Let’s be honest—ten years ago, no one ever got excited about opening a bank account. Long lines, stale coffee, cryptic forms. Fast-forward to now, and digital banking apps like Revolut, N26, and Monzo are slicker than your favorite ride-hailing app. They’re smart, stylish, and… wait for it… profitable. So what changed?

Well, for one thing, the smartphone took over. For another, we’ve entered an era where people want finance to feel like social media: instant, intuitive, and even a little addictive. That craving for a seamless experience gave birth to the boom in digital banking platforms. And guess what? Behind every clean interface is a clever revenue model keeping the lights on and the investors smiling.

Whether you’re an ambitious startup founder or just someone dreaming up the next fintech unicorn, knowing how digital banks make money is your first step toward disrupting the industry. And yes, Miracuves has helped plenty of fintech entrepreneurs do exactly that.

Core Revenue Streams of Digital Banking

Understanding the foundational revenue sources is key to building a profitable digital banking app. Whether you’re creating a Revolut clone or launching a niche neobank, these monetization methods form the backbone of your business model.

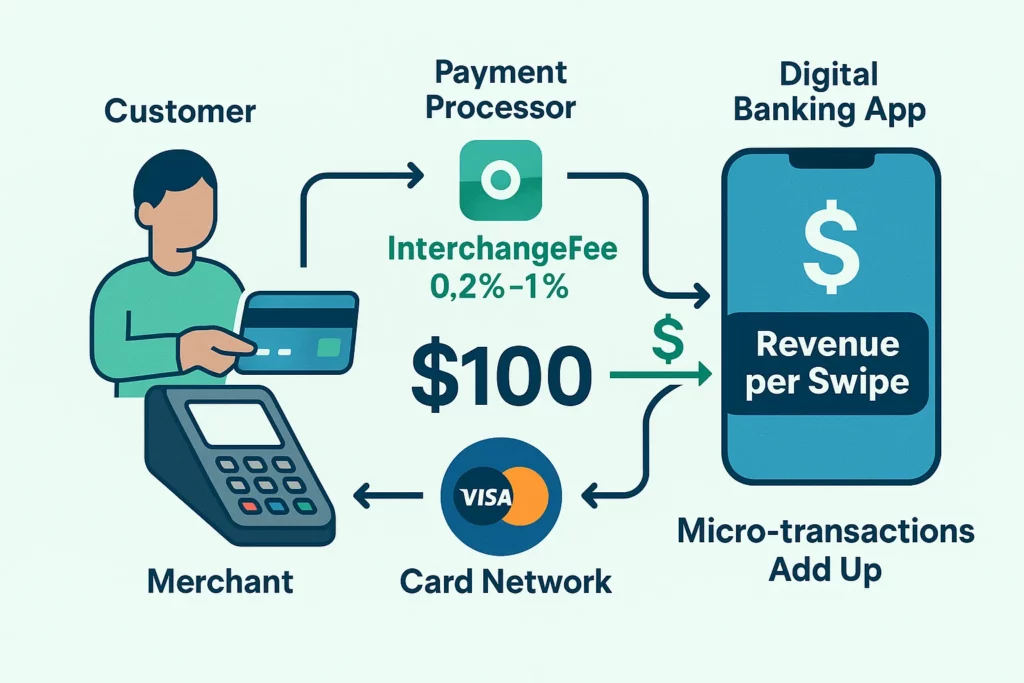

Interchange Fees (The Subtle Cash Machine)

Every time a user swipes their debit card, the bank earns a slice. This tiny fee—usually 0.2% to 0.3% in Europe and up to 1% in the U.S.—adds up fast. Multiply that by millions of transactions and boom, you’re swimming in micro-revenue.

Subscription Plans (Freemium Works!)

Many digital banks offer a free basic account and then upsell users to premium plans with perks like:

- Free international transfers

- Lounge access

- Crypto trading features

- Higher savings interest

N26, for example, charges up to €16.90/month for its Metal plan. That’s recurring revenue heaven.

FX & Cross-Border Fees

When users travel or send money abroad, digital banks charge a small markup on foreign exchange rates. It’s minimal on paper—but lucrative in scale. This is especially effective in travel-heavy markets.

Interest on Deposits

Here’s a twist: digital banks often partner with licensed banks and invest user deposits in low-risk bonds or loans. They keep the interest difference (also known as net interest margin).

Add-On Monetization Models

Beyond the basics, these revenue boosters can supercharge your digital banking app earning potential. Think of them as value-added features that deepen user engagement while expanding your profit channels.

In-App Insurance & Financial Products

Think travel insurance, gadget protection, and life insurance—all available with a few taps. Monzo and Revolut both integrate this. Digital banks take a commission for every policy sold.

Personal Loans and Overdrafts

Offering short-term credit with dynamic interest rates is another goldmine. Bonus: AI-driven underwriting minimizes risk and enhances approval speed.

Crypto & Stock Trading Commissions

Fintech-savvy users want more than banking—they want to invest. Revolut monetizes its investment features by charging small trading fees or spreads on crypto and stock transactions.

New-Age Models: Data, Partnerships & Ecosystems

Digital banking apps are evolving into full-fledged ecosystems, not just transaction tools. These innovative fintech revenue models rely on collaboration, personalization, and data-driven experiences. By adopting a Revolut clone structure, startups can tap into these powerful revenue layers and scale faster without reinventing the wheel.

Affiliate Revenue & Partner Offers

Digital banks can recommend partner services—like travel booking apps or subscription boxes—within their ecosystem. Every referral click or conversion earns them a kickback.

Marketplace Banking

Some players open up their platforms to third-party fintech tools—budgeting, investing, savings, etc. Banks earn a platform fee or revenue-share model.

Data Monetization (Handled Ethically!)

Aggregated, anonymized user data can be a goldmine for financial analytics firms and credit bureaus. But trust is key—transparency is non-negotiable.

Real-World Example: How Revolut Does It

Revolut’s multi-tiered model includes:

- Subscription fees (up to $16.99/month)

- Crypto and stock trading margins

- Cross-border transfer fees

- Interest from deposits

- Affiliate earnings from lifestyle partners

In 2023, Revolut reportedly hit $1.1 billion in revenue. Let that sink in.

Why the Revenue Model Matters for You

Choosing the right revenue mix is make-or-break. Go too heavy on subscriptions, and users may bail. Ignore interchange, and you’re leaving money on the table. The magic is in balancing user value with business viability.

That’s where working with a tech partner who understands the nuances (like Miracuves) makes all the difference.

Conclusion

Digital banking is here to stay—and grow. If you’re thinking of launching one, remember: user trust, feature utility, and monetization must walk hand in hand. Get that right, and you’ve got a scalable, profitable fintech rocket.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

How do digital banks earn if they offer “free” accounts?

They monetize through interchange fees, upgrades to premium plans, FX markups, and in-app services like insurance or loans.

Is it legal for digital banks to make money on user data?

Only if done ethically and with user consent. Most use aggregated, anonymized data for analytics.

Do users actually pay for premium banking?

Yes! Premium tiers are popular, especially for perks like travel insurance, better FX rates, and investment features.

How much can a startup digital bank earn annually?

Depends on the user base and monetization strategy, but even small banks can earn millions through clever revenue stacking.

Can I build a Revolut-like app without a banking license?

Yes, by partnering with licensed banks and using a white-label development service like Miracuves.

What’s the biggest risk in monetizing a banking app?

Losing user trust—especially if monetization is too aggressive or lacks transparency.