—and suddenly, your dollars are worth less in rupees, euros, or pesos. For example, a “mid-market rate” for USD to INR might be 83.5, but your provider offers you 81.0. That’s a 3% haircut right there—before any “transparent” fee even kicks in.

Transfer Fees: The Obvious Culprit

While the exchange rate is a sneaky player, transfer fees are the obvious villain. Think of them like the convenience fees you see on concert tickets—annoying, but at least they tell you they’re there. These fees vary wildly—some platforms charge flat fees ($10 per transfer), while others go for a percentage (1-3%). For high-volume entrepreneurs or creators making multiple international payments, this compounds quickly.

Regulatory Compliance and FX Spreads

Ever wondered why your money transfer is “in review” or “pending compliance check”? Cross-border transactions need to pass through various regulatory hoops—KYC (Know Your Customer), AML (Anti-Money Laundering), and more. And guess what? These checks aren’t free. Providers pass on these operational costs through spreads in the exchange rate or added service fees.

The Hidden Costs You Probably Didn’t Know About

Intermediary Bank Fees

Here’s the sneaky part: Even if your transfer app says, “No hidden fees,” the banks in between can—and do—charge fees. These are known as correspondent bank charges or SWIFT fees, and they’re often unpredictable. Imagine sending $5000 via a money transfer service—by the time it lands in your recipient’s account, a $30-$50 chunk might have disappeared in the banking void.

Currency Conversion Penalties

If you’re paying someone in a different currency, the currency conversion fee is often baked into the process—sometimes without you even noticing. For instance, if your app offers “multi-currency accounts,” you might think you’re saving—but the actual conversion rates can be brutal compared to mid-market rates.

Payment Method Charges

Here’s one more: the payment method itself can trigger fees. Credit card payments often come with cash advance fees or higher service charges, while ACH or bank transfers might be cheaper. But hey, if you’re in a rush, you might opt for a card and not even realize you’ve paid an extra 2-3%.

How Entrepreneurs and Startups Can Beat the System

Smart Money Management Tools

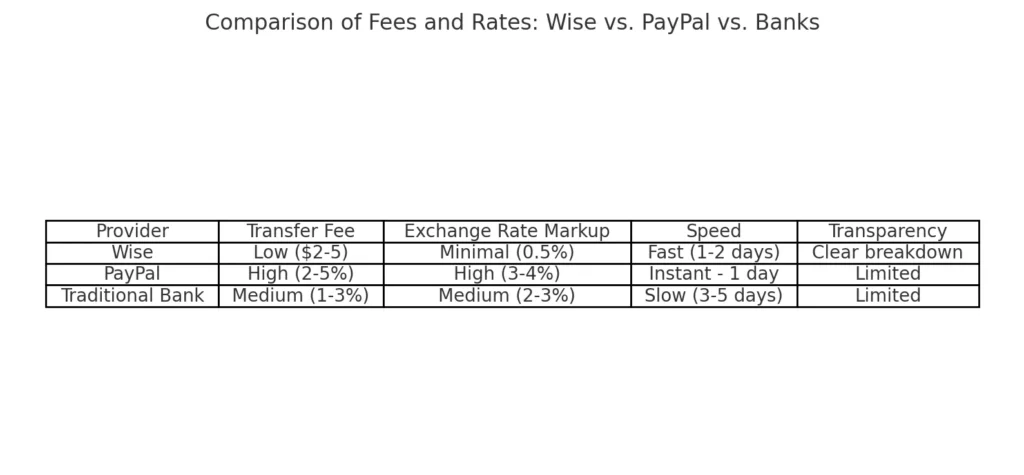

Apps like Wise (formerly TransferWise) and Revolut have been disrupting the space by offering better transparency. But even then, vigilance is key. Always compare rates, read the fine print, and consider multi-currency wallets or borderless accounts to reduce conversion hits.

Build Your Own Payment App (Yes, Seriously)

Here’s where the game changes. If you’re running a creator platform, e-commerce startup, or SaaS solution that handles global payments, you might want to build your own cross-border payment solution. That way, you control the fees, negotiate better rates, and own the customer journey. Companies like Miracuves can help you launch payment-ready apps that handle global transactions seamlessly—think of it as cutting out the middlemen and creating your own global payment pipeline.

Plan Your Transfers

For freelancers, creators, and small businesses, planning matters. Batch your payments instead of multiple small transfers, avoid peak periods (when FX spreads widen), and always double-check rates before hitting “Send.”

The Bigger Picture: Why It Matters

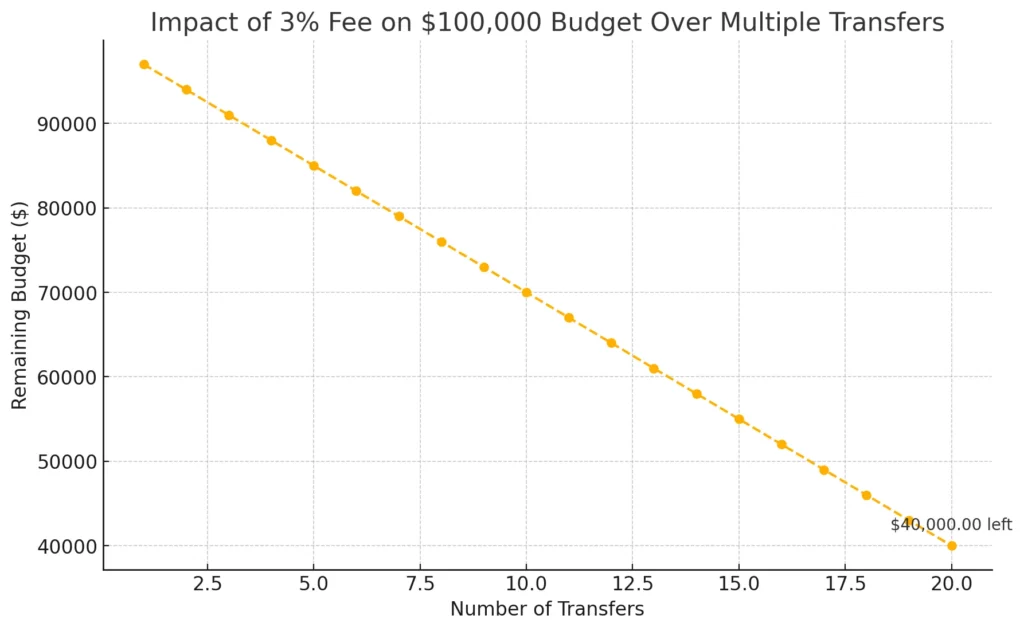

These hidden costs aren’t just a financial inconvenience—they can make or break the sustainability of global businesses. A startup bleeding 3-5% on every cross-border payment is essentially paying a hidden “tax” that erodes margins over time. In a digital world where creators, SaaS founders, and entrepreneurs are already working with tight budgets, this is the kind of cost you just can’t ignore.

Conclusion

Cross-border money transfers are like those too-good-to-be-true deals online—you think you’re getting a bargain, but there’s always a hidden cost. By understanding where these fees hide, you can outsmart the system, protect your margins, and build a truly global business. And if you’re thinking bigger—like building your own global payment app—why not go all in?

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

Q:1 Why are international money transfers so expensive?

It’s a mix of exchange rate spreads, service fees, compliance costs, and intermediary bank charges—each taking a small bite out of your funds.

Q:2 What’s the cheapest way to send money abroad?

Typically, bank transfers via services like Wise or Revolut offer better rates than credit cards or PayPal, but it depends on the amount and destination.

Q:3 How do I avoid hidden fees when sending money internationally?

Always check the mid-market exchange rate, compare services, and be aware of intermediary bank fees and currency conversion charges.

Q:4 Are cryptocurrency transfers a better option for cross-border payments?

They can be, especially for large transfers, but volatility and regulatory hurdles are major considerations.

Q:5 Can I build my own app to handle international payments?

Absolutely! With platforms like Miracuves, you can build your own cross-border payment solution to control fees and user experience.

Q:6 How much can hidden fees impact my business in the long run?

Even a 2-3% fee on regular payments can add up to thousands in lost revenue over time—so it’s worth optimizing.