In today’s digital age, the rise of financial apps has transformed how people manage their investments and finances. One of the leading platforms in this space is Fidelity, a robust investment and stock trading app that offers users a wide range of financial services, from trading stocks to retirement planning. Building an app like Fidelity requires careful consideration of its features, security standards, and user experience, all while ensuring compliance with strict financial regulations.

Whether you’re a financial startup or a tech entrepreneur, developing a mobile app like Fidelity can be a game-changer in the world of fintech. But how do you go about creating such a complex platform? In this guide, we’ll walk you through the essential steps, key technologies, cost considerations, and strategies needed to bring your financial app idea to life. By the end, you’ll have a clear roadmap to develop a secure, scalable, and feature-rich app, much like Fidelity.

If you’re looking to turn your app idea into a reality, Miracuves Solutions is here to provide expert guidance and development support throughout the entire process. We’ll ensure that your app not only meets market demands but also stands out in a competitive landscape.

What is Fidelity and What Does It Do?

Fidelity is a financial powerhouse, offering a comprehensive suite of services designed to meet the needs of both novice and experienced investors. The app enables users to trade stocks, bonds, mutual funds, and ETFs, while also providing access to retirement planning, portfolio management, and even financial advice. With its user-friendly interface, Fidelity allows investors to seamlessly monitor their portfolios, make informed decisions, and execute trades in real-time.

One of the app’s standout features is its integration of real-time data, allowing users to stay up-to-date with market trends and prices. Fidelity also offers tools like research reports, financial calculators, and educational resources to empower users to make smarter investment decisions. Beyond trading, the app provides access to personalized financial planning services, ensuring users can plan for their long-term financial goals like retirement or saving for big expenses.

In addition to its features, Fidelity stands out for its robust security protocols, ensuring all transactions and personal data are fully protected. As regulations around financial services become stricter, security and compliance play a critical role in building trust with users. From two-factor authentication to encryption, Fidelity prioritizes user safety, which is essential for any financial app to thrive in today’s competitive market.

Why Build an App Like Fidelity?

The surge in digital finance has created a golden opportunity for businesses to enter the financial technology (fintech) space. Building an app like Fidelity taps into this growing demand, offering users a platform that simplifies investing, stock trading, and financial management. The increasing popularity of investment apps is driven by their convenience, accessibility, and ability to empower users with direct control over their financial futures.

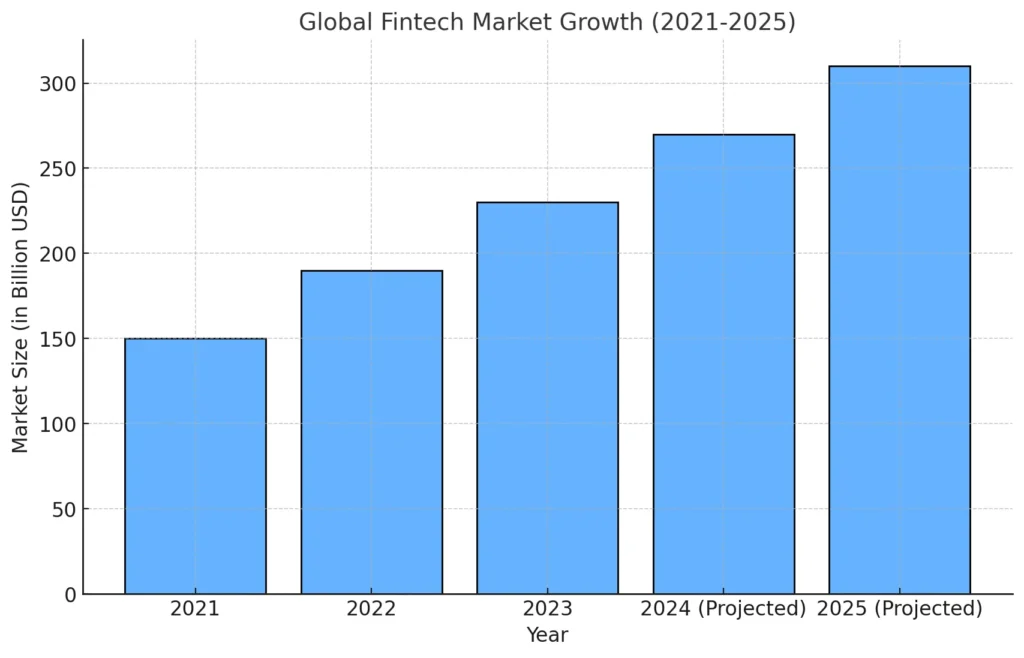

Fidelity’s success lies in its ability to cater to a broad audience—from seasoned investors managing complex portfolios to beginners looking to learn and make small investments. With more people embracing digital platforms for their financial needs, creating a similar app positions your business to capture a significant share of this expanding market. The global fintech market, particularly investment and stock trading apps, is expected to see continued growth, driven by the rising number of retail investors and the increased availability of real-time financial data.

Moreover, an app like Fidelity can serve multiple revenue streams. Whether it’s through commission-based trades, premium subscriptions for advanced tools, or ads, the business model behind such an app offers high scalability. Plus, with a strong focus on user experience, an investment app can build long-term customer loyalty, which is crucial for sustained growth and profitability in the fintech industry.

By creating a financial services app that competes with established players like Fidelity, you’re not just tapping into a lucrative market—you’re offering users the tools to manage their wealth with ease and confidence.

How to Differentiate Your App from Competitors

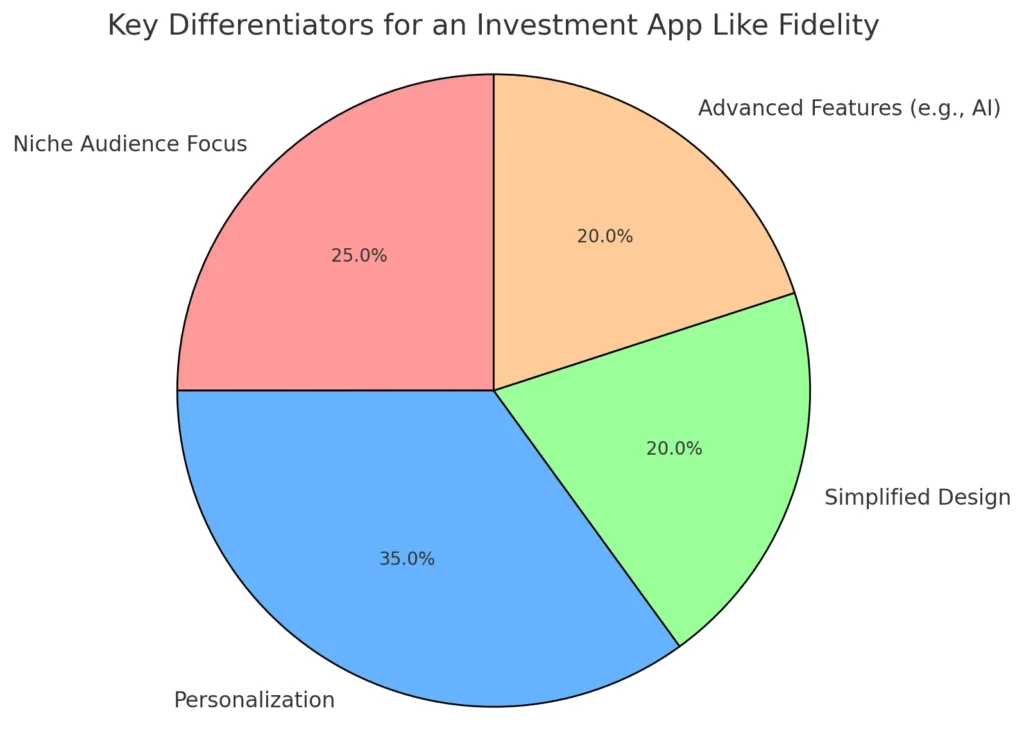

In the crowded world of fintech, standing out from competitors like Fidelity requires more than just replicating existing features. To truly differentiate your app, you need to offer unique features, enhanced user experience, or target niche markets that established players may overlook. Understanding the gaps in the market and addressing specific customer pain points can help your app gain traction quickly.

One way to set your app apart is by focusing on a niche audience. While Fidelity serves a broad range of investors, your app could target a specific demographic, such as millennial investors, crypto enthusiasts, or those interested in socially responsible investing (SRI). By catering to specialized financial needs, you can create a loyal user base that feels your app is tailored just for them.

Another important aspect is personalization. Integrating AI-powered tools for personalized portfolio recommendations or robo-advisors can enhance the user experience significantly. Users appreciate apps that help them make smarter decisions based on their financial goals, risk tolerance, and investment history. Offering customized insights and alerts based on real-time data can make your app a go-to resource for users who value convenience and expert guidance.

Additionally, simplified design and intuitive navigation can give your app an edge. Financial apps often get bogged down by complexity, but offering a clean, easy-to-navigate interface can attract users looking for a hassle-free experience. Adding tools like voice-enabled commands for trading or hands-free portfolio monitoring can also be a standout feature that appeals to tech-savvy users.

By blending niche focus, personalized experiences, and a sleek interface, you can build an app that not only competes with industry giants but also creates a unique space in the market.

Market Size, Growth, and Business Model

The financial technology sector, especially investment and stock trading apps, has experienced exponential growth in recent years. With the global increase in retail investors and the adoption of mobile-first financial solutions, apps like Fidelity are thriving. In fact, the global fintech market is projected to reach over $310 billion by 2025, driven by a growing demand for seamless, secure, and user-friendly financial platforms.

Investment apps, in particular, are a fast-growing segment of the fintech industry. In 2023, there were more than 10 million new brokerage accounts opened in the U.S. alone, reflecting the strong interest in accessible trading tools for both beginner and experienced investors. Additionally, the growing popularity of cryptocurrency and alternative assets has expanded the scope of what financial apps can offer.

As for business models, apps like Fidelity typically rely on a combination of commission-based earnings, subscription fees for premium services, and ads. A popular strategy is the freemium model, where basic services like stock tracking and news feeds are free, while advanced features like detailed analytics or personalized financial advice require a paid subscription. This model ensures that the app can appeal to a wide audience while still generating revenue from users seeking more advanced tools.

Another aspect to consider is asset management fees, where apps can charge a percentage of the assets under management (AUM) for providing portfolio management services. This can be highly profitable as users invest larger amounts over time, allowing the app to grow with its users’ financial success.

Key Features of Fidelity

| Feature | Casual Investors | Professional Investors/Advisors |

|---|---|---|

| Real-Time Stock Trading | Simple buy/sell functionality with real-time data | Advanced trading tools with custom alerts and order types |

| Portfolio Management | Basic portfolio tracking and performance overview | Detailed analytics with multi-account integration and advanced metrics |

| Research and Analytics | Access to basic market insights and news | In-depth research reports, analyst recommendations, and market forecasts |

| Investment Tools & Calculators | Retirement calculators and investment estimators | Comprehensive financial modeling and custom calculators |

| Account Management | Manage one or two linked accounts, transfer funds | Multi-account management with advanced fund transfer options |

| Customer Support & Resources | Basic FAQ and chatbot for queries | Direct access to financial advisors and personalized customer service |

To build a successful financial app like Fidelity, it’s crucial to understand the core features that users rely on. Fidelity offers a wide range of tools and services that cater to both casual investors and professionals. Incorporating these key features into your app will ensure that it meets the expectations of modern users.

- Real-Time Stock Trading: Fidelity allows users to buy and sell stocks, bonds, ETFs, and mutual funds with real-time market data. This feature is a must-have, as it gives users the ability to react quickly to market changes.

- Portfolio Management: The app provides users with a comprehensive dashboard to monitor their investments. Users can track the performance of their portfolios, set financial goals, and adjust their holdings according to market trends.

- Research and Analytics: One of Fidelity’s strongest features is its access to in-depth research and financial analysis. Users can access reports from top analysts, news feeds, and market insights to make informed decisions.

- Investment Tools and Calculators: Fidelity offers a variety of tools to help users plan for retirement, estimate investment returns, and calculate the cost of specific financial goals. These tools are valuable for users looking to manage their finances in the long term.

- Account Management: Users can manage all aspects of their accounts directly through the app, from viewing statements to depositing funds. The ability to link multiple accounts and transfer money between them is crucial for user convenience.

- Customer Support and Educational Resources: Fidelity emphasizes customer support, offering in-app access to live agents, chatbots, and a library of educational resources. These help users at all experience levels better understand how to use the app and invest wisely.

These features are designed to provide users with a seamless, all-in-one experience that covers everything from real-time trading to long-term financial planning. Integrating similar capabilities into your app will be key to its success.

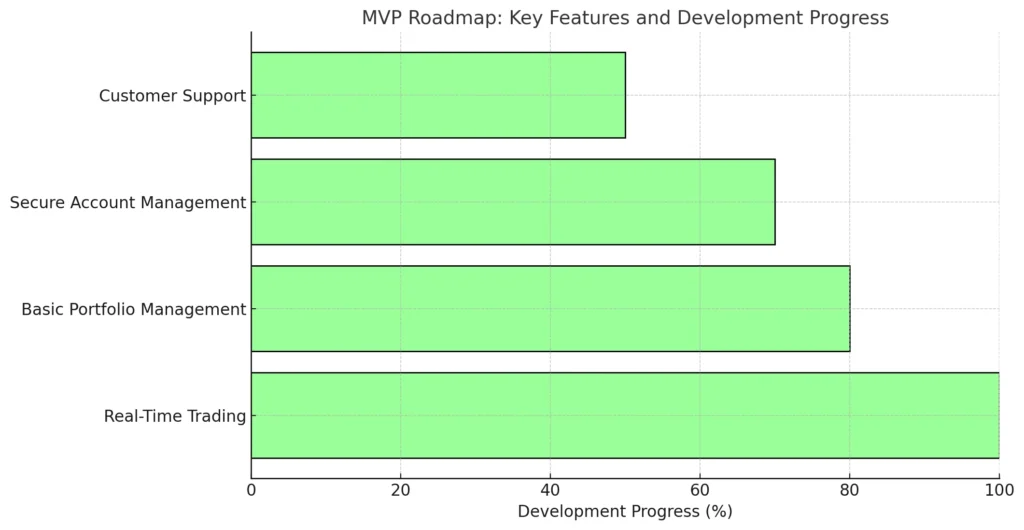

Minimum Viable Product (MVP) Approach

When building a complex financial app like Fidelity, starting with a Minimum Viable Product (MVP) is a smart strategy. An MVP allows you to launch the core features of your app quickly, gather feedback from users, and iterate on the product based on real-world insights. This approach reduces both risks and costs by ensuring that you’re developing features users actually need and use.

For a financial app like Fidelity, the MVP should focus on delivering the most essential features that drive user engagement and offer immediate value. Here are the key components to consider for your MVP:

- Real-Time Trading: Ensure that users can perform basic stock and ETF trades with real-time market data. This feature is the backbone of any investment app and should be functional from day one.

- Basic Portfolio Management: Include a simple dashboard where users can track their investments, view their portfolio’s performance, and monitor any gains or losses. This will keep users engaged and coming back to the app regularly.

- Secure Account Management: Implement account creation and management features that allow users to securely register, link their bank accounts, and start trading. Make sure your app complies with relevant security and financial regulations from the outset.

- Customer Support: Offering basic customer support through in-app FAQs or a chatbot is important even in the MVP stage. Users should have easy access to help if they run into issues.

Once the MVP is launched and you start receiving feedback from users, you can begin to refine and add more advanced features, such as detailed analytics, financial planning tools, and personalized investment advice. This iterative process helps you build a product that not only meets user needs but also evolves in line with market demands.

Technical Requirements

| Component | Technology Option 1 | Technology Option 2 | Description |

|---|---|---|---|

| Frontend | React Native | Flutter | Cross-platform development for both iOS and Android |

| Backend | Node.js | Python/Django | Scalable backend options with real-time capabilities |

| Database | PostgreSQL | MongoDB | Reliable for handling large data volumes and transactions |

| Stock Market API | Alpha Vantage | IEX Cloud | Provides real-time financial market data |

| Payment Gateway | Stripe | PayPal | Secure payment processing for trades and fund transfers |

Building a financial app like Fidelity demands a robust and scalable technical foundation to ensure seamless performance, top-tier security, and a smooth user experience. Choosing the right technologies for both the frontend and backend of the app is crucial in delivering a reliable, high-performing product.

Frontend Technologies

For the user interface, you want to focus on technologies that offer responsiveness, ease of use, and compatibility with multiple devices. Popular choices include:

- React Native: Known for its efficiency in building cross-platform apps, React Native allows you to create a single codebase that works on both iOS and Android, reducing development time and costs.

- Flutter: Another great option for cross-platform development, Flutter provides a rich set of UI components that help create a smooth, high-performance user interface.

Backend Technologies

The backend of the app is where the heavy lifting happens. You’ll need to process user requests, manage transactions, and provide real-time updates—all while ensuring security and compliance. Common backend technologies include:

- Node.js: Highly scalable and ideal for real-time applications, Node.js is perfect for managing high-traffic environments like stock trading apps.

- Python/Django: Known for its simplicity and efficiency, Django helps in building secure and robust backend frameworks. It’s especially useful for integrating APIs and managing databases.

Databases

Handling large volumes of user data and transactions requires a reliable database system. Popular options include:

- PostgreSQL: Known for its strong performance in handling complex queries and transactions, PostgreSQL is often favored for financial applications.

- MongoDB: This NoSQL database is a great fit for apps that need to scale quickly, especially for real-time data handling.

APIs and Integrations

To provide real-time stock data, secure payments, and other essential features, you’ll need to integrate several third-party APIs:

- Stock Market APIs: Services like Alpha Vantage or IEX Cloud can provide up-to-date financial market data.

- Payment Gateways: Secure integrations with services like Stripe or PayPal will allow users to transfer funds or execute trades securely.

By choosing the right technologies, your app will be well-equipped to handle large numbers of users, process transactions securely, and provide a seamless experience across devices. Prioritizing scalability and security in the technical stack will set the foundation for future growth.

Ready to launch a next-level trading app that competes with Fidelity?

Let’s integrate powerful tools, secure payment systems, and

seamless user experiences to bring your vision to life.

Design and User Interface (UI/UX)

In the world of financial apps, user experience (UX) and interface design (UI) can make or break your product. When users interact with complex tools like stock trading or portfolio management, they need an intuitive and streamlined interface that helps them make quick decisions without confusion. A financial app like Fidelity needs to combine functionality with simplicity to ensure that users of all levels can navigate the app effortlessly.

Simplicity Meets Functionality

One of the main goals of UI/UX design in financial apps is to simplify the complexity of financial data. Whether it’s stock prices, account balances, or transaction histories, the app should present information in a way that is easy to understand at a glance. This means using clean layouts, clear typography, and intuitive navigation menus. Fidelity’s design succeeds because it allows users to access essential tools quickly while keeping more advanced features just a few taps away.

Visual Consistency

Consistency in design elements, such as icons, fonts, and color schemes, is crucial. For example, using a consistent color palette helps users develop a sense of familiarity and trust when navigating the app. Fidelity uses a clean white and blue color scheme, which promotes a professional and trustworthy image. By sticking to a unified design system, your app will feel more polished and reliable.

User-Friendly Features

- Personalized Dashboards: Offering users a customizable dashboard is a great way to enhance their experience. They should be able to prioritize the information that matters most to them, such as stock tickers, watchlists, or portfolio updates.

- Simple Navigation: Even though financial apps are feature-rich, ensuring simple navigation with clear labels and shortcuts will make users feel more confident in using the app. Features like a bottom navigation bar and quick access buttons for trades and accounts can enhance usability.

Mobile-First Design

Given the mobile-first nature of modern users, the app should be optimized for smaller screens while still offering the same functionality as a desktop version. Touch-friendly interactions, such as swiping between sections or pinch-to-zoom on charts, can significantly improve the mobile experience.

In summary, a successful UI/UX design for a financial app should focus on simplicity, consistency, and user-friendly functionality. This will ensure that users not only trust the app but also find it easy to use—whether they’re making a quick trade or managing a complex portfolio.

Development Process

Developing an app like Fidelity involves a multi-step process that ensures each aspect of the platform, from its core functionality to user experience, is built with precision. The development process is crucial because it determines how smoothly your app will run and how effectively it will meet user needs. Here’s a breakdown of the essential steps involved in building a financial app like Fidelity.

1. Idea Validation

Before starting development, it’s critical to validate your app idea. This involves conducting thorough market research to identify your target audience and their needs. By analyzing competitors like Fidelity, you can pinpoint gaps in the market and figure out how your app can offer a unique solution. Engaging potential users through surveys or beta testing can provide valuable insights that shape the app’s direction.

2. Wireframing and Prototyping

Once the idea is validated, the next step is to design wireframes and create prototypes. Wireframes are basic layouts of the app that show where elements like buttons, text fields, and charts will be placed. Tools like Figma or Sketch can be used to create interactive prototypes that simulate how users will navigate the app. This stage is essential for mapping out the user experience and refining the interface before moving into full development.

3. Backend and Frontend Development

The core of the app is built during the development phase, where both frontend (what the user sees) and backend (how the app operates) are constructed.

- Frontend Development: This involves creating the app’s user interface and ensuring it works seamlessly across different devices (iOS, Android). Technologies like React Native or Flutter are commonly used for building responsive financial apps.

- Backend Development: Here, developers focus on handling transactions, storing user data securely, and managing the app’s overall functionality. This stage ensures the app can support real-time trading, manage user portfolios, and process transactions efficiently.

4. Testing

Once the app’s core functionalities are in place, it’s time for rigorous testing. Financial apps handle sensitive data, so testing needs to include both functional testing (making sure everything works) and security testing (ensuring that user data and transactions are protected). Beta testing with a small group of real users can also help identify any usability issues before the app is officially launched.

5. Deployment

After all the testing is complete, the app is ready for deployment. It’s important to follow the guidelines set by app stores like Apple’s App Store and Google Play to ensure smooth approval. After the app is launched, it’s crucial to monitor performance closely, fix any bugs, and update the app regularly based on user feedback.

In conclusion, building a financial app like Fidelity is a step-by-step process that requires thorough planning, meticulous development, and ongoing improvements. By following this structured approach, you can ensure your app meets market expectations and operates flawlessly.

Cost Estimation and Timeframe

| Development Component | Estimated Cost (USD) | Description |

|---|---|---|

| Frontend Development | $15,000 – $30,000 | Building the user interface and ensuring responsiveness for iOS/Android |

| Backend Development | $20,000 – $50,000 | Handling server infrastructure, data storage, and secure transactions |

| UI/UX Design | $10,000 – $20,000 | Creating user-friendly design and wireframes |

| APIs & Integrations | $5,000 – $15,000 | Integrating third-party APIs (stock market data, payment gateways, etc.) |

| Security & Compliance | $5,000 – $15,000 | Implementing encryption, data privacy compliance, two-factor authentication |

| Testing & Quality Assurance | $5,000 – $10,000 | Ensuring the app works flawlessly and securely |

| Total Estimated Cost | $50,000 – $140,000 | Depending on feature complexity and region of development team |

Building a financial app like Fidelity requires careful budgeting and time planning. The cost and timeframe depend on various factors such as the complexity of features, the development team’s expertise, and the technologies used. Understanding these factors will help you set a realistic budget and timeline for your project.

Factors Influencing Cost

- App Features: The more advanced features your app includes—such as real-time stock trading, portfolio management, and financial analysis tools—the higher the development cost. Simpler apps with basic features like account management and trade execution will cost less, while apps with AI-powered investment advice or detailed analytics require more time and resources to build.

- Development Team: Hiring an in-house team versus outsourcing can significantly impact the cost. An in-house team in countries with high labor costs (e.g., the U.S. or UK) will be more expensive compared to outsourcing to regions like Eastern Europe or Asia, where development costs are lower but quality can still be excellent. You’ll need developers for both frontend and backend, as well as UI/UX designers and quality assurance testers.

- Technology Stack: The choice of technologies also affects the cost. Using a cross-platform solution like React Native or Flutter can save time and money because you’ll only need to build the app once for both iOS and Android. However, if you opt for separate native development for iOS and Android, the cost and time involved will increase.

- Security and Compliance: Financial apps like Fidelity need to comply with strict regulations to ensure user data is safe. Implementing features like encryption, two-factor authentication, and adhering to data privacy laws (e.g., GDPR or CCPA) adds to the development cost. However, this is non-negotiable for financial apps, as security is paramount.

Estimated Cost

For a basic financial app with essential features, development costs can range from $50,000 to $100,000. A more advanced app with complex features like real-time trading, detailed analytics, and AI-driven recommendations could push the cost up to $200,000 or more.

Timeframe for Development

The time required to develop a financial app like Fidelity depends on the number of features and the development approach:

- Basic MVP: 3 to 6 months

- Full-featured App: 9 to 12 months

This timeline includes planning, wireframing, development, testing, and deployment. It’s essential to account for potential delays during the testing phase, as financial apps must undergo thorough testing for security and performance before launch.

Miracuves Solutions for Cost-Efficient Development

At Miracuves Solutions, we understand the importance of balancing cost and quality. With our experienced team, we provide transparent cost estimation and ensure efficient development without compromising on security or functionality. Whether you need an MVP or a full-featured app, we tailor the project to meet your budget and timeline.

Monetization Strategies

Building an app like Fidelity offers immense revenue potential, but choosing the right monetization strategy is key to long-term success. There are several ways to generate revenue from financial apps, depending on your target audience and the features you plan to offer. Here are the most effective monetization models for a financial app like Fidelity:

1. Commission-Based Revenue

One of the most common monetization strategies in investment apps is to charge a commission on trades. Fidelity allows users to trade stocks, ETFs, and other assets, and charges a small commission for each transaction. While some platforms offer commission-free trading, charging a nominal fee on certain transactions (like foreign assets or premium services) can still generate significant revenue without turning users away.

2. Subscription Plans

Another popular model is offering a subscription-based service for premium features. For instance, basic account management and stock trading could be free, while more advanced tools—like in-depth financial analytics, real-time notifications, or personalized investment advice—could be locked behind a subscription plan. This approach allows you to cater to both casual investors and professionals, providing extra value to those willing to pay for premium services.

3. Asset Management Fees

If your app provides portfolio management or investment advisory services, you could charge a fee based on the assets under management (AUM). For example, charging users a small percentage of their portfolio’s value can provide steady, scalable revenue as their investments grow. This model aligns your success with the success of your users, making it an attractive option for long-term sustainability.

4. Advertisements and Partnerships

While ads might seem intrusive in a financial app, partnering with financial institutions or investment firms for sponsored content or in-app promotions can create a subtle revenue stream. For instance, offering users discounts on financial products or services through in-app advertisements could enhance their experience while generating ad revenue for your app. However, it’s essential to strike a balance to avoid overwhelming users with too many ads, which can hurt user retention.

5. In-App Purchases

Offering one-time purchases for specific features, like detailed market reports, advanced charting tools, or access to exclusive webinars, can provide an additional revenue stream. Users may be willing to pay for these value-added features to improve their investment strategies or deepen their financial knowledge.

Long-Term Monetization Potential

The key to successful monetization is flexibility. Offering a mix of commission-based transactions, subscription plans, and in-app purchases allows you to cater to different user segments, ensuring a stable revenue flow as your user base grows. Additionally, as your app gains popularity, you can explore further monetization opportunities, such as launching your own financial products or expanding into global markets.

Launching and Marketing the App

Once your financial app is ready for launch, the next crucial step is to ensure it reaches the right audience and gains traction in a competitive market. The launch phase is just as important as development because even the most feature-packed app won’t succeed without a solid marketing strategy to support it. Below are some key strategies to effectively launch and market your app like Fidelity.

1. App Store Optimization (ASO)

To maximize visibility, start by optimizing your app for the Apple App Store and Google Play Store. App Store Optimization (ASO) is essential for ensuring your app ranks higher in search results. Focus on the following key elements:

- Title and Keywords: Make sure your app’s name and description include targeted keywords such as “investment app,” “financial services,” or “stock trading.”

- App Description: Write a clear and compelling description that highlights the app’s core features and benefits. Make sure it addresses users’ pain points and clearly explains why your app is the best solution.

- Screenshots and Videos: Include high-quality screenshots and videos that demonstrate the app’s functionality, showing users exactly how it works and what they can expect.

2. Leverage Social Media and Content Marketing

Social media platforms like Facebook, LinkedIn, and Twitter are excellent channels for building awareness. Regularly post updates, blog content, and educational materials that provide value to your target audience. Engage with users by answering questions about investing, market trends, and personal finance. Create content such as:

- Educational blog posts that explain how users can manage investments.

- Short videos or webinars about financial tips and how to use the app effectively.

This helps position your app as a valuable resource in the fintech space and builds trust with potential users.

3. Paid Advertising Campaigns

Running paid ad campaigns is an effective way to reach a larger audience, especially during the initial launch phase. Platforms like Google Ads and Facebook Ads allow you to target users based on demographics, interests, and behaviors. For a financial app, you might want to target users who are already interested in investment platforms, personal finance, or stock trading.

4. Influencer and Affiliate Marketing

Partnering with financial influencers or bloggers who have a strong following can help promote your app to their audience. These influencers can provide trusted recommendations and reviews, which can drive app downloads and build credibility. You can also create an affiliate marketing program, offering commissions to affiliates who successfully refer new users to your app.

5. Offer Early Bird Discounts or Promotions

To incentivize downloads, offer special promotions or discounts for early users. For example, you could provide free access to premium features for the first few months or offer discounted commission rates for early adopters. Promotions like these help attract users to your app and create a sense of urgency.

6. Collect Feedback and Iterate

Even after your app is launched, it’s important to gather feedback from your users. Use in-app surveys or monitor app reviews to see what users like and what could be improved. Addressing user feedback quickly and rolling out updates based on their needs will not only improve your app but also increase customer satisfaction and retention.

Launching your app successfully requires a mix of strategic marketing, customer engagement, and ongoing improvements. With the right tactics, you can build a strong user base and generate long-term success for your app.

Legal and Regulatory Considerations

When developing a financial app like Fidelity, ensuring compliance with legal and regulatory standards is non-negotiable. Financial services are heavily regulated across the globe, and failure to meet these standards can result in fines, loss of user trust, or even the shutdown of your platform. This makes understanding and adhering to the relevant regulations a critical aspect of your development process.

1. Data Privacy Laws

Financial apps handle sensitive user data, including personal information and financial details. To protect users and their information, your app must comply with data privacy laws such as:

- General Data Protection Regulation (GDPR): If your app serves users in Europe, GDPR requires you to handle user data with strict confidentiality and offer users the ability to control their data (e.g., request deletion, consent to data collection).

- California Consumer Privacy Act (CCPA): If your app targets users in California, you must comply with CCPA, which offers similar data privacy protections as GDPR, including disclosure of what data is being collected and how it’s being used.

2. Financial Regulations

Financial regulations vary by country but share some common principles aimed at ensuring secure, transparent transactions and protecting consumers. Some regulations you should consider include:

- Securities and Exchange Commission (SEC) regulations: If your app deals with stock trading in the U.S., it must comply with SEC rules to ensure transparent and legal financial transactions.

- Know Your Customer (KYC) Requirements: KYC laws require financial institutions to verify the identity of their users. Implementing KYC processes within your app—like identity verification using government-issued IDs—helps prevent fraud, money laundering, and other illegal activities.

- Anti-Money Laundering (AML): AML regulations, often aligned with KYC, are designed to detect and prevent money laundering activities. Your app should integrate robust transaction monitoring systems to comply with these regulations.

3. Secure Payment Processing

For any financial app, secure payment processing is a top priority. Your app will likely handle deposits, withdrawals, and transactions, so compliance with Payment Card Industry Data Security Standard (PCI DSS) is essential. This standard ensures that all credit card transactions are handled in a secure environment to prevent fraud.

Additionally, it’s important to integrate two-factor authentication (2FA) and encryption protocols to safeguard user accounts and transactions from unauthorized access.

4. Tax Compliance

Your app must also account for tax implications related to users’ investments. For example, you may need to provide tax documents such as Form 1099 in the U.S. for users to report their investment earnings. Building tax-reporting tools into your app can simplify compliance for both you and your users.

5. Intellectual Property Protection

It’s important to secure the intellectual property (IP) of your app by obtaining patents or trademarks for proprietary features or technologies. This will protect your app from potential infringements and ensure that your unique solutions are legally protected.

Legal and regulatory compliance is crucial for maintaining the integrity and security of a financial app like Fidelity. Without proper adherence to these laws, your app could face significant penalties or operational shutdown. By ensuring your app complies with data privacy laws, financial regulations, and payment security standards, you build trust with users and protect your business from legal risks.

Also Read :- How to Create a Robinhood like Stock Trading App in 2024

Future Growth

Building a financial app like Fidelity is only the beginning. Once the app is live, you must plan for future growth to ensure it stays relevant, scalable, and competitive in the ever-evolving fintech market. Planning for the future involves improving your app’s features, expanding its market reach, and continuously enhancing user experience.

1. Scaling for More Users

As your app grows in popularity, one of the first challenges you’ll face is ensuring that it can handle a larger user base without performance issues. Your app’s backend infrastructure should be designed to scale easily, allowing you to add more server capacity as user numbers increase. Leveraging cloud services such as Amazon Web Services (AWS) or Google Cloud can help your app scale seamlessly, ensuring smooth performance even with a large user base.

2. Adding New Features

User feedback will play a critical role in shaping your app’s future. As users engage with the platform, you’ll likely receive requests for additional features. Implementing these based on demand not only improves user satisfaction but also helps retain users in the long run. Some advanced features to consider include:

- Robo-Advisors: Offering automated, algorithm-based financial advice to users based on their risk profiles and financial goals.

- Cryptocurrency Trading: Expanding beyond traditional investments by allowing users to trade cryptocurrencies can attract a new segment of investors.

- Advanced Analytics: Providing users with detailed insights into their investment performance, trends, and predictive market data can set your app apart from competitors.

3. Expanding to New Markets

Global expansion offers significant growth potential. While you may start with a specific region (e.g., the U.S. market), there’s value in extending your app’s services to new markets. However, this requires understanding regional financial regulations, languages, and cultural preferences. By offering multi-language support and localizing your app to meet regional compliance standards, you can tap into a broader audience.

4. Personalization and AI Integration

With the rise of artificial intelligence (AI), personalization is becoming a key differentiator in the fintech space. AI can help you provide users with customized financial recommendations based on their investment habits, financial goals, and risk tolerance. By analyzing user data, AI can deliver personalized insights, making your app more useful and engaging for individual users.

5. Community and Social Engagement

Incorporating social trading features, where users can share investment strategies, insights, and portfolio performance, can boost user engagement. Building a community around your app encourages users to stay active, learn from each other, and feel connected to the platform. Features like forums, live chat, and expert-led webinars can foster a sense of belonging and keep users engaged long-term.

6. Continuous Security Improvements

As the app grows, so does the importance of security. Financial apps are prime targets for cyberattacks, and scaling your app requires ongoing security enhancements. Regular updates, patching vulnerabilities, and staying compliant with the latest security standards will ensure that user data remains safe, even as your app expands.

In conclusion, future growth for your app involves a combination of scalability, new features, personalization, and global expansion. By anticipating these needs from the outset, you’ll be well-positioned to adapt to a growing user base and keep your app ahead of the competition in the rapidly changing fintech landscape.

Also Read :- Step-by-Step Guide to Building a Crypto Exchange App Like Binance

Why Trust Miracuves Solutions for Your Next Project?

When it comes to building a financial app as sophisticated as Fidelity, having the right development partner is crucial. Miracuves Solutions has the expertise, experience, and dedication to turn your app vision into a reality. We understand the unique challenges that come with developing financial platforms—from ensuring top-notch security to creating an intuitive user experience—and we have the tools and know-how to tackle them head-on.

1. Proven Expertise in Fintech Development

Miracuves Solutions specializes in fintech app development, with a proven track record of delivering high-performance financial apps. Our team of experts is well-versed in the nuances of creating investment platforms, stock trading apps, and digital banking solutions. We follow industry best practices and comply with all necessary financial regulations, ensuring your app is secure and compliant from day one.

2. Customized Solutions Tailored to Your Needs

We believe that no two projects are the same. That’s why we offer customized development solutions based on your specific requirements. Whether you’re looking to build a basic MVP or a full-featured app with advanced analytics, Miracuves Solutions will work closely with you to deliver a solution that aligns with your business goals and user expectations.

3. Full-Cycle Development Support

From concept to launch and beyond, Miracuves Solutions provides full-cycle development support. We start by validating your idea through market research and competitor analysis, then move on to design, development, and rigorous testing to ensure your app is flawless. But we don’t stop there—post-launch, we offer ongoing support and updates to keep your app optimized and scalable as your business grows.

4. Security and Compliance

As financial apps deal with sensitive user data and transactions, security is paramount. Miracuves Solutions prioritizes building secure, robust platforms that adhere to industry standards like GDPR and PCI DSS. We implement cutting-edge security features such as two-factor authentication, encryption, and secure payment gateways, ensuring that your users can trust your app with their financial data.

5. Commitment to Innovation

At Miracuves Solutions, we are passionate about innovation. We stay ahead of industry trends and integrate the latest technologies—such as artificial intelligence, blockchain, and robo-advisory services—into our fintech projects. This allows you to offer your users advanced features and stay competitive in a rapidly evolving market.

By choosing Miracuves Solutions as your development partner, you can be confident that your app will be built to the highest standards of quality, security, and user experience. We’re not just focused on delivering a product—we’re invested in your app’s long-term success.

Also Read :- Build a Multi-Asset Trading App Like WeBull: A Complete Guide

Conclusion

Building a financial app like Fidelity is a significant undertaking, but it offers immense potential in the rapidly growing fintech industry. With the right combination of robust features, intuitive design, and ironclad security, you can create an app that empowers users to manage their investments, trade stocks, and achieve their financial goals—all from their mobile devices.

Success in this space comes down to understanding the needs of your users and providing a seamless experience that keeps them engaged. From real-time trading capabilities to personalized financial insights, every feature should be crafted with the user in mind. The future of fintech is bright, and with continuous improvements and innovative features, your app can stand out and scale in this competitive market.

Choosing a trusted partner like Miracuves Solution ensures that your app is not only built to meet today’s standards but is also designed for future growth. With a team of fintech experts by your side, your app will have the technical foundation, security, and user experience needed to thrive in this fast-paced industry.

Whether you’re just starting with an MVP or looking to develop a full-featured platform, the key is to remain agile, innovative, and committed to delivering a top-tier financial service to your users. The opportunity is vast—now is the time to make your mark in the fintech world.

Ready to launch your own financial platform?

Our pre-built solution for trading, investment tracking, and portfolio management is customizable and ready to go.

FAQs

How long does it take to develop a financial app like Fidelity?

On average, it can take anywhere from 6 to 12 months to develop a full-featured financial app like Fidelity, depending on the complexity of features and the development team’s size. An MVP version may take around 3 to 6 months.

What are the essential features needed in an investment app?

Core features include real-time stock trading, portfolio management, account management, secure transactions, and financial analytics. Additional features like robo-advisors or crypto trading can add more value.

How much does it cost to build an app like Fidelity?

Development costs can range between $50,000 to $200,000 or more, depending on the app’s complexity, features, and security requirements. A basic version with core features may fall on the lower end, while more advanced options require a larger investment.

What regulations must a financial app comply with?

Financial apps must adhere to strict regulations, including GDPR, CCPA, PCI DSS for payment security, KYC (Know Your Customer) requirements, and relevant anti-money laundering (AML) laws.

How can I monetize my financial app?

Popular monetization strategies include commission-based revenue, subscription plans for premium features, in-app purchases, and advertisements. You can choose a combination that suits your target market.

Explore our finance and investment app services offered by Miracuves – crafted for security, speed, and smart money management:

- NeoBank Like Service – A digital banking experience with quick account setup, virtual cards, and real-time expense tracking like service.

- Banking Like Service – A complete digital banking model offering secure transactions, customer management, and easy navigation like service.

- Wise Like Service – A smart money transfer solution with low fees, multi-currency support, and transparent exchange rates like service.

- Revolut Like Service – Modern financial services inspired by Revolut, offering multi-currency accounts, instant transfers, budget tracking, and seamless card management in one sleek experience.

- Transfer Now Like Service – Smart money transfer services modeled after Transfer Now, delivering fast, secure, and easy international and domestic transactions with real-time tracking and user-friendly features.