So, you’ve been watching the crypto boom from the sidelines and wondering—”How do these crypto exchanges actually make money?” You’re not alone. Thousands of founders and startup dreamers are realizing that building the next big exchange might just be their golden ticket. But before you dive headfirst into code and compliance, let’s talk numbers—the kind that go ka-ching.

Back in the day, it was all about Bitcoin. Now? It’s about the platforms. Exchanges are becoming the infrastructure of the digital economy—handling trades, wallets, conversions, and often, headaches. Yet, with great chaos comes great opportunity. Some savvy entrepreneurs are cashing in on this volatility, turning simple trading platforms into fintech empires.

In this blog, we’re going to demystify the crypto exchange revenue model. From bread-and-butter transaction fees to the spicy margin spreads and secret back-end deals, we’ll lay it all out. And if you’re building your own platform, remember—Miracuves is the go-to for launching app clones that scale.

The Crypto Exchange Landscape in 2025

Crypto exchanges have come a long way since Mt. Gox. As of 2025, the market is projected to surpass $100 billion in revenue globally (Statista). These platforms are no longer fringe tech—they’re fintech mainstays.

You’ve got:

- Centralized Exchanges (CEXs) like Binance and Coinbase

- Decentralized Exchanges (DEXs) like Uniswap and PancakeSwap

- Hybrid Exchanges offering the best of both worlds

Each has a different monetization model, but one thing’s clear: there’s money on the table.

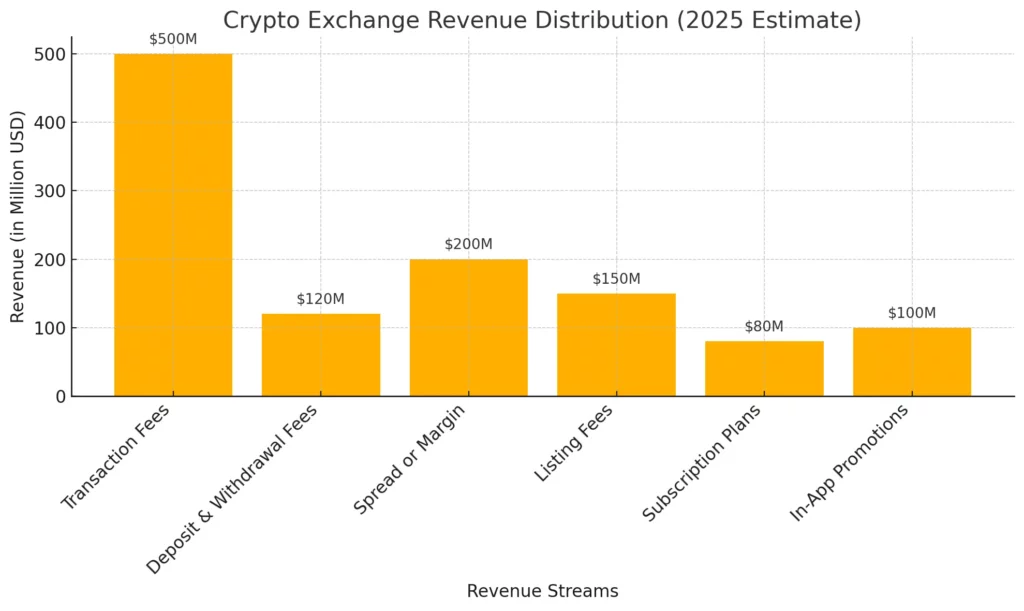

Revenue Streams That Actually Work

Transaction Fees

This one’s the old faithful. Whether it’s 0.1% per trade or a tiered structure for high-volume traders, this model is responsible for billions in revenue. Binance made over $20B in 2022 from fees alone.

Deposit & Withdrawal Fees

Exchanges often charge when users bring in fiat or take it out. Some even charge for blockchain transfers.

Spread or Margin

You know when you buy BTC at $60,000 and the sell price is $59,800? That $200 difference is profit—called the spread. It’s subtle, effective, and scales fast.

Listing Fees

Got a new token? Want it on a major exchange? That’ll be anywhere from $50K to $1M. Startups line up for this visibility.

Subscription or Membership Plans

Advanced tools, insights, early token access—VIP plans for pro traders are becoming the Netflix of crypto apps.

In-App Ads & Sponsored Promotions

Think Google Ads, but for crypto. Projects pay to get visibility on platforms through banners, promoted coins, and priority listings.

Value-Added Services

Want API access? Algo-trading dashboards? Cold storage solutions? These extras can rake in major B2B revenue.

The Hidden Giants: Back-End Revenue Models

Not all profits are public-facing. Some exchanges make bank from:

- White-label licensing – selling the platform tech to startups

- Data monetization – anonymized trading behavior insights

- Institutional APIs – premium packages for banks and fintech firms

Case Studies: Who’s Doing It Right?

- Binance: Dominates through low fees and massive trade volume

- Uniswap: Profits from liquidity provider fees and tokenomics

- WazirX (India): Regional success through fiat integration and mobile-first design

Risks, Regulations & Monetization Limits

No model is bulletproof. Government regulations, tax compliance, KYC/AML requirements, and regional bans can limit revenue or add compliance costs.

Some countries prohibit crypto-to-fiat pairs. Others demand strict reporting. And then there’s user distrust—transparent monetization builds trust.

Conclusion:

Crypto exchanges aren’t just digital stock markets—they’re the engines of the new economy. And if you’re smart about how you build and monetize them, they can be your next big payday.

Trends like gamification, micro-investments, and DeFi integrations are expanding what’s possible. So don’t just launch—launch with a strategy.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQ’s

1) How do crypto exchanges make money without fees?

They rely on spreads, listing fees, advertising, and B2B services like APIs.

2) What’s the most profitable type of exchange?

Centralized exchanges (CEXs) generate the most revenue due to high volume and multiple fee layers.

3) Are crypto listing fees legal?

Yes, though they must comply with advertising and financial regulations in various countries.

4) Can I monetize a DEX the same way as a CEX?

Not exactly. DEXs rely more on liquidity pool fees, tokenomics, and governance incentives.

5) Is it worth offering subscription plans in crypto apps?

Absolutely. Traders value access to premium features, insights, and early launches.

6) Do crypto apps need licenses to operate?

Most regions require licensing, especially for fiat gateways and custodial services.