Bumble generated more than $243 million in Q4 2024 alone, continuing its strong upward momentum into 2025. As dating apps grow into multi-billion-dollar businesses, understanding how Bumble actually makes money is essential for entrepreneurs planning to build similar platforms. Bumble’s revenue engine combines premium subscriptions, in-app purchases, advertising, and innovative monetization that many modern platforms — including those built with Miracuves — can adopt for fast revenue generation.

Bumble Revenue Overview – The Big Picture

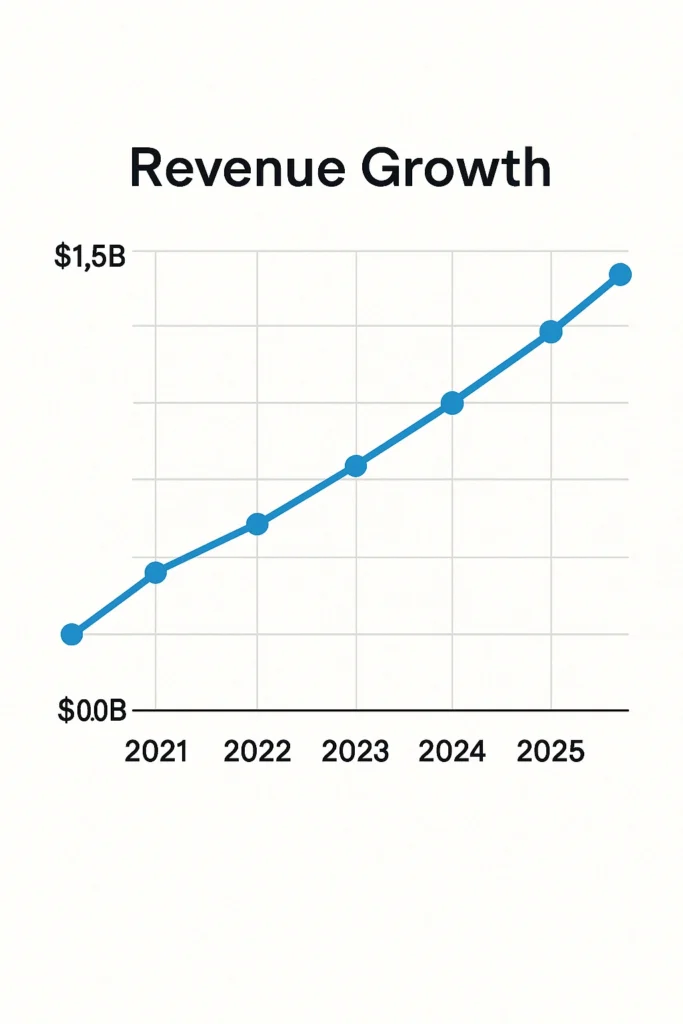

Bumble’s parent company, Bumble Inc., closed 2024 with $1.05 billion+ in annual revenue, with 2025 projections showing mid-single-digit annual growth driven by international expansion and higher ARPU (Average Revenue Per User).

Valuation in early 2025 sits near $2.2–$2.5 billion, fluctuating with market trends.

Year-over-year growth: Bumble App revenue increased approx. 12% YoY between 2023–2024 due to stronger monetization.

Regional revenue split:

– North America: ~63%

– Europe: ~22%

– APAC & Latin America: ~15%

Profit margins: Gross margins remain high at ~75%, but net margins fluctuate due to marketing and product development costs.

Bumble holds a strong market position as the #2 most popular dating app in the US after Tinder, but leads in safety-first and women-first markets globally.

Read More: How to Build an App Like Bumble – Full Developer Guide

Primary Revenue Streams – Deep Dive

Revenue Stream #1: Premium Subscriptions (Bumble Boost & Bumble Premium)

How it works: Users pay for enhanced visibility, unlimited swipes, and advanced filters.

% of total revenue: ~55%

Pricing: $14.99–$39.99 monthly depending on region and tier

Trend: Subscription ARPU is increasing steadily at 9–12% YoY.

Example: If Bumble has ~3.9M paying users globally, at $18 avg ARPU/month → ~$70M monthly revenue.

Revenue Stream #2: In-App Purchases (Spotlights, SuperSwipes)

How it works: Users pay for boosts to increase profile visibility.

% of total revenue: ~27%

Pricing: $1.99–$7.99 per item

Trend: Microtransaction usage is growing faster than subscriptions in emerging markets.

Example: If 20M users purchase 1 Spotlight/month at $3 → $60M monthly potential.

Revenue Stream #3: Advertising & Brand Partnerships

How it works: Brands pay for placements, interactive ads, and sponsored campaigns.

% of revenue: ~10%

Rates: $6–$18 CPM depending on region

Trend: Rising as Bumble launches in-app video ads.

Revenue Stream #4: Bumble for Business (Networking)

Still early-stage, but growing steadily.

% of revenue: ~3%

Trend: Expected to grow 40–50% by 2026 as networking apps expand.

Revenue Stream #5: New Services (AI safety tools, background checks)

% of revenue: ~5%

Users pay for advanced verification or safety add-ons.

Read More: Bumble Marketing Strategy: Swiping Right on Growth

Revenue streams percentage breakdown

| Revenue Stream | % Contribution | 2025 Trend |

|---|---|---|

| Subscriptions | 55% | Steady growth |

| In-App Purchases | 27% | Fast growth |

| Advertising | 10% | Moderate growth |

| Business Networking | 3% | Emerging |

| Safety/AI Tools | 5% | Strong potential |

The Fee Structure Explained

User-Side Fees

– Premium subscriptions

– Pay-per-use boosts

– Profile highlighting

– Safety-verification add-ons

Provider-Side Fees

Unlike Uber/Airbnb, Bumble doesn’t charge providers — it monetizes users exclusively.

Hidden Revenue Tactics

– Algorithmic placement boosting

– Personalized pricing tests

– Region-specific in-app purchase pricing

Regional Price Variations

Prices in North America are ~40% higher than Asia and Latin America.

Complete fee structure by user type

| User Type | Fees | Notes |

|---|---|---|

| Free User | None | Limited access |

| Premium User | Monthly/Yearly | Access to advanced features |

| Pay-Per-Use | Per boost | High-margin items |

| Safety Services | Add-on price | Region-specific |

How Bumble Maximizes Revenue Per User

Bumble’s monetization strategy is built on strong ARPU expansion.

User segmentation: Women-first approach increases trust and retention.

Upselling: Feature previews to encourage upgrading.

Cross-selling: Bundled boosts + premium packs.

Dynamic pricing: Region-based income targeting.

Retention monetization: Weekly incentives, badge unlocks.

Lifetime value optimization: Discounts for long-term plans.

Psychological pricing: Odd-number pricing ($14.99 instead of $15).

Real examples: Premium ARPU increased from $22 to $25 in mature markets in 2024.

Read More: Business Model of Bumble: How the App Makes Money

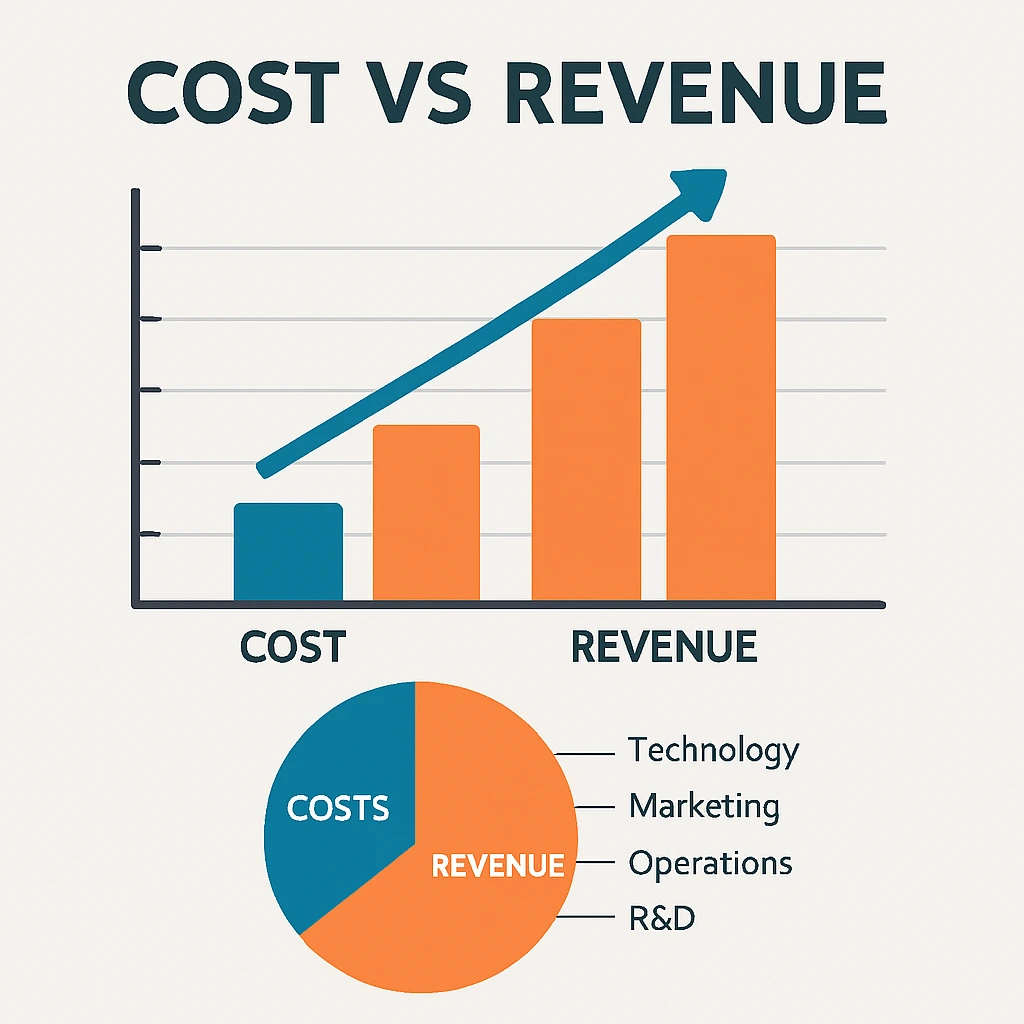

Cost Structure & Profit Margins

Major cost categories:

– Technology infrastructure (servers, AI moderation)

– Marketing (up to 35% of spend)

– Payroll & operations

– R&D (AI safety tools, ML algorithms)

Unit economics: High gross margin (~75%), but variable user acquisition costs reduce net margins.

Profitability path: Efficiency improvements and international growth.

Future Revenue Opportunities & Innovations

Bumble is testing:

– AI-driven matchmaking (paid upgrades)

– Video-first dating features

– Virtual dates & live events

– Expansion to India, SEA, LatAm

2025–2027 predictions:

– ARPU will increase 15–20%

– In-app purchases will overtake subscriptions

– AI personalization will become a major revenue driver

Threats: Competition, regulatory pressure, shifting user behavior

New opportunities emerge for entrepreneurs building Bumble-like platforms with partners like Miracuves, who offer customizable monetization modules.

Lessons for Entrepreneurs & Your Opportunity

Key takeaways from Bumble’s model:

– Simplicity works: monetize visibility, not dating itself

– Microtransactions create predictable recurring revenue

– Safety features can be monetized sustainably

– AI personalization boosts retention

Market gaps to exploit:

– Hyperlocal dating

– Community-specific matchmaking

– Video-first dating

– Verified-only dating services

Want to build a platform with Bumble’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization features. Our Bumble clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch. Get a free consultation to map out your revenue strategy.

Final Thought

Bumble’s growth comes from steady subscription revenue, well-timed in-app upgrades, and a brand built around trust and clarity. It’s a formula that keeps users engaged while giving the business a predictable, scalable income engine. Founders who adopt the same mix of strong positioning and diversified revenue streams can grow far faster in today’s competitive market.

With Miracuves as a development partner, that journey becomes even quicker. Their ready-to-launch platforms remove months of heavy lifting, letting entrepreneurs focus on brand, features, and user growth instead of long technical builds. It’s a shortcut to launching a polished, high-performing app that earns from day one.

FAQs

1. How much does Bumble make per transaction?

In-app purchases average $1.99–$7.99, with high margins.

2. What’s Bumble’s most profitable revenue stream?

Premium subscriptions contribute the largest share at ~55%.

3. How does Bumble’s pricing compare to competitors?

Bumble is slightly cheaper than Tinder Gold but more premium than Hinge subscriptions, striking a perfect balance — and with Miracuves, you can build a Bumble-style dating app starting at just $2499.

4. What percentage does Bumble take from providers?

Bumble does not charge providers or creators; monetization focuses on users.

5. How has Bumble’s revenue model evolved?

Shifted from subscription-first to hybrid monetization with in-app purchases and AI tools.

6. Can small platforms use similar models?

Yes, especially using clone frameworks like those built by Miracuves.

7. What’s the minimum scale for profitability?

Most dating apps require 100k–300k active users for meaningful subscription monetization.

8. How to implement similar revenue models?

Use modular monetization: subscriptions, boosts, ads, safety tools.

9. What are alternatives to Bumble’s model?

Commission-based dating services, community memberships, virtual events.

10. How quickly can similar platforms monetize?

With ready-made solutions from Miracuves, platforms can start monetizing in just 3–6 days with guaranteed delivery, ensuring a fast launch and immediate revenue generation.